Thanks to my only real source of news, NPR podcasts, I learned that the cost that college students are paying for tuition isn't rising very fast at all. This story from Planet Money tells a very different narrative than the one I'd been hearing for years. So I was skeptical. But as the good folks at NPR make clear, the disparity makes sense. There are two costs being tracked: the sticker price, which is the cost that colleges list on their official websites, and the net price, the average price that students actually end up paying. So while the sticker price is increasing, most students do not pay the sticker price.

The narrative told by the price students actually pay the university, the net price, is a lot more interesting. That number is increasing very slowly -- tracking with inflation, basically. According to a College Board report, that net price actually decreased over the past decade, when you account for inflation. (Want another shocking statistic? The median published tuition and fee price at private and public universities was only $11,093 for undergraduates in the 2013-2014 school year.)

Still, it makes you wonder. Why would colleges artificially create higher list prices, when the true costs are staying relatively flat? There are a few reasons. As the podcasters note, schools are competing heavily for the best students. One of their marketing tools is to offer a big discount from the list price as a merit scholarship. As any shopper knows, it is harder to resist a big discount off of a high ticket price. The higher the original price, the better the impact. On the podcast, an administrator stated that the real reason merit scholarships are offered are to change a student's decision to enroll at a university. It's used to close a deal.

This is the Anchoring Effect in action. A cashmere sweater that's simply showing a $50 price tag is not as enticing as a $100 sweater that is 50% off. Even if they are the same exact sweater, the $100 sweater seems nicer. It's the same price, but a better deal.

But here's the tricky part: once the seller establishes an initial price, we start making assumptions about the product's quality. The high priced sweater seems softer. More durable. More stylish. In the university's realm, the high sticker price of $55,000 per year establishes a certain aura of prestige and quality. At that price, the school must be pretty good, no? So when a half-scholarship is later offered, the prospect of attending that expensive school gets a lot more enticing. You're now being offered a better education at a great deal. It's no longer seen as a $27,500 tuition...it's a $55,000 annual tuition that's half off. Never mind that the prices are being intentionally manipulated to create that impression.

The higher price also allows the university to offer a wider range of prices to students. A school can have some students pay the full sticker price, so long as they have the means and are willing to do so. The administration can also offer lower prices to desirable students who don't have the financial means to attend. This shows the advantages of segmented pricing. By being able to offer a wider range of prices, the school gets a better mix of students than they would have with a single, set price.

The rub is, as with the sweater, it's the same product when it's all said and done. The student who's paying $27,500 might feel she is getting a good deal, and so might the student who's paying $55,000. Both students' feelings are valid, so it's a matter of perception on one level. On another, we're talking about an education that is, for all intents and purposes, the exact same service being sold at shockingly different prices. They can't both be getting a good deal, can they?

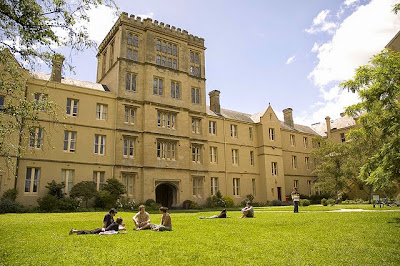

*Photo is from Queen's College at Flickr Creative Commons.

OMG, it's the antique desk principle at work! When I was a kid my dad used to tell a story about a friend trying to sell an antique desk. He put an ad in the paper (which tells you how old this story is). After a week when he'd gotten no calls he called the paper to change the ad. My dad was sure he was going to lower the price, but no... he raised it by $100. Each week when the desk didn't sell, Dad's friend would raise the price. My dad thought he was crazy and a small wager ensured. Not sure if Dad's friend was confident or just stubborn, but finally after he'd nearly tripled the original price, he got a dozen calls and sold the desk! Suffice it to say, Dad had to buy the beer for a good long time on that one!

ReplyDeleteAnyhow, I'm not sure how I feel about this principle being applied to higher education. Perhaps students should take it as a free lesson in market economics!

That's an awesome story. I love the guts your dad's friend showed, too. I think I might try the same experiment with some of my stuff that's bound for Craigslist.

DeleteI think your story illustrates the other side of the coin. While we might accept that high prices anchor us towards a positive emotion or outlook, very low prices have an effect, too. If we see a $2,000 tuition, or a $50 price tag on a desk, we assume the quality is low.

Fascinating DB40, I always assumed the cost of college education was rising significantly in real terms (although I think real education costs are rising here in Australia - I'm sure either way it will be a ton of money by the time my 2 year old daughter gets there :S ).

