Our early retirement goal is a scant four years from now, which on top of putting some real pressure on us to kick our savings into gear, is just plain old depressing since, you know, I'm going to be forty dang years old.

To the kids reading this, that whole YOLO thing has some legs. Get out there and live life while you're young and mistakes are encouraged.

But since this is supposedly a personal finance blog, we should occasionally talk about our personal finances, I suppose.

Transparency gets tricky quick when it comes to checking in our retirement progress, since we decided a couple years ago to take down all our Budget Porn and Net Worth posts. Since some of our friends and family read the blog, it felt weird being that open and that specific with figures that we'd been taught you just shouldn't share in public.

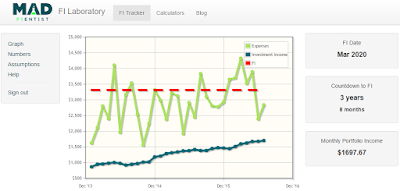

But then we found the Mad Fientist's laboratory, which is maybe the perfect tool for turning years of budget spreadsheet tabs into actionable data and planning out our early retirement. From piles of granular Excel data, we get a helpful graphic like this:

Neat, right? Without getting into a discussion of specific asset amounts, we can still get into the weeds a bit when it comes to where we're trending to with our retirement plan.

I entered our monthly spending (green data points), monthly saving, and net worth figures into the Mad Fientist's laboratory going back to the start of 2014, and it calculated the average spending figure over the last twelve rolling month period (red dash line, about $3,300 a month) and the current hypothetical income that could be generated by our portfolio (blue data points).

But the best bit is that the Mad Fientist's lab spits out a target financial independence date, March of 2020, which is a good deal closer than I thought. I figured we'd be working right up until the last day I was still forty. Now it seems we might be able to pull the plug while still in my thirties.

Net Worth & Portfolio Income

A few caveats here, because we never quite fit the norm.

One, when deciding what to count in Net Worth, you'll get different opinions, at least when it comes to calculating how close you are to being financially independent. We chose not to include any of the equity in our personal residence or our rental properties. While there's a significant amount of capital tied up in these houses and we'd surely net some coin if we sold, we prefer to just be ultra conservative here.

In the same conservative vein, we do factor in (i.e. - subtract) our brand new mortgage on our personal residence. And to make things even more complicated, when it comes to our rental properties, we don't factor in the mortgage figures (or, as noted earlier, the equity). Basically, we work from the assumption that if we sold the rentals today, we would sell for exactly the amount we owe the bank, plus any transaction costs, and come out of the deal without making a profit or taking a loss.

I'm sure getting tangled in the details is terribly interesting for you readers, so let's just bottom line this thing. We take the total value of our paper assets (stocks, bonds, cash), then subtract the mortgage on our primary residence, and poof, that's the net worth figure we use. Our true net worth is higher, but whatever, we're just being overly cautious.

Our "True" Annual Spending

As we've written about the past few years, our annual spending is in the range of $35,000 or so, but the trend is towards some spending creep since 2014 and 2013. Looking strictly at the last twelve months though, that figure looks a lot like $40,000, and a worrisome pattern is emerging.

Not to make excuses for ourselves, but the last twelve months were particularly spendy due to the trip to Western Europe in the winter (London, Paris, Amsterdam, and Brussels are decidedly not cheap) and our recent trip to Africa (which while inexpensive on a day to day basis, lasted for almost a month).

So I suspect our true average spend going forward will be less than the forty grand that the last twelve months have shown, but who knows? We have a mortgage adding about four hundred and fifty dollars to the monthly budget starting in September. And we want to start a family. Maybe our costs will be even higher once Baby Done by Forty rears her stupid, expensive baby head. We'll just have to wait and see.

The Date: March 2020

This would mean we'd hit financial independence a good half year before my fortieth birthday, which would be fantastic. But I suspect it's pretty optimistic.

