October has come and gone, and so have all three groups of trick-or-treaters who visited our house this Halloween.

In our old neighborhood, so many kids came that we often had to head out for an extra bag of candy. Now, we apparently live in a hood populated exclusively by childless couples, the elderly, and dentists.

On the plus side, we are Kit Kat rich.

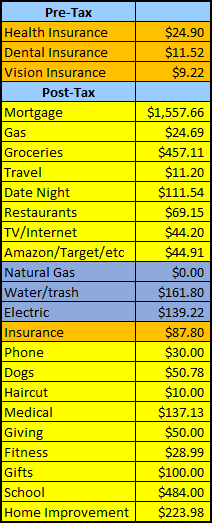

This is the breakdown of what we spent in October:

Total October Spend: $3,870

Non-Mortgage Spend: $2,312

Annual Spend YTD: $40,530

Forecast for 2017 Spend: $48,636

The outliers this month were spending nearly five hundred bucks on the fees associated with Mrs. Done by Forty's PhD program. While her tuition and health insurance are generously covered with her R.A. position, which also happens to pay a pretty sweet stipend, we are responsible for the university fees twice a year, covering everything from athletics to technology.

The other big expense was home improvement, as we decided to overseed our lawn. You see, here in the preposterous desert of Arizona, the grass that survives our summer (bermuda) goes dormant in the winter. If you want a green lawn in the winter months, you actually have to plant a winter lawn, which involves mowing the lawn short, raking out all the thatch, throwing a bunch of rye seed down, and covering it with a soil topper. It's a huge pain in the ass.

But we're in a new house, and we like having a green lawn...even if that involves me busting my hump for a couple weekends, paying for the seed and topper, and guaranteeing a ridiculous water bill come December. Sorry, Mother Gaia.

|

| The backyard right after putting the seed & topper down |

|

| A couple weeks later, Cayenne is ensuring that we can't have nice things. |

We are still adjusting to the new, larger mortgage. I get the feeling we're going to trend towards something around $50k so long as we have that bill hanging around.

I'm actually okay with that on paper. The plan right now is to basically copy the 1500 Days plan: to get a million into investments, and to save up an additional amount equal to our mortgage, but to keep the actual mortgage around because low-interest debt can be a good thing, especially over 30 years of opportunity costs.

But as someone who'd previously paid off a mortgage and been entirely debt-free, I can certainly see the advantage of the Root of Good plan. Paying off the mortgage might have opportunity costs, but it also would bring our annual expenses back down below $40,000 and eliminate a decent amount of risk.

For now, we can entertain both options. I'm still leaning towards the 1500 Days plan because over 30 years (or, say, 27 years after we reach financial independence), $250k will do a lot better in the market while carrying a roughly 4% mortgage, than it would had we just used the money to be debt free. And if we change our mind down the line, we can always pay off the debt later. But once it's paid off, getting money out of the house is easier said than done, especially if we leave traditional employment.

This sure seems like a problem for future Brian.

For today, we can enjoy the fact that, even with our higher annual spending, we are trending towards still reaching financial independence before I'm forty:

|

| Still on track, but with just two months to spare. |

The spiky 2017 has pushed our rolling twelve month average much higher, but I suspect that this average is a lot closer to reality than we'd like to admit.

Our ace in the hole is the fact that Mrs. Done by Forty will graduate soon and, like me, wants to pursue some sort of career regardless of our financial status. While no one has a crystal ball, our income is likely to spike right as we approach financial independence, and it's pretty likely that both of us will have at least some sort of part-time income going forward anyway.

Which all goes to say, we are crazy fortunate. We are a exploding cornucopia of privilege, as evidenced by the fact that we're even talking about the possibility of working just because we feel like it at the ripe old ages of forty and thirty four. We're both very lucky to have degrees, and to be three-quarters white and one quarter Asian between the two of us, and to be healthy Americans, to boot. We have fortune falling out of our butts over here.

I have a lot more to say on this in a future post, but for now, if you're reading this and maybe thinking that the author is a lucky mofo, you are not wrong. I am. I owe the world quite a debt and I get the feeling that whatever I plan to do in this next stage of life, that debt-repayment ought to be part of it.

If you have some ideas on that, please let me know in the comments below. And as always, thanks for reading.