ReplyDeleteThere's some really clever stuff going on out there with people playing on our biases for anchoring. I love to see it being called out in posts like this to help increase awareness. Reminds me of the trick restaurants use by including one incredibly expensive dish on the menu - you'll usually opt for the 2nd or 3rd most expensive item, and feel like you're getting a good deal by anchoring to that most expensive dish.

Must admit though, I'm a sucker myself for 50% off items, especially when I'm in the supermarket - it's usually my default setting for deciding between goods...

Great example about the very expensive item on a menu. That sort of price segmenting is truly clever. Next to the $50 steak, the $28 chicken seems fairly reasonable all of a sudden.

DeleteI'm a sucker for a good 50% off sale, too. I can barely resist, even when I know it's just anchoring that makes me think it's a great deal.

I often wonder about how universities control their costs as well. I would think not very well, there's certainly an air of entitlement around any campus. Probably no different than government, maybe worse. Something about academia and the pursuit of knowledge being self righteous makes me think there's a lot of " I deserve" thoughts permeating the faculty. Perhaps our friend Alicia can weigh in on that. :-)

ReplyDeleteI get that feeling sometimes, too, debt debs. Mostly I think it's because academia sometimes operates in a bit of a bubble.

DeleteThat said, when I worked for a state university, there was quite a lot of cost cutting going on. When I left, they were implementing mandatory furloughs.

Amazing, DB40!! Wow - the "sneakocity" of marketing never ceases to shock me. The sellers, all of them, have our number, so to speak, don't they? Thanks for an eye-opening post.

ReplyDeleteThank you, Laurie! I'm impressed by the marketers savvy, as always. We have a worthy opponent.

DeleteWe have 3 kids heading toward college. The private college I attended was $15k about 21 years ago. Now the sticker price is over $40k. Virtually nobody pays that, but if you get a $15k grant and get the price down to $25k are you getting a "good deal"? At this price our kids will likely be attending a state school. We hope to "strap" our kids with no more than 1 year of student loans. It should be interesting to see how it works out. Thanks for the information.

ReplyDeleteThat's a reasonable goal, Wade: 1 year of student loans. I think there's something to be said for having a little skin in the game, too. I know that when I started working for my education myself (working full time at a University, and taking classes at night) I certainly took the process more seriously.

DeleteAs for the $25k tuition being a good deal, it's tough to say. The main thing the universities are adding into the equation is complexity. It's much harder to compare prices when there's so much variability & discounting happening.

There are two things that always get me shaking my head (from a Canadian perspective) - health insurance and cost of university in the US. I just cannot fathom either.

ReplyDeleteGranted, I am very spoiled, and not used to paying so much. University education here is heavily subsidized. I went to a Top 15 school in Canada (used to be a Top 10, but it appears to have dropped a bit...) and I paid $5,000 per year for tuition. My friend just started med school, and she's paying $17,000/year in tuition. Because her husband is working, she can get out of med school with only about $60,000 in debt. And that's what some people in theory pay for one year?!

Where do the scholarships come from? Are they alum endowments, or are they government? I'm just trying to wrap my head around the discount model for an Ivy :) Seems so counter-intuitive.

I hear you, Alicia, though some of that information being reported isn't telling the whole story. I learned that the median list price (not the lower price students actually pay) for tuition was only around $11k. Pretty reasonable, IMO.

DeleteI don't actually know the funding source for most merit scholarships. Those offered by the University are probably just in their budgets: they artificially increase the sticker price, to give themselves room to offer merit scholarships when they really want a student. Anchoring effect for the win.

That is very interesting! I wonder then why student loan debt keeps rising each year.

ReplyDeleteIt's a good question. We might also consider the amount people are saving for college, what costs might be going onto debts more frequently now (e.g. - housing & living expenses), etc.

DeleteMy guess would be lack of awareness and students using loans to fund an extravagant lifestyle for their station in life.

DeleteGood old NPR, I listened to that one as well. I get the premise behind it but with student loans being a crisis we should be figuring out this issue instead of discounting a 55K school.

ReplyDeleteRight, but we should also be skeptical of the reasons people cite for their crushing student loan debt. They always say, "the cost of education is rising so quickly..." Which might not actually be true.

DeleteDoes anyone ever say, "Neither my parents or I saved very much for college over the past 18 years..."

