We are here in Montevideo, the capital of Uruguay, which apparently is not pronounced "Mon-tee-VID-ee-o" as I originally had thought. We live, we learn. Once again we were able to score a room upgrade with the hotel when we let the good people at the front desk know that we were celebrating our three year anniversary, and they were so nice that they gave us a suite. After going out for dinner, we came home to find a chocolate cake and a card waiting for us. (And maybe even more importantly, free wifi.) I can't say enough good things about the good people at the Four Points here -- everyone on the staff is so dang nice.

Tuesday, May 27, 2014

Wednesday, May 21, 2014

Cash in Buenos Aires

Hi there, blogging buddies. I'm writing from the comfy confines of our hotel in Buenos Aires, while my beautiful wife sleeps in. The hotel is nicer than the digs we'd normally stay in, but Holly from Club Thrifty introduced us to our very first hotel travel hack about a year ago, and we're using our Starwood points to get eight free hotel nights here and in Montevideo. And because we paid with points, I think the guy at the front desk mistook us for globetrotters who stay in Sheratons all the time, as he upgraded our room, gave us free wifi (normally $10 a day here) and, best of all, gave us access to this "Sheraton Club", which may be my favorite thing at any hotel, ever. They give you free breakfast (a really decent one, with eggs, bacon, fancy espresso drinks and everything) and free snacks throughout the day. Like, whenever you want. Feeling peckish at 10 pm? Go up and grab some little appetizer sandwiches and desserts. Want to grab some fruit or a Coke midday before heading out on a walk? No problem. It's been only two days and the staff up front already know me by name. I am totally abusing this system for free food. As always, I feel no shame.

Tuesday, May 13, 2014

Investment Properties, Indexing, and Use Value

Before diving into the post, I need to apologize for not writing more often and for not reading the posts that you all have written. I swore I wouldn't be the type of blogger who would start out posts that way, but here I am. I've been in a funk the past couple months with Mrs. Done by Forty still abroad (off and on since September), and it is finally catching up to me. I'm a bit depressed. It is impacting a lot: work, health, and writing, of course. Trying to just snap myself out of it has proved to not be effective. Despite my best efforts, I have turned into a sad little monkey. Still, I'm trying to find ways to improve my mood, and that will hopefully improve my writing frequency, too. Thanks for your understanding!

Monday, April 28, 2014

Preaching to the Choir

When I see who is commenting on the blog, sometimes I have to ask myself why I write about personal finance at all. I mean, most of you who read and comment here have your own personal finance blogs, and, let's face it, you know at least as much about this stuff as I do. We may differ on the varying approaches of debt repayment or investing strategies. But if you read the blog and leave a comment here, my guess is that out of the hundreds or thousands of people in your network of friends, family, and coworkers, you are the person who least needs to read a blog about personal finance. You already have your stuff together. You know how this money thing works. Heck, you know enough about cost cutting, budgeting, investing, tax efficiency, and financial independence to actually write about it three times a week.

Sunday, April 20, 2014

Wait Till I Get My Money Right...

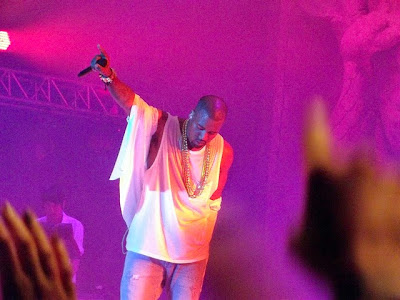

I had a dream I could buy my way to heaven.

I had a dream I could buy my way to heaven.

When I awoke, I spent that on a necklace.

I told God I'd be back in a second.

Man, it's so hard not to act reckless....

I feel the pressure, under more scrutiny.

And what do I do? Act more stupidly.

Bought more jewelry, more Louis V.

My momma couldn't get through to me....

I'm just saying how I feel man.

I ain't one of the Cosby's -- I ain't go to Hillman.

I guess the money should've changed him.

I guess I should've forgot where I came from.

-Kanye West

I told God I'd be back in a second.

Man, it's so hard not to act reckless....

I feel the pressure, under more scrutiny.

And what do I do? Act more stupidly.

Bought more jewelry, more Louis V.

My momma couldn't get through to me....

I'm just saying how I feel man.

I ain't one of the Cosby's -- I ain't go to Hillman.

