Money was on the line, and I had a call to make. After sixteen weeks, I found myself in our league's fantasy football championship. (Yes, it is a dorky hobby, but it is mine. I like football, I like winning money, and now I had a chance to enjoy both.) But I am also risk averse. I, as most humans, feel losses more acutely, and for much longer, than I feel gains. Victory is fleeting. Regret lasts. So like I said, I had a call to make.

Here are the details...

Wednesday, December 24, 2014

Wednesday, December 10, 2014

An Embarrassment of Riches

It really is the little things. A comfortable bed, clean sheets, and a soft pillow. A thermostat set just right, so that you can walk around your house in bare feet all year long. The wonder of turning on your faucet, day or night, and pure, cool water coming out. Opening up your refrigerator and realizing you get to choose between, count 'em, two different breakfast meats. Life is good here in the Done by Forty household. Which would be a lot easier to enjoy if it weren't for news stories like these, about the homeless living in tent cities spread all around Silicon Valley. Or these, about the hundreds of thousands of Syrian children refugees, who have to do backbreaking labor in potato fields to support their displaced families. Don't click those links if you're already in a good mood today.

Monday, November 24, 2014

Quick Hits

I'm feeling refreshed today, readers. The missus and I just took a little trip to Tucson, and as usual we have fallen in love with the city. We had a free hotel night certificate (thanks to the Marriot card) that was expiring and figured, what the hey. Let's leave the dogs with a friend and hit the road. The hotel room was nice, the city was fun, and the drinks were cheap. What else does a young couple in love need?

Rather than a single topic today, let's cover a few bite-size ideas that I like, but don't deserve their own blog post.

Rather than a single topic today, let's cover a few bite-size ideas that I like, but don't deserve their own blog post.

Friday, November 14, 2014

Power of the Baseline

We have dirt cheap cell phone service: $5 or $10 a month, per phone, on a pay-as-you-go plan. We use basic Android phones through PTel, a T-Mobile "MVNO" (a kind of subcontractor who provides cell phone services, but does not actually own the network). How do we keep costs so low? We primarily use free options to call and text (Google Voice for free texts and free calls in Gmail) when we're by our computers or in wifi. Which is all the time. We learned about this stuff from IP Daley, the guru of all things telecom, who we met on Mr. Money Mustache's forums.

Monday, November 3, 2014

House Lust

|

| I want this house. |

Wednesday, October 8, 2014

When Sunk Costs Help

I love my little sister. After our parents divorced, we became modern day latchkey kids. We spent every weekday afternoon after school hanging out and playing mancala and watching t.v. And, yeah, back then I sort of tortured her, too. But in a loving, big-brother kind of way.

The funny thing is that we grew up into such different people, even though we were raised in the same household. My sister is completely health conscious, hiking all over the place and eating organic foods; but exercise and diet are a constant struggle with me. I'm obsessed with finances and investments, while my sister would rather be doing something, maybe anything, else.

The funny thing is that we grew up into such different people, even though we were raised in the same household. My sister is completely health conscious, hiking all over the place and eating organic foods; but exercise and diet are a constant struggle with me. I'm obsessed with finances and investments, while my sister would rather be doing something, maybe anything, else.

Monday, September 22, 2014

Social Capital vs. Financial Capital

It is my very first podcast and, go figure, immediately after having me on the show, Stacking Benjamins won the Plutus Award for "Best Podcast". Coincidence?

If you have an hour to burn, click here to give it a listen. And if you just want to skip to the roundtable, you can fast forward to 11:15. And...back to the blog.