Our "pay off the mortgage" decision was pretty easy as we only had 2 years and around $30k remaining. I wanted to ditch a particular ETF position that didn't make sense in the portfolio so I sold it and used the proceeds to pay off the mortgage (it was a bank index fund ETF which is a little ironic that I sold banks to pay off the bank :) ). Without refinancing into a long term 30 year position, there wouldn't have been any long term growth/arbitrage opportunity for us. So I paid it off!

ReplyDeleteThat makes sense, Justin. We are thinking of refinancing right before we leave full time employment, depending on rates and costs, and whether we want to actually lean into an arbitrage play.

DeleteThere's certainly a nice aspect of just being debt free, too.

I suppose we have three more years or more to figure it out.

'We have fortune falling out of our butts over here." Hmmm, what does that look like exactly? Rainbows? Unicorns? Pixy dust? :) I met up with some local FIRE people over the weekend (Waffles on Wed, who I actually knew in person before they became bloggers), and as I was talking about my "problems" I realized just how first world, middle class white people they really were, and that anyone should be so lucky to have my "problems." I think acknowledging and being grateful for what we DO have is so important. It's not that you can't pursue your dreams and should just settle, but just check in from time to time to take stock of what you do have in life.

ReplyDeleteI wish it were rainbows or pixy dust.

DeleteCool that you're meeting other PF folks in person! Even those insufferable FIRE bloggers, ugh. ;)

We certainly do have problems in this country: nothing's perfect. But our problems are someone else's dream scenario.

This is my visual on the fortune falling out of butts thing... sorry, I couldn't resist. :-)

Deletehttps://youtu.be/KlEovr29KBU

That is AMAZING. And I kind of along the same lines...

Deletehttps://www.youtube.com/watch?v=D7DvEIfrP84&feature=youtu.be&t=24m54s

Bwahahahaha!!!!

DeleteThe health insurance costs employees get makes me wonder if you have any idea how much it actually costs.

ReplyDeleteI'll spend $22800 on premiums this year and have a $7500 deductible. That adds up to over half of your total expenses.

Wow, that's quite a lot, Kassy.

DeleteBut yes, we have some idea what it costs. ;)

Is that the cost for just you, or for a larger family? Any help from ACA?

It is a lot. It is also what any ACA plan costs once you add up the premium and maximum out of pocket for a family of 4 non-smokers ( 2 40ish adults and 2 school age kids)that doesn't get the subsidy.

DeleteReally? I thought there was quite a lot of cost variance state by state.

DeleteThis comment has been removed by the author.

DeleteI admit I have not looked in states I don't live in. But if wager it doesn't vary much. Later tonight I'll look at Colorado (since it seemss lot of FIRE people live there

DeleteMr. Money Mustache wrote about this recently, for CO, in which he's seeing a big increase in 2018:

Deletehttp://www.mrmoneymustache.com/2017/11/05/when-your-shitty-health-insurance-doubles-in-price/

Of course, it's pretty rare for FIRE people to earn so much in retirement that they no longer qualify for ACA subsidies. MMM earns a ton from his blog, whereas the average early retiree is earning very little income in retirement: perhaps no taxable income at all.

I, too, did a double take on the health insurance cost. Hell, I pay more than that for my cat's monthly health insurance premium! Seriously though, I just renewed through the ACA and feel very fortunate for the tax credit because without it my premium for a $5K deductible plan would be around $600/month - apparently you get slammed once you hit 50 no matter how healthy you are.

ReplyDeleteI'm also laughing at your paltry home improvement expense. With all of my bathroom remodeling, buying area rugs for the whole house where I ripped up the avocado green shag, and now tackling sealing the concrete in the basement, I'm sure I'm well over $3K for the past few months. And a tile just came loose from the kitchen floor signaling that my days of ignoring that room are quickly coming to an end. Sigh... first world problems. But hey, I guess you can look at those sorts of things as investments rather than pure expenditures.

Anyhow, thanks for the gratitude reminder. I've been having a whiney day so it was quite timely. :-)

Yeah, my health insurance is crazy cheap. The cost is further reduced by a healthy living program our company has for employees (basically, keeping BMI and some biometrics in range and not smoking), hence the crazy $12 per pay period cost. This will go up quite a lot once Mrs. Done by Forty and any future children come on to our plans and again if we leave traditional employment behind.

DeleteAnd yeah, I'm sure a bathoom remodel dwarfs our own home improvement costs but $3k for a bathroom remodel is still really good! I think it looks sharp: and I'd personally vote to leave the sink as is.