I guess the money should've changed him.

I guess I should've forgot where I came from.

-Kanye West

Monday, April 14, 2014

Bill and Ted's Excellent Investing

Today we have a guest post on investing from a new blogger: Islands of Investing. Hey, where are you going? Wait! Don't leave! I know your first instinct when being told of a guest post is to click away and read some other post from one of your old standbys. But this is a legitimately good post on investing, and the mistakes we can make with our money. If you don't stay and read it, you will probably be poor and unpopular forever, and will likely regret this one key decision when you look back on your life from your deathbed.* Don't let this day be another wasted one, filled with feelings of what might have been. Carpe...something.

*Disclaimer: reading this post will probably not have any material impact on your wealth, popularity, or anything else. The blog does not recommend any specific form of investing, such as picking single stocks. Like everything on this site, the following post is for entertainment purposes only and should not be considered investment or financial advice. Consult real professionals before making financial decisions.You have been warned.

*Disclaimer: reading this post will probably not have any material impact on your wealth, popularity, or anything else. The blog does not recommend any specific form of investing, such as picking single stocks. Like everything on this site, the following post is for entertainment purposes only and should not be considered investment or financial advice. Consult real professionals before making financial decisions.You have been warned.

Monday, April 7, 2014

What Are You Going to Do When You Retire?

That's the big question I eventually get whenever I share the idea of retiring at forty with friends or family. What am I going to do with all that time? What am I going to do with my day?

And my answers are really unsatisfying to them. I can tell, because they tell me they'd be bored (and if they're especially blunt, that I will, too). Instead of doing what I want to do (which would be crazy), they suggest that I should volunteer full time somewhere, or write a book, or go back into teaching.

Basically, the assumption is that I should trade fifty hours a week of one activity for fifty hours a week of some other, singular, lower-paying or non-paying activity that I would like more.

And my answers are really unsatisfying to them. I can tell, because they tell me they'd be bored (and if they're especially blunt, that I will, too). Instead of doing what I want to do (which would be crazy), they suggest that I should volunteer full time somewhere, or write a book, or go back into teaching.

Basically, the assumption is that I should trade fifty hours a week of one activity for fifty hours a week of some other, singular, lower-paying or non-paying activity that I would like more.

Monday, March 31, 2014

Sex Sells...Health Insurance

With today being the deadline to sign up for ObamaCare, healthcare companies are making their last ditch efforts to sign up as many new customers as they can. One example caught my eye recently. There's a non-profit health insurance co-op in Colorado that's using an old trick to sell our nation's new health plan: beautiful models standing in front of a booth. Colorado HealthOp hired four young, tightly dressed models to convince more people to sign up.

At least there were two male and two female models, so even the ladies have some eye candy to enjoy while they ponder their health insurance options.

And, let's face it, it's easier to decide whether you want a plan with a Health Savings Account when there's an attractive model walking you through the options.

At least there were two male and two female models, so even the ladies have some eye candy to enjoy while they ponder their health insurance options.

And, let's face it, it's easier to decide whether you want a plan with a Health Savings Account when there's an attractive model walking you through the options.

Tuesday, March 25, 2014

Opportunity Costs are Sunk Costs

Ever since we paid off our house early, I've had a nagging feeling that we'd done something a little foolish. Like Johnny Moneyseed says, paying off your mortgage early is silly, right? In the timeframe that we did it, from 2010 to 2013, it was downright costly. This handy calculator from dqydj.net shows that we gave up a 17.4% annualized return by not putting our extra mortgage payments into the S&P 500. Because the market went on a tear during those years, the money we put towards the house had significant opportunity costs.

Opportunity costs are what you sacrifice when you take one course of action instead of another. Every choice has opportunity costs: you go down one path, and you pass up the chance to go down another. Two roads diverged in the woods, and all that.

In this case, we gave up historic gains in the market in order to book a 4.25% gain by paying down the mortgage. And it frustrates me, because who knows when an opportunity like that will come again?

Opportunity costs are what you sacrifice when you take one course of action instead of another. Every choice has opportunity costs: you go down one path, and you pass up the chance to go down another. Two roads diverged in the woods, and all that.

In this case, we gave up historic gains in the market in order to book a 4.25% gain by paying down the mortgage. And it frustrates me, because who knows when an opportunity like that will come again?

Subscribe to:

Posts (Atom)