Sunday, September 7, 2014

Convenient Narratives

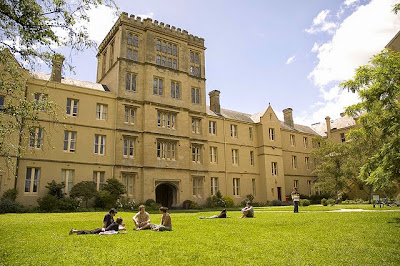

Last month I wrote about an NPR podcast that outlined how the real cost of education is not rising all that dramatically. In inflation adjusted dollars, the amount may be going down slightly. This is not the narrative we hear when we turn on the television or radio. We hear about skyrocketing tuition and fees that the average American family simply cannot keep up with. The truth is trickier than that. But I suspect that we're more comfortable hearing news stories and statistics that confirm what we already think: confirmation bias at work.

Monday, August 25, 2014

Is College Really Getting More Expensive?

Thanks to my only real source of news, NPR podcasts, I learned that the cost that college students are paying for tuition isn't rising very fast at all. This story from Planet Money tells a very different narrative than the one I'd been hearing for years. So I was skeptical. But as the good folks at NPR make clear, the disparity makes sense. There are two costs being tracked: the sticker price, which is the cost that colleges list on their official websites, and the net price, the average price that students actually end up paying. So while the sticker price is increasing, most students do not pay the sticker price.

Sunday, August 10, 2014

I Am Miley Cyrus

A quick note: I offered to write about any subject whatsoever if someone could get my comments to show up again on other blogs. EcoCatLady came to the rescue with a tip on Akismet, which was great, but then she took me up on my offer to do an in-depth analysis of Miley Cyrus' cover of "Jolene", which was terrifying. I mean, it's cute to say you can write 800 words on an ironic subject. Then someone calls your bluff, and you have to stare into your computer monitor and face the hard the truth: you only have about 80 words in the hopper, and they are not even good words. But, a promise is a promise, so it's time to give it the old college try. Lord help us.

Sunday, July 27, 2014

Why Aren't We Getting Better With Money?

Cry for help: a few months ago, I noticed a lot of my comments weren't showing up on my favorite blogs. Apparently, WordPress thinks I am a spam bot. (This likely says something about the quality of my comments.) So, if you think I've stopped reading and commenting on your blog, it's likely that my comments are getting caught in a spam filter.

If someone can fix this for me, I will write a post (on my blog or yours) on any subject you want. Want an in-depth analysis on Miley Cyrus' cover of "Jolene"? You got it. Want me to wax poetic about "In Living Color" and the sad, slow death of live sketch comedy? No problem.

Just help me fix my computer problems and I'll gladly whore out my writing.

And...back to the post.

If someone can fix this for me, I will write a post (on my blog or yours) on any subject you want. Want an in-depth analysis on Miley Cyrus' cover of "Jolene"? You got it. Want me to wax poetic about "In Living Color" and the sad, slow death of live sketch comedy? No problem.

Just help me fix my computer problems and I'll gladly whore out my writing.

And...back to the post.

Sunday, July 13, 2014

Trickle Down Consumption

I was driving to a kickball game the other day, when I heard a cool story on Marketplace about those little white oval stickers with two big letters that people sometimes put on their bumpers. You know, "GB" for Great Britain, or "F" for France, stating the places the driver has visited, or where he's from. The stickers were created by the UN back in the 1940s, in Europe.

There were so many drivers from other parts of the world that the United Nations created the stickers as an easy way to identify the country the driver was from. The reporter notes that, "in the US, they became a status symbol: EH for East Hampton, or AK for Nantucket. Secret codes that said the driver of this car lives or vacations in America's most elite resorts."

These days, the stickers are a way to brag about the cool places you've been, or a flag you can send up as a beacon, hoping others from your home town might be living in this new place with you.

There were so many drivers from other parts of the world that the United Nations created the stickers as an easy way to identify the country the driver was from. The reporter notes that, "in the US, they became a status symbol: EH for East Hampton, or AK for Nantucket. Secret codes that said the driver of this car lives or vacations in America's most elite resorts."

These days, the stickers are a way to brag about the cool places you've been, or a flag you can send up as a beacon, hoping others from your home town might be living in this new place with you.

