I woke up a little after midnight with a pretty intense pain on the right side of my stomach. I'd felt something earlier in the evening but thought it was maybe just gas.

I snuck out of the bedroom Mrs. Done by Forty, Baby AF, and our dog, Cayenne were all sleeping in while visiting my in-laws, and crept into the bathroom to, um, validate whether or not it was just gas. It was not.

I managed to ignore the throbbing and get back to sleep, but then the pain woke me up again around two in the morning. I started googling and it seemed like I might have appendicitis.

Monday, December 30, 2019

Monday, December 16, 2019

Daycare or Not Daycare

The other day, a good friend of ours asked if we knew a specific date we'd be hitting financial independence. Unfortunately, I told her I didn't think we could give an answer. At least in our case, I'm not sure we'll really be able to do a lot of forecasting.

Financial independence, ironically, becomes less in our control as we get closer to it. More and more is in the hands of the market, while our contributions make up a smaller and smaller portion of the overall portfolio. If the market goes up the next year or so we'll likely hit financial independence in my fortieth year without much problem.

If the stock market dips hard, then there's literally nothing we can do to make up for it. Those are the breaks.

Financial independence, ironically, becomes less in our control as we get closer to it. More and more is in the hands of the market, while our contributions make up a smaller and smaller portion of the overall portfolio. If the market goes up the next year or so we'll likely hit financial independence in my fortieth year without much problem.

If the stock market dips hard, then there's literally nothing we can do to make up for it. Those are the breaks.

Monday, December 2, 2019

Does FIRE Make for Healthy Comparisons?

My good friends recommended a great podcast recently, Dr. Laurie Santos' The Happiness Lab. The show is based on Santos' immensely popular class on positive psychology at Yale, "The Science of Well-Being", which at one point had over a quarter of the students at Yale enrolled, with hundreds of thousands more enrolled online for free through Coursera.

The podcast tackles the myths of what we think will make us happy (but doesn't), while also outlining the science of what actually makes us happy (even though it's not often what we think).

The podcast tackles the myths of what we think will make us happy (but doesn't), while also outlining the science of what actually makes us happy (even though it's not often what we think).

Monday, November 25, 2019

Gone Too Soon

I broke my writing streak last week, as I went home to Pittsburgh for a funeral. My good friend from high school, T, passed away suddenly. He lived in the same neighborhood as me, and we graduated together. If not for some weird last minute circumstances, he was going to be a groomsman in my wedding. He was my age: not even forty years old yet, with a daughter left behind.

The trip home was a conflicted one. The gut-wrenching feelings of seeing my friend in the casket and knowing that this would be the last time I saw him were paired with a rare reunion: getting to see all my old friends again, all in one place for once. I caught myself feeling happy at times in seeing loved ones I hadn't seen in years, and then felt guilty for feeling that way. Why should I be happy at a time like this?

The trip home was a conflicted one. The gut-wrenching feelings of seeing my friend in the casket and knowing that this would be the last time I saw him were paired with a rare reunion: getting to see all my old friends again, all in one place for once. I caught myself feeling happy at times in seeing loved ones I hadn't seen in years, and then felt guilty for feeling that way. Why should I be happy at a time like this?

Monday, November 11, 2019

The CEO of Me Inc., Quitting, and FIRE

I've often heard that people should think of themselves as businesses: that I am the CEO, the Chief Marketing Officer, and sole employee of "Me, Inc." I honestly kind of like the metaphor. I like the idea that, when it comes to our money, we should think about it in terms of profit and loss statements, of investing in ourselves the way a business invests its capital into its own people and its equipment, and how it might be helpful to have some sort of formal vision statement to guide this little company of Me, LLC.

I like the organized nature of this kind of worldview: its commitment to efficiency. And I find it empowering, in a way, to think of myself as the CEO of this tiny organization. You and me and everyone we know: we're all the head boss in charge, in a way.

Monday, November 4, 2019

Our Half Baked Slow Travel Plans

You'd think that after working towards financial independence and early retirement since 2012, a full seven years, that we'd have a thorough plan of what we want to do right after leaving work. Even though we have some decent ideas of what we'd like to fill our days with -- walking Baby AF and yet-to-exist MC Baby to school, volunteering at school and with local charities, helping with homework, making dinner as a family, writing more on the blog, making a podcast and maybe creating a boardgame -- none of these things on their own is necessarily a 'life plan', whatever that is.

They're a lot of things we enjoy, of course. But they're also things that we are either doing right now, or that we could do if we wanted to. None really require us to leave full time work.