That's a great point/statement. My argument would be how many kids aged 14-18 are saving a ton of money so they can go to college, I do not think this is their responsibility, it's only an added bonus if they do contribute. On to the parents, if Mom and Pops are like every other survey I read that says nobody is saving a dime for anything then I think there needs to be more of a plan. Just an idea but any kid that has to take out the entire balance in student loans his/her first year should be required to attend community college for the first 2 years of school. Boom I just saved kids thousands of dollars and their parents too, just an idea. Good talk DB40.

DeleteFascinating! The price of higher ed is something I think about a lot and, I loved that Planet Money story (I'm also guilty of often mono-sourcing my news from NPR...). Something I wonder is whether or not college is a good deal at all these days. With the rise of MOOCs and other alternative means to a degree, I have to wonder if the traditional 4-year, living on campus model has legs anymore. Granted, I followed that model for undergrad and had the time of my life, so it's kind of easy for me to say.

ReplyDeleteAnother NPR story that resonated with me is the fact that many schools with robust graduate programs (the example cited was Duke) often pass those costs along to their undergraduates. The idea is that the schools need the ability to attract grad students with grants/fellowships and undergrads have become acclimated to paying high tuition.

I agree that the landscape of education is changing dramatically. ASU is ahead of the game, I think, with their drive towards online education -- that's where we're headed, for better or worse.

DeleteAnd yes, the costs of PhD students (who typically don't have to pay for much or any of their tuition, and even get packages to pay them stipends) are subsidized by Master and Undergrads. It is what it is. Still, I think the overall message is that college is not nearly as expensive as most people estimate it to be, or as some media outlets would have you believe.

That's so interesting that the real cost has decreased after you take inflation into account. Great post. That students end up paying very different prices is bothersome to me. My husband and I went to the same college, but his parents paid the sticker price and I had a partial scholarship, probably because they were trying to recruit women. Doesn't seem fair. :/

ReplyDeleteAnother recent Planet Money podcast on Duke's tuition illustrated that depending on what the students do once they get to school some are getting better deals than others. If you aren't doing research and developing a close mentoring relationship with a faculty member, you are wasting a lot of your tuition.

The segmented pricing does leave a sour taste in my mouth. Still, it illustrates the value of being a savvy buyer or negotiator. Prices are not as advertised, nor are they as firm as they would seem. There's wiggle room, and a lot of it.

DeleteI remember listening to this podcast and it's exactly what my college did. I come from a family that could afford to pay the sticker price, but that college only got me on their campus by giving in an academic scholarship that covered 50% of my tuition. It felt like most of the kids paying the full sticker price were the ones who really couldn't afford it and wouldn't probably have the highest earning potential after graduation. It's sad that we associated high prices with high quality, but alas that's the way many Americans' consumer minds work.

ReplyDeleteI got the same deal from my private college: 50% off tuition on a merit scholarship. To the school's credit, that was the factor that made me choose the school. So the marketing/anchoring effect worked on me, too.

DeletePart of it is that a person is enticed by the discount of the merit and/or needs-based scholarship. But not everyone is going to qualify every year for that merit and/or needs-based scholarship. However, once 2+ years into the program, very few people will leave.

ReplyDeleteRemember that anyone under age of 23 is considered a dependent, and their parents income is counted as a contribution to tuition costs. In my case, my scholarship was merit + needs-based. But when my sister graduated, my parents "contribution" (even though I paid my own way through) was all counted towards me instead of half. I no longer qualified as needs-based, which limits the scholarship pool. So I paid 2 years of full price instate tuition.

I also wonder how much of the decrease to due to counting instate tuition as a "discount" instead of the sticker price.

It's a complicated situation, for sure. Give the College Board report a read if you want to see how they came to the numbers. But the overarching theme is that the doom and gloom of ever rising education costs is overblown. It's not even all that accurate.

DeleteVery interesting...NPR often tackles interesting topics. I can understand the premise like Even Steven, but I'm still not convinced that college is getting exponentially more expensive. I do see that sticker price may not necessarily be the price most students pay (I think many universities get rich families as well as international students with wealthy families to foot the full price). But with my experience with grad school, there is very little scholarships offered and I did pay full price which was $25k part time (2007), it is now $38k part time. Full time was in the $30k range and now its $51k. Great point about anchoring though...schools definitely do this. Why the heck is a 4th tier school just around the same price as an Ivy league one???