Wednesday, July 2, 2014

A Penny Saved is More Than a Penny Earned

I like debating false dichotomies. Black and white is more interesting than fifty shades of grey, right? So I really enjoy reading posts on whether we should devote our energy towards earning more or reducing our expenses. Yes, of course, the right answer is "both," but that's boring. Plus, we only have a finite number of hours and an equally finite amount of willpower to aim at behavior change. As anyone who creates a laundry list of new goals in January can tell you, spreading yourself too thin just results in broad failure. Like Joe Saul Sehy says, narrowing your focus to a small set of financial goals is the (only) way to success. So, if you have to choose between earning more and saving more, which way do you go?

Tuesday, June 24, 2014

Betting on Yourself

Like so many others, I am a secret fan of "American Ninja Warrior". This is not television that you admit liking to coworkers around the water cooler. As with romantic comedies, the catalog of Katy Perry, and anything from KFC, American Ninja Warrior ought to be enjoyed in private, behind closed doors with the curtains drawn, and then should never be spoken of again. Like a lot of television, the show is a copy of a copy: the original program is from Japan, but NBC has kept the general format. Fit people from across the US try to complete an impossible series of obstacle courses, failing spectacularly as they careen into padded walls and then splash awkwardly into the water below. Competitors hurl themselves across chasms to grab comically small hand-holds mid-flight, propel themselves over water via trampolines, and, no joke, must run up a curved fourteen foot high wall just to complete the qualifying round. In the show's history, no American has even made it to the fourth and final course, let alone completed it. I find it strangely motivating to watch. It is the only show that gets me off the couch to do push-ups and ab workouts during the commercials. With all these athletes attempting the impossible, I mysteriously get off my tuchus and onto the living room floor.

Monday, June 16, 2014

Hotel Soaps and Externalities

When we're on vacation, we steal hotel shampoo. And conditioner. And, fine, yeah, we steal the free lotion and soaps and razors, too. Like, every day when housekeeping brings a new bottle containing any sort of liquid, it goes directly into Mrs. Done by Forty's bag. So after eight nights in hotels down in South America last month, we had a pretty sizable stash. It got to the point that we were a bit concerned about the weight of her suitcase when checking in at the airport. Still, it begs the question: is it wrong to check out with a few pounds of "free" hotel swag?

Wednesday, June 4, 2014

Vaca's Over...Back to Reality

The good times had to end sometime. Our vacation is over, so I am back at home and back to work. I wrote this post on Sunday from the Mexico City airport, thanks to a handy table in the food court with electricity outlets and an especially nice retail employee who shared a wifi password. It's amazing how quickly an eight hour layover passes when you have Netflix at your fingertips. At the touch of my mouse, I have all the episodes of Parks and Rec and Archer that a man could ever ask for. We are truly a lucky people.

The good times had to end sometime. Our vacation is over, so I am back at home and back to work. I wrote this post on Sunday from the Mexico City airport, thanks to a handy table in the food court with electricity outlets and an especially nice retail employee who shared a wifi password. It's amazing how quickly an eight hour layover passes when you have Netflix at your fingertips. At the touch of my mouse, I have all the episodes of Parks and Rec and Archer that a man could ever ask for. We are truly a lucky people.Tuesday, May 27, 2014

Anchoring in Montevideo

We are here in Montevideo, the capital of Uruguay, which apparently is not pronounced "Mon-tee-VID-ee-o" as I originally had thought. We live, we learn. Once again we were able to score a room upgrade with the hotel when we let the good people at the front desk know that we were celebrating our three year anniversary, and they were so nice that they gave us a suite. After going out for dinner, we came home to find a chocolate cake and a card waiting for us. (And maybe even more importantly, free wifi.) I can't say enough good things about the good people at the Four Points here -- everyone on the staff is so dang nice.