Mrs. Done by Forty might focus on making said baby after she finishes her PhD, rather than going back to work. And our income would actually go down a bit if that happened, while our expenses would increase as she came onto my health insurance along with the future baby. Will these costs exceed those of the international travel that's probably coming to an end when we start a family? Will our investments start to earn enough as our nest egg grows, so that losing Mrs. Done by Forty's income might not be such a detriment?

I'm not sweating the details quite yet: it's just too hard for me to estimate future years' costs and income accurately. I figure we'll get an idea of the new financial realities as they come, and adjust. There's still plenty of wiggle in our budget, if we ever want to lean back into frugality.

The part I really love about the Mad Fientist's graph was that it's crazy motivational. As we've written about before, I'm kind of a sprinter, and I've been wearing down on this multi-year slog to financial independence. When I have a bad week or month at work, I'll find myself wondering if I can even make it the remaining years to FIRE, or if I'd be better off taking a sabbatical of sorts.

But seeing that we might only be three and a half years out, I notice that I am focusing on our budgets again, and writing more again, and all in all just finding that I somehow have the energy to make it through the home stretch.

Sometimes, all you need to keep going is to catch a glimpse of the finish line.

*Photo is from Andreanna Moya Photography at Flickr Creative Commons.

I'll have to check out that chart! I love that kind of stuff because it keeps me motivated. And as far as income and posting what someone's actual net worth is, I'm totally with you. I never liked it very much and I don't find it motivating when someone posts that they make 100k per month or something. I'm so impressed that your on track to retire when you are. I'm 45 and feel like I'm sort of at the beginning (even though I know I'm not).

ReplyDeleteI'd definitely recommend the Mad Fientist chart to anyone who's trying to track their net worth in a motivational way, even if you're not trying for an 'early' retirement, or retirement at all. And I'm kind of right there with you about feeling like we're at the beginning -- especially when I read about people who are retiring in their early thirties. There's always someone doing it earlier than you, which is both cool and, you know, not.

DeleteWe used to share our monthly budgets and net worth, as you know, but something changed along the way. I don't know exactly what it is...maybe it's the fact that we're not totally anonymous anymore.

Definitely with you on the "Sprint" as it comes to FI, blogging, etc only thing I don't really sprint at is prob running, lots of irony there of course.

ReplyDeleteHa, I'm with you, Even Steven. Other than the occasional run to first base in kickball, I very rarely ever truly sprint.

DeleteThat's totally cool I haven't seen the chart before so will have to take a look and plot our own version to see where we are. Retire before 40 would be fantastic!

ReplyDeleteThanks for the kind words, Tawcan. I took a look at your blog and it seems we have some similar goals: trying to get a portfolio of a million, plus maybe some side income to go along with it. Best of luck to you guys, too!

DeleteVery cool chart!!! You got this. I'd suggest buckling down now before baby DB40 comes and then you can relax a bit once he/she gets here. If you can spend twelve months really kicking it, you might speed up your FI date really big!!

ReplyDeleteHey Laurie! That's good advice about buckling down before the kids come along. On the other hand, we really want to see a lot of the world before we have family, so we keep scheduling these international trips, always wanting one more. It's become a habit I think, but also helps us fulfill a goal. The rub is that one goal is cannibalizing the other.

DeleteI know how you feel about families being able to see your personal finances. It's the same thing to me. But it doesn't feel weird with strangers on the internet seeing your numbers because you don't know them hehe. Anyways, being able to track closely like that will keep you focus on your goals which you seem to be doing fine:)

ReplyDeleteThat's a good point, Aaron. When we were truly anonymous, we overshared all the time here on the blog...on like a monthly basis. But then we shared our blog with some friends and family, and had to change course.

DeleteOverall, I'm happier this way: being transparent and open lets me live in a more integrated way. No second life, or secret writing/plans. But then, we have to self-censor a bit.

"last twelve months were particularly spendy due to the trip to Western Europe...So I suspect our true average spend going forward will be less than the forty grand that the last twelve months have shown, but who knows?"