ReplyDeleteAndrew: I agree that grad school, especially for a Masters, is a different animal. PhDs seemingly get a free (or even a paid) ride, but masters degrees are treated as cash cows. They seem to be the most expensive options, with higher sticker prices and few financial aid options available. And as you noted, some mediocre schools are jacking up their prices on these MBAs like they're top schools. Like the podcasters noted...anchoring high works.

DeleteUnless you go to Pitt, that is. The most expensive school in the main precisely because they don't do this. (Also heard this on NPR.) Did a semester there and can tell you, the financial aid sucks.

ReplyDeleteThis is super interesting, and further solidifies my opinion that you really can do college without loans if you are aware of how the system works.

Dang it... Nation not main. So hating my autocorrect lately. I swear it changes words after I proof read.

DeleteYes! College can definitely be done without loans if you plan and are willing to be flexible. I ended up working at my university full time and taking classes at night to get my bachelor's and my teaching credential. It sucked, but I didn't acquire more student loans!

DeleteI'm in college now and I firmly believe it is getting more expensive by the year. I wish I lived in parts of Europe so I didn't have to pay for my education. (Or does all of Europe do this.? I forgot.)

ReplyDeleteHey Alexis. I don't know much about the education system in Europe but I've heard it's free, or nearly free. Good deal if you can get it!

DeleteThis is an interesting take on tuition! When I was going to "college fairs," most representatives only told me that a majority of their students were eligible for aid and scholarships, so I kept the sticker price in mind. I ended up choosing to go to community college (super cheap), and then a local private college, that still ended up being less than most of the colleges I had been accepted into. Or so I thought. I wonder if I had been a bit savvier, if I could have gotten a better deal elsewhere. I did receive a small scholarship, but I had friends that received full rides, and I know my grades were better. I'm glad I'm done with all that.

ReplyDeleteI think your path to a degree is super savvy. I wish someone had tried to convince me to go the community college route. Being a pompous, know-it-all teenager, I wanted to go to a fancy schmancy private college right out the gate. Then, after two years, I hated it and transferred to a state school. Go figure.

DeleteI listened to that exact same podcast a few weeks ago. I was going to write my thoughts on it, but it looks like you beat me to it!

ReplyDeleteHey Lisa! I think there's plenty of room in the blogosphere for both our thoughts. Give it a go!

DeleteTerribly interesting topic! I had also been under the distinct impression that higher ed costs were rising faster than health care. In particular, my "cost savings" of investing in the state's educational savings plan now rather than paying full price later were heavily emphasized in a sales-y seminar.

ReplyDeleteI personally wonder if we will begin to see the net price drop substantially in coming years in response to increased competition in the market as private and alternative options become more and more legitimate. My brother is a computer science graduate student, but many argue that getting a grad degree in the tech arena is foolish since technology changes so quickly and there are hands-on opportunities to learn at high paying jobs right out of high school or your undergrad.

In a different realm, I earned my MBA from University of Phoenix, despite their reputation (no, I did not take my classes online). It was 50% cheaper than the evening "professional" MBA program at my local public university an my instructors all had high level jobs and many years of experience in their subject areas. I learned a great deal more in that program than I did in my public university MSW program. That said, I'm excited for where the higher education market will take us in the years to come!

I agree with a lot of what you wrote, Emily. For a while, I wanted to go into computer science but agree that the degrees for that sort of tech field are often not worth the price tag. Alternatives like Treehouse seem like a much better option to get into the field.

DeleteI have mixed feelings on the University of Phoenix but have met with, and worked with, some super sharp MBA grads from there. The proof's in the pudding, I think.

Agreed that higher education is in exciting transition right now. I feel like we're just seeing the tip of the iceberg with online degrees, for better or worse.

Having been to both a state university and a "elite" private university - I paid more at the state school. I got a free ride to the private university - *and* they paid me $1000/mth for "working" 10hrs/week. I now work for that university - and at least in our department, money is a big issue. We pay competitively, but any money comes from research grants and faculty, not tuition.

ReplyDeletePersonally, I feel that I got a better education at the state school than the "elite" private school. The name reputation of the private school has been immeasurable in my career though.

I'm in a similar boat as Mom here. My undergrad came from a state school that doesn't have much of a name for itself, and I did take out about $6K in loans to complete my degree there. The rest was all scholarships.

DeleteBut my masters was from an Ivy where I was paid through NSF grants and was paid around $27K/year on top of tuition and healthcare waivers to complete my studies and do the occasional grading and TA-ing. While the Ivy name gets top billing on my resume, the bulk of the liberal arts education that makes me a well rounded employee came from that state school.