Wednesday, May 21, 2014

Cash in Buenos Aires

Hi there, blogging buddies. I'm writing from the comfy confines of our hotel in Buenos Aires, while my beautiful wife sleeps in. The hotel is nicer than the digs we'd normally stay in, but Holly from Club Thrifty introduced us to our very first hotel travel hack about a year ago, and we're using our Starwood points to get eight free hotel nights here and in Montevideo. And because we paid with points, I think the guy at the front desk mistook us for globetrotters who stay in Sheratons all the time, as he upgraded our room, gave us free wifi (normally $10 a day here) and, best of all, gave us access to this "Sheraton Club", which may be my favorite thing at any hotel, ever. They give you free breakfast (a really decent one, with eggs, bacon, fancy espresso drinks and everything) and free snacks throughout the day. Like, whenever you want. Feeling peckish at 10 pm? Go up and grab some little appetizer sandwiches and desserts. Want to grab some fruit or a Coke midday before heading out on a walk? No problem. It's been only two days and the staff up front already know me by name. I am totally abusing this system for free food. As always, I feel no shame.

Tuesday, May 13, 2014

Investment Properties, Indexing, and Use Value

Before diving into the post, I need to apologize for not writing more often and for not reading the posts that you all have written. I swore I wouldn't be the type of blogger who would start out posts that way, but here I am. I've been in a funk the past couple months with Mrs. Done by Forty still abroad (off and on since September), and it is finally catching up to me. I'm a bit depressed. It is impacting a lot: work, health, and writing, of course. Trying to just snap myself out of it has proved to not be effective. Despite my best efforts, I have turned into a sad little monkey. Still, I'm trying to find ways to improve my mood, and that will hopefully improve my writing frequency, too. Thanks for your understanding!

Monday, April 28, 2014

Preaching to the Choir

When I see who is commenting on the blog, sometimes I have to ask myself why I write about personal finance at all. I mean, most of you who read and comment here have your own personal finance blogs, and, let's face it, you know at least as much about this stuff as I do. We may differ on the varying approaches of debt repayment or investing strategies. But if you read the blog and leave a comment here, my guess is that out of the hundreds or thousands of people in your network of friends, family, and coworkers, you are the person who least needs to read a blog about personal finance. You already have your stuff together. You know how this money thing works. Heck, you know enough about cost cutting, budgeting, investing, tax efficiency, and financial independence to actually write about it three times a week.

Sunday, April 20, 2014

Wait Till I Get My Money Right...

I had a dream I could buy my way to heaven.

I had a dream I could buy my way to heaven.

When I awoke, I spent that on a necklace.

I told God I'd be back in a second.

Man, it's so hard not to act reckless....

I feel the pressure, under more scrutiny.

And what do I do? Act more stupidly.

Bought more jewelry, more Louis V.

My momma couldn't get through to me....

I'm just saying how I feel man.

I ain't one of the Cosby's -- I ain't go to Hillman.

I guess the money should've changed him.

I guess I should've forgot where I came from.

-Kanye West

I told God I'd be back in a second.

Man, it's so hard not to act reckless....

I feel the pressure, under more scrutiny.

And what do I do? Act more stupidly.

Bought more jewelry, more Louis V.

My momma couldn't get through to me....

I'm just saying how I feel man.

I ain't one of the Cosby's -- I ain't go to Hillman.

I guess the money should've changed him.

I guess I should've forgot where I came from.

-Kanye West

Monday, April 14, 2014

Bill and Ted's Excellent Investing

Today we have a guest post on investing from a new blogger: Islands of Investing. Hey, where are you going? Wait! Don't leave! I know your first instinct when being told of a guest post is to click away and read some other post from one of your old standbys. But this is a legitimately good post on investing, and the mistakes we can make with our money. If you don't stay and read it, you will probably be poor and unpopular forever, and will likely regret this one key decision when you look back on your life from your deathbed.* Don't let this day be another wasted one, filled with feelings of what might have been. Carpe...something.