ReplyDeleteVacations drove up our costs while we were working too, but after we stopped working, travel costs went down A LOT. We no longer had to restrict our travel to 2 weeks and buy flights leaving on Sat and Sundays. It makes a HUGE difference. We somehow spent LESS money travelling the world in retirement than living and working in Toronto.

And now the countdown to 2020 begins! You're are only 4 years away from freedom! YAY! Can't wait for you guys to join the FI club! ONE OF US! ONE OF US!

I'm really excited to join the FIRE cult, if only for the burlap sack outfits and the free Kool-Aid.

DeleteGreat to know that slow travel will reduce costs because, man, we are not being thrifty at all with this shit anymore. I think we may top $10k in travel costs this year, somehow by "travel hacking". That process is a red herring, man. We spend more on travel now than we did before. We just travel way more and to way cooler places.

Meh. It's worth it! :)

DeleteMeh. It's worth it! :)

DeleteWe're kindof in a similar boat in that we're aiming for a late 2018 FIRE, but last year was spendy with renovations, this year is kindof spendy with travel and next year will likely be spendy as Mr PoP gets the "fun car" he's wanted for quite a while. Mostly I feel like we're subconsciously trying to tick off all the boxes of things we might deny ourselves while looking at a budget and no steady salaried income for the foreseeable future. It does impede our progress a tad in the meantime, but (so far) not so much that our projected date has been impacted. A weird balancing act, either way.

ReplyDeleteI like your approach, Mrs. Pop. If we're thinking of pulling the trigger on early retirement, then it's definitely a good idea to get those big ticket items and experiences out of the way first.

DeleteI've never heard of Mad Fientist, but it sounds like a pretty neat tool. I'll have to check it out. And congrats on being closer to your goal!

ReplyDeleteHey, Latoya! Thanks for the congrats.

DeleteHe has a fantastic blog and podcast. If you're someone who really likes to get into the analytical/optimization bits of personal finance, Mad Fientist is a must read.

After working for decades, seeing coworkers get tapped on the shoulder for layoffs, I got interested in personal finance. Being naturally frugal, a DIY person, and no kids, saving a high percentage wasn't too hard. My calculations were we could retire early even in my high tax state. My biggest concern for you is child rearing cost and healthcare cost for you. We are looking at $2K per month for pre-retire healthcare! This is from a Fortune 50 company for salaried types. Deductible is $3k/yr for family and coverage in network is 85℅. Not as good as a union plan, but acceptable over other bare bones plans. I'm choking on the monthly fee, as I was planning on a maximum of $1.5k per month. I'm sharing this to alert you of what you can expect to come. Good luck on your journey to FIRE.

ReplyDeleteThat's fantastic advice, Maverick. Thank you. Healhcare is the bugaboo...I think I may go onto the Obamacare site just to get an understanding of what we might expect.

DeleteThanks again.

"remember to eat a bunch of cake while your friends and loved ones sing for you, pay for your life insurance policy" - Your loved ones pay for your life insurance policy? That's an interesting present! ;) (That's how I read it at first anyway haha)

ReplyDeleteOn the serious stuff: "Our true net worth is higher, but whatever, we're just being overly cautious." - No, I think you are just doing it correctly. You can't count money tied up in the house as part of your Net Worth when calculating FI date (or Mad FIentist software does it for you) because, I assume it's using the 4% rule to work out the "current hypothetical income that could be generated by our portfolio". You can't generate income out of money tied up in your house! And if you sold you would still need somewhere to live and so the money generated would just generate income to pay your rent so it's a wash. I'm sure there are special cases where this wouldn't be the case though but I think that's the best way to count those figures for most people, when it comes to something like the FI tool MF has made.

And what an awesome tool it is!!! I will have to have a play around with it at some point even though I have a spreadsheet which calculates my "Years to FI" (and it is quite a lot of years unfortunately at this point in time!) it will be good to see it in graphical form.

Cheers and good luck in the final sprint ;)