That makes total sense! I went to a relatively high-priced private college that honestly is flush with cash. They raised over a half a billion dollars recently for new buildings. It may sound unnecessary, but I think they invested the money wisely because the buildings were long overdue (athletic center and student union, among other things). The point is that students are paying a decent amount to go there (even with the discounts) but they don't *really* need all that tuition money because they have so many big donors. The scholarships and discounts they offer are great and bring them in-line with state schools, but it still seems more prestigious than the state schools.

ReplyDeleteFull disclosure -- my husband works for a small private college. So, we have a front row seat to some of what goes on to attract students. There's gamesmanship on the part of colleges, students, and their parents. Clearly, I think colleges have the upper hand, for the most part. But, some parents also have the flexibility to "engineer" their tax returns to receive higher financial aid awards. Unfortunately, it's not the student of modest means who benefits. It's usually kids from monied families who can hire experts or have the time to help them figure it out. My friend -- a college financial aid director -- once told me that a parent called demanding more aid for his kid since Dad had just been laid off. His severance package was $1 million, but apparently the situation was "dire." Snark aside, these are extreme examples.

ReplyDeleteWith respect to the student debt crisis I do have to say this -- I think the crux of the problem is that many students do not stand back and consider their employment prospects, the wages associated with those, and the debt that they are taking on. I am not suggesting that everyone go into high paying professions or that lower paying professions have no societal value. But taking on $50,000 in debt for a $25,000/year job in human services is not a good trade off. My suggestion to that student would be to go to a community college for a couple of years, then transfer to a four year college/university. Also, explore frugal living arrangements (living at home?).

If I had a child who were a really gifted artist and wanted to make a living at it I might encourage them to consider a double major or learning a trade (carpentry, DIY skills) so they can have a good "side hustle" while they pursue their art. I would not discourage them from doing so outright, but would try to get them to carefully consider the true costs of living on your own. Motivated people can usually find a way.

Also, we tend to look down on trade education in the United States, but it is a particularly wonderful thing. I know many students who would have been better off with a two year degree, working, and then going on later -- if they so desired. I also know electricians and finish carpenters who are making far more money than I will ever see.

The bottom line is, we all get paid for bringing skills and value to the marketplace. (Based on my values, I think that certain valuable professions like teaching are underpaid, but that's not the crux of my argument.) Most of us don't get paid for being "thinkers." Big thinkers make a difference, for sure, because they can translate their big ideas into actions or creative ways to solve problems.

I think higher education institutions are catching on and learning that they need to focus on skills and outcomes.

Wow! Great article. I had heard about this method for more typical consumer product... but having it applied to education is just outright depressing. Looking back at my education, I went to private schools for both undergrad and grad degrees. In the middle of my undergrad, I realized how much the tuition was costing me and my parents, and started taking summer classes at my in-state university. Best decision ever. I saved myself over $25,000 in student loans. By the time I got to grad school - I realized if I couldn't get someone else to pay for my education, well, then I didn't deserve it! haha My kids are still toddlers, but I'm hoping by the time they get to college age that the higher education system has reformed itself.

ReplyDelete"A school can have some students pay the full sticker price, so long as they have the means and are willing to do so."

ReplyDeleteExcept that students often don't have the means, their parents do. And in this, often middle class parents screw their kids. "Well, I worked my way through school" or go to community college and then state school, which takes longer, or "you won't get anything from the FAFSA so I am not going to sign" or the parents just don't want their kids to know their assets and income. Then, a kid can't get ANY aid, because everything is based on their parents, college costs are well beyond anything they can earn by working summers and a reasonable amount during the school year. The government has changed a few things since I was an undergrad, allow unsubsidized loans, even if the parents refuse to sign the FAFSA but that is not enough. If private schools want to do this fine, but for public school, raising the rates over inflation, having very little merit aid makes this not ok. Those is the baby boomer generation got the benefit of a subsidized education, so should their children, and the children after them.

College is definitely getting expensive only because the economy is bad and people aren't able to find work. Once they graduate they aren't able to find any good jobs that pay. How does the government expect us to pay back the federal loans without good jobs while still managing a normal lifestyle? I don't know. I am currently in student debt of at least $26,000. I am trying many side hustles like blogging to hopefully gather up some money to pay this off. Still I don't think my degree in IT is a waste, I just have to relocate to places that will hire me. Great post!

ReplyDeleteWe’ve been stumbling around the internet and found your blog along the way.

ReplyDeleteWe love your work! What a great corner of the internet :)

grow your business