*Disclaimer: reading this post will probably not have any material impact on your wealth, popularity, or anything else. The blog does not recommend any specific form of investing, such as picking single stocks. Like everything on this site, the following post is for entertainment purposes only and should not be considered investment or financial advice. Consult real professionals before making financial decisions.You have been warned.

*Disclaimer: reading this post will probably not have any material impact on your wealth, popularity, or anything else. The blog does not recommend any specific form of investing, such as picking single stocks. Like everything on this site, the following post is for entertainment purposes only and should not be considered investment or financial advice. Consult real professionals before making financial decisions.You have been warned.

Monday, April 7, 2014

What Are You Going to Do When You Retire?

That's the big question I eventually get whenever I share the idea of retiring at forty with friends or family. What am I going to do with all that time? What am I going to do with my day?

And my answers are really unsatisfying to them. I can tell, because they tell me they'd be bored (and if they're especially blunt, that I will, too). Instead of doing what I want to do (which would be crazy), they suggest that I should volunteer full time somewhere, or write a book, or go back into teaching.

Basically, the assumption is that I should trade fifty hours a week of one activity for fifty hours a week of some other, singular, lower-paying or non-paying activity that I would like more.

And my answers are really unsatisfying to them. I can tell, because they tell me they'd be bored (and if they're especially blunt, that I will, too). Instead of doing what I want to do (which would be crazy), they suggest that I should volunteer full time somewhere, or write a book, or go back into teaching.

Basically, the assumption is that I should trade fifty hours a week of one activity for fifty hours a week of some other, singular, lower-paying or non-paying activity that I would like more.

Monday, March 31, 2014

Sex Sells...Health Insurance

With today being the deadline to sign up for ObamaCare, healthcare companies are making their last ditch efforts to sign up as many new customers as they can. One example caught my eye recently. There's a non-profit health insurance co-op in Colorado that's using an old trick to sell our nation's new health plan: beautiful models standing in front of a booth. Colorado HealthOp hired four young, tightly dressed models to convince more people to sign up.

At least there were two male and two female models, so even the ladies have some eye candy to enjoy while they ponder their health insurance options.

And, let's face it, it's easier to decide whether you want a plan with a Health Savings Account when there's an attractive model walking you through the options.

At least there were two male and two female models, so even the ladies have some eye candy to enjoy while they ponder their health insurance options.

And, let's face it, it's easier to decide whether you want a plan with a Health Savings Account when there's an attractive model walking you through the options.

Tuesday, March 25, 2014

Opportunity Costs are Sunk Costs

Ever since we paid off our house early, I've had a nagging feeling that we'd done something a little foolish. Like Johnny Moneyseed says, paying off your mortgage early is silly, right? In the timeframe that we did it, from 2010 to 2013, it was downright costly. This handy calculator from dqydj.net shows that we gave up a 17.4% annualized return by not putting our extra mortgage payments into the S&P 500. Because the market went on a tear during those years, the money we put towards the house had significant opportunity costs.

Opportunity costs are what you sacrifice when you take one course of action instead of another. Every choice has opportunity costs: you go down one path, and you pass up the chance to go down another. Two roads diverged in the woods, and all that.

In this case, we gave up historic gains in the market in order to book a 4.25% gain by paying down the mortgage. And it frustrates me, because who knows when an opportunity like that will come again?

Opportunity costs are what you sacrifice when you take one course of action instead of another. Every choice has opportunity costs: you go down one path, and you pass up the chance to go down another. Two roads diverged in the woods, and all that.

In this case, we gave up historic gains in the market in order to book a 4.25% gain by paying down the mortgage. And it frustrates me, because who knows when an opportunity like that will come again?