As you said, putting money into your home hypothetically raises its value. Even if you only get sixty cents on the dollar back, it's way better than the average expenditure by comparison.

For what it's worth, I'd be pumped to see how your kitchen remodel turns out.

OK... just to clarify, that $3K includes the cost of the area rugs for the rest of the house, as well as the ridiculously expensive stuff for sealing the concrete in the basement. The bathroom itself (including all the tools) was closer to $1K... of course I haven't resurfaced the tub yet...

DeleteAnyhow, I'm glad you're optimistic about my kitchen project. I can't stop thinking about that horrible tar paper in the bathroom and wondering if I could live through that again! :-)

That's even more impressive! A thousand bucks for a total bathroom re-do is amazing.

DeleteI remember seeing pictures of the kitchen and I don't think it would necessarily be as involved as a total teardown. Seems like you have a good room as it is.

Very nice on the expense front. I’m typing out ours for the month and I’m constantly amazed at the food costs. It was a great reminder that we’re so privileged and fortunate to be pursuing FI. Thanks for that!

ReplyDeleteAgreed, Laurie. It's easy to get wrapped up in our own push towards FI and forget that the fact that we're even considering such a goal means we're at the tippy top of the privleged pyramid.

DeleteWe should be vomiting gratitude every day, right?

I didn't know you were in Arizona - I'm impressed that you're willing to do the work for a green lawn :)

ReplyDeleteI'm a sucker for giving the dog the best home possible though, so I'll do my best to grow a bit of a lawn for Seamus. Look how happy Cayenne looks!

We are extraordinarily lucky, aren't we? I'm debating between the mortgage payoff vs saving and investing the money too. For now, I'm focused on payoff because it's well over the point I'm comfortable. The interest rate is no great shakes (just under 4%), but the amount of interest that we'll pay over the lifetime of the loan if we don't pay down at least half of it is staggering. We'll reevaluate when it's sub $300K. As if that's such a small number! ;)

I'd be interested in hearing your thoughts as you debate this yourselves.

Yeah, we are suckers for our dogs, too. There's nothing quite like seeing them happily rolling around in the grass.

DeleteI hear what you're saying about the mortgage. For now, we have an opportunity to itemize & deduct a little of the interest: but it's not a huge savings. Still, over 30 years I just don't see how funds invested in a balanced portfolio wouldn't beat 4%.

That's kind of where we are with it. We know that the math is pretty clearly against a mortgage payoff. But having paid off the house before, it does feel pretty good (for about 2 years) to be totally debt free. After that, we revert to the mean.

Can see your point about paying off vs keeping the mortgage. It's a tough decision. Access to cheap debt could be handy in the future though and if it doesn't cost you much to keep the mortgage account then why not. Man alive though, you have a lush lawn! Come summer in Aus my old lawn would essentially just get the scorched earth treatment. Now that I live in an apartment I kinda miss the regular satisfaction of giving it a trim and a nurturing in winter.

ReplyDeleteHey there, wealth from thirty.

DeleteI used to hate yard work. Now in the new house, I like it. I have that pride of ownership and enjoy DIYing almost anything. I can't say what exactly flipped the switch.

As you said, keeping the debt around could really provide an arbitrage play. Imagine if treasury bonds were paying out 5 or 6% in a few years.

$1k/year split into two payments if I'm understanding correctly? Not bad! And Cayenne just knows the value of fertilizer. :P

ReplyDeleteThat's so awesome that you're still on track to reach FI by forty! I'm so happy for you guys! I have some ideas on the "debt repayment" but there are so many causes in need right now. I'd hone in on a cause or two that's really important to you, donate a lot, and then keep a little liquid so you can give throughout the year as things arise a little closer to home with people you know or within your community. Have you seen JL Collins stuff on how he set up a foundation? Tax benefits plus doing good.

Yeah, that's roughly the cost for her university fees. They're actually a bit higher in the spring semester (I think b/c it technically also covers summer) but it's in the ballpark of $1200 or so, I think. Plus, Uncle Sam helps out a bit on university fees at tax time. :)

DeleteWe really stink at giving to charity, unfortunately. We're so focused on our own financial goals that it cannibalizes our charitable giving to a large degree. We still give to some charities locally but it's nowhere near the overall percentage we'd like for it to be. The hope is that things will change once reaching FI. Will have to check out Jim Collin's post!