Friday, March 21, 2014

That Time Someone Ran Over My Scooter

Didn't I ever tell you about that time someone ran over my scooter with an SUV? No? Well, it happened about a year ago, in a parking lot. I was doing some errands and scooted on over to Target to pick up the basics: deodorant, some makeup for my wife (don't judge), and a package of toilet paper that I'd have to tie down with bungee cords. I'm always nervous about our scooter getting hit in parking lots, since it kind of hides in a parking space. When going down an aisle, it initially seems like the parking space that our scooter is in is empty, so I can see how a driver might pull halfway into the spot before realizing there's a scooter in there. So I parked in a spot far away from the entrance, and without a car on either side.

Monday, March 17, 2014

Renters, Utilities, and Moral Hazard

We live in an old house. It was built in 1950, back when cement block was the material of choice here in the Phoenix valley. The little details, like the low pitch roof and the long, skinny windows that wrap around the corner of each bedroom, made us fall in love with the place. We put in our offer the first day we saw it...and then waited over nine months, through a short sale and a foreclosure, to finally close on the house. Those cute little details, unfortunately, are also what keep our energy usage so high.

Monday, March 10, 2014

Rashard Mendenhall is My Hero

I stumbled across an interesting article on ESPN today: Rashard Mendenhall, former running back for the Pittsburgh Steelers and the Arizona Cardinals, is retiring. The interesting bit is that Mendenhall is only twenty six years old: right in the prime of the typical NFL player's career. The main reaction from sports outlets seems to ask, "Why?" While Mendenhall is not a premier running back, it's likely some team would have wanted the former first round pick to join their stable of backs. Considering the financial consequences of the decision, it's hard to imagine why he would leave this lucrative career. Even role players and bench-warmers make extremely good money: NFL players with six years of experience earn at least the minimum salary of $715,000, not including any signing bonuses. It's possible Mendenhall could have made a good deal more than that: last season he earned $2.5M with the Cardinals.

Thursday, March 6, 2014

Rent to Own

Mrs. Done by Forty and I were driving home from a date night earlier this week, when we passed an Aaron's. Aaron's is a rent to own business, like Rent-A-Center, that leases everything from furniture to big screen televisions. I said to her, "We need to close that place down."

"Why?"

"They take advantage of poor people. Rent-to-own places are just like payday lenders: they make their money by exploiting the fact that poor people don't have money available right now."

"Is it that different than what any money lender does?" Mrs. Done by Forty asked.

"Um, no."

"Why?"

"They take advantage of poor people. Rent-to-own places are just like payday lenders: they make their money by exploiting the fact that poor people don't have money available right now."

"Is it that different than what any money lender does?" Mrs. Done by Forty asked.

"Um, no."

Tuesday, March 4, 2014

Relative Costs

Hi, Done by Forty readers. Work has picked up lately, so I am recycling a post from back in February 2013. The blog got about one reader a day back then, and I am pretty sure that reader was my wife, most days. Sweet as she is, she wouldn't admit it, letting me think at least someone outside the walls of our home was reading my words. But the bottom line is that, hopefully, the post will be new to you. I'll be back with original articles soon.

I'm writing to you from the island of Oahu, as my wife is attending a conference here and we decided to make a vacation of it. We've hiked a lot, up to Manoa Falls and Diamondhead and along the North Shore, watched the surfers take on ridiculous waves at the Pipeline, rode "Da Bus" everywhere for a surprisingly affordable $2.50 (which apparently includes unlimited transfers), and are trying to get our money's worth out of the snorkels we bought at Target back home. It's been a great time and we still have a few more days to enjoy it all.

|

| From madmarv00 at Flickr Creative Commons |

Thursday, February 27, 2014

The Psychology of a Tax Return

Yesterday morning we got our federal tax refund deposited into our checking account. And at almost $700, it felt great. We used a free e-file program that gave us a pretty accurate estimate of what to expect to get back so it wasn't a huge surprise. Mrs. Done by Forty and I started talking about some of the fun things we could do with this money: we could put it towards an upcoming vacation, or maybe spruce up the house with a DIY project. But after a while, I had to catch myself and ask: why am I getting excited about our tax return? Isn't it a bit odd? We give the government money that we earned, all year. And then when we get a little of our own money back, it's like we won something: like it's some prize we're lucky to receive. Like Teddy KGB says in Rounders: it's a f-ing joke, anyway. Uncle Sam is paying me with my money.

Sunday, February 23, 2014

President Obama Emailed Me About the Minimum Wage

The blog must be getting pretty popular, because recently I started getting emails from President Obama. Pretty cool, right? The economy must be still recovering though, because he's always asking me for money. Dude makes $400,000 a year, but mismanages his pay so badly that he has to ask me to send him money every week. Every time I send him five bucks, I think, man, this is the last time, Barack. But I've got a soft spot for him. I sent him a link to Mr. Money Mustache the other day, but I get the feeling he isn't going to start biking around D.C. or hanging his laundry out to dry on the front lawn of the White House.

Thursday, February 20, 2014

BLS Consumer Statistics: What Do They Tell Us?

I stumbled across some Bureau of Labor Statistics (BLS) numbers the other day, outlining the average amount American household's spending on everything from clothing, to transportation, food, and housing. This is a treasure trove of data for a personal finance nerd like me. As I dug into the statistics though, I found myself getting a little discouraged by the whole thing. Somewhat surprisingly, it looks like the average "Consumer Unit" (what the BLS calls various groups of people living together) is making pretty good money: nearly $66k before taxes. But, unsurprisingly, we Americans are spending almost all of our income. Let's dig into the numbers:

Monday, February 17, 2014

Anchoring My Expectations

|

| Anchoring? |

Now that I'm back, the next big thing coming down the road is my annual review. This will be my first performance review with my new employer, and I'm not entirely sure what to expect. Normally I would let my mind run wild, day-dreaming of raises and fancy promotions. But after hearing about a friend's recent experience, I am taking a different tactic and throwing an anchor on my expectations. Let me explain:

Thursday, February 13, 2014

Limit Your Options, Expand Your Wallet

Hi there, Done by Forty readers. My wife and I are still in Hawaii and loving it. Though, sadly, our time here is coming to a close this weekend. On the plus side, that means I'll have time to read the posts you've written while we were away.

Today, we have a cool guest post from The FIREStarter. He's a UK blogger who writes about reaching Financial Independence & Early Retirement on that side of the pond. Today, his post is on the pitfalls of having too many options, and the paradox of choice.

Today, we have a cool guest post from The FIREStarter. He's a UK blogger who writes about reaching Financial Independence & Early Retirement on that side of the pond. Today, his post is on the pitfalls of having too many options, and the paradox of choice.

Monday, February 10, 2014

Give Yourself Credit (Progress is PROGRESS)

Hi there, blogging buddies! Mrs. Done by Forty and I are on vacation this week, stuffing ourselves with good food and trying to work it off by hiking around this beautiful island. I'm sorry that I haven't been able to keep up with your blog posts, but I'll catch up soon! Today, we have an intriguing guest post from FI Fighter about the psychological hurdles involved with reaching an early financial independence.

Wednesday, February 5, 2014

There Ain't No Rest For the Wicked

"There ain't no rest for the wicked.

"There ain't no rest for the wicked.

Money don't grow on trees.

I got bills to pay.

I got mouths to feed.

I got mouths to feed.

Ain't nothing in this world for free.

No, I can't slow down.

I can't hold back,

Though you know, I wish I could.

No there ain't no rest for the wicked

Until we close our eyes for good."

-Cage the Elephant

-Cage the Elephant

Wednesday, January 22, 2014

Girls Just Want to Raise Funds

Last week, my friends and I were drinking beers and discussing a thought-provoking blog post from Emily Capito, "Nonprofit Piety Won't Change the World," as one of my friends works for a local nonprofit. The post centers on the notion that there are separate sets of economic rules for the nonprofit sector and the for-profit sector. Take one example: it's a commonly held belief that in the for-profit sector, offering good compensation to your leadership and employees well help to attract and retain talent, and ultimately lead to better results for the organization.

But try applying that logic to the non-profit sector, and people get upset that so many dollars are going toward overhead, instead of making their way to the people in need. Never mind the fact that higher compensation may draw better talent, who can raise more funds, or craft strategies that would have greater impacts for the recipients of that charity. Donors want to see those dollars going straight to those in need, not to the people working at a nonprofit.

But try applying that logic to the non-profit sector, and people get upset that so many dollars are going toward overhead, instead of making their way to the people in need. Never mind the fact that higher compensation may draw better talent, who can raise more funds, or craft strategies that would have greater impacts for the recipients of that charity. Donors want to see those dollars going straight to those in need, not to the people working at a nonprofit.

Monday, January 20, 2014

Did Americans Really Overpay by $1B at Tax Time?

So I'm finding that watching commercials again isn't so bad, as I get to learn new things. For example, did you know that LL Cool J is hosting the Grammys this year? Which is awesome, as there's an outside chance we'll all get to see "Momma Said Knock You Out" on live television in 2014. This would be the highlight of my year. Also, I heard a statistic on a running commercial series that is so shocking that I don't want to believe it's true: H&R Block claims Americans overpaid by $1 billion in taxes last year. Apparently this is enough for a stack of five hundred dollars to be placed on every seat of every NFL stadium (one on each of 2 million seats in the thirty two professional football stadiums). Here is a video of the ad:

Tuesday, January 14, 2014

Should We Pay Personal Capital to Advise Us?

Late last year, we signed up for Personal Capital's free software. Their dashboard provides a quick, holistic view of all our investments, our spending, net worth, the whole shebang. And after a few days, Michelle from Personal Capital emailed me asking if we'd be interested in speaking about our portfolio. I figured there'd be no harm, so we spoke briefly about our goals and our investments. At the end of the call, she asked if we'd like to meet again, and to see a personalized recommendation from Personal Capital. It was free, so why not have a professional view our portfolio and give recommendations?

Monday, January 13, 2014

The Lottery: You Can't Win If You Don't Play

I have given up my quest to avoid advertisements, and I'm admitting defeat. After a few months of trying to avert my eyes when passing billboards, and changing channels every ten minutes in the middle of football games, I am throwing in the towel. I am one man against the thousands and millions of advertisers, and their millions and billions of advertising dollars. It was never a fair fight, so rather than continuing to aggravate myself, now I am just watching playoff football like a normal American, and watching the stupid commercials. And it's not a big deal.

Thursday, January 9, 2014

Mindless Accumulation

Matt Richel wrote an excellent article in the New York Times about a term I've never heard of before, but now absolutely love: "mindless accumulation". Mindless accumulation refers to the human instinct to earn past the point of our needs, or even our wants, and to simply work until we cannot work any more. The article centers on research that notes that, because of new technologies and greater productivity, the current generation can work fewer hours or less diligently than the prior generation, but still achieve the same standard of living. But, typically, they do not. The theory is that humans have a desire to earn and acquire more than they possibly could use: leading to another great term, "overearning".

Monday, January 6, 2014

What's it Like in America?

A while back, Mrs. Done by Forty had lent a little money to a woman she's been working with in Peru. She's been working off the debt bit by bit, and this woman invited my wife to lunch at her house yesterday. They went to the market together and bought ingredients, including the meat, from the open air market. They were making lomo saltado together, and the total cost was seven Soles (about $2). To save money on housing, the woman lives with her family outside the city limits, where the city just turns to a desert and there aren't really permanent structures, per se. The houses are made of reed mat walls and reed roofs: kind of what we might describe as a shanty town, since the structures aren't permanent. But I don't mean that in any derogatory way. To them, it's just their homes.

Subscribe to:

Posts (Atom)

+at+Flickr.jpg)