But after years of traveling at our quick pace, maybe four or five days in a city and then on to the next, and seeing that Baby AF traveled like a champ earlier this fall, we've finally come up with a thing we'd like to do that truly would require the freedom of a retirement from our current jobs: some slow travel.

They're a lot of things we enjoy, of course. But they're also things that we are either doing right now, or that we could do if we wanted to. None really require us to leave full time work.

But after years of traveling at our quick pace, maybe four or five days in a city and then on to the next, and seeing that Baby AF traveled like a champ earlier this fall, we've finally come up with a thing we'd like to do that truly would require the freedom of a retirement from our current jobs: some slow travel.

Monday, October 28, 2019

Mental Accounting and HSAs

It's open enrollment time for Mrs. Done by Forty and me, a strangely exciting time for a board game geek like me, since open enrollment decisions are like a very nerdy puzzle. One to be noodled over, guessing at how likely certain outcomes will be, weighing costs and tax benefits, and picking the right combination of options between our choices for optimal benefit outcomes.

I think I need to find a new boardgame.

In the meantime, we get to stare at the beautiful puzzle of our combined benefits.

Monday, October 21, 2019

Way Too Transparent: All the Money We Made

Whenever someone asks me how we're able to even consider hitting financial independence or an early retirement by the time I'm forty, I try to be honest. I try to avoid the temptation to tell them it's because we drive a paid off car, that we use our bikes or scooters when we can, or that we budget and watch what we spend on food.

I try not to tell them it's because we travel hack to get cheap travel, or that the things we like to do, like board game nights with some friends and a twelve pack, end up being cheaper than hopping from bar to bar.

Not that those things aren't true. They are, and to some small degree they do save us money. I just think leading with those details of frugality is, well, kind of misleading.

Monday, October 14, 2019

Baby AF in Daycare

Today is the first day of Mrs. Done by Forty's new job, a cool post-doc position that will let her work in her field for a couple of years and let us stay local, all complete with a hardly-believable set of benefits. We're both excited for this opportunity for her to use her PhD in a project that just sounds so cool to me.

I'd tell you about it, but we're weird about keeping our anonymity. Just know that her job is way neater than mine.

It is a little bittersweet though, as that also means Baby AF will be going to daycare for the first time. He's sixteen months old now, and has never spent a day away from Mrs. Done by Forty and me.

In fact, Baby AF has only been truly babysat by someone...one time. So this might be an adjustment for all of us.

Monday, October 7, 2019

To Jax

It was two days before we flew back from Germany that we got the email.

"Please call when you can, son. It's about Jax."

Due to the time difference there was no answer when we called. We spent the day thinking the worst, but felt relieved when we finally were able to get in touch later that evening. Jax was having trouble walking, but, honestly that is something we've seen before and it's usually just that he sleeps directly on the tile rather than on his bed. He has arthritis in one of his hips but, even still, when it's too hot he prefers the cool tile to a soft bed.

I told my mom to convince him to sleep on the bed and to turn down the AC a bit, and I bet he'd be walking fine in a day or two.

But then we got another email the day before we were getting on a plane. Jax wasn't eating now.

Monday, September 23, 2019

Monday, September 9, 2019

Tiny Privileges from Buying in Bulk

I went to Target this weekend for some last minute shopping for our upcoming trip to Europe with Baby AF. It was our third trip to Target, recently, because no matter how many lists I make there's always something I think of later.

The worst part is that, thanks to an ongoing renovation at our Target store, I can't even engage in my favorite junk food shame: ordering the chicken fingers from the little food court in the store, placing the cardboard container directly on the seat of the cart where rando babies put their rando bums with only a napkin in between, and then walking through the store to shop for the things I need. Sure, I get some weird looks, but they are just jelly of my chicken.

The worst part is that, thanks to an ongoing renovation at our Target store, I can't even engage in my favorite junk food shame: ordering the chicken fingers from the little food court in the store, placing the cardboard container directly on the seat of the cart where rando babies put their rando bums with only a napkin in between, and then walking through the store to shop for the things I need. Sure, I get some weird looks, but they are just jelly of my chicken.

Monday, September 2, 2019

Trust Fund Baby AF?

There's a certain amount of pride that I feel, being the son of an immigrant. I like that part of my personal history; after the divorce, I was raised by a Filipino woman. She taught me lessons borne out of her life of poverty, in another country, in a culture very different to that in the US.

Before spending a dollar, she'd tell me, ask yourself three times whether you really need to spend it.

No matter how much or how little you make, Brian, always set aside something for savings: pay yourself first.

The world is not always fair. To even the odds, you need to work harder than others: they may be bigger or richer or smarter than you, but never let them outwork you.

Monday, August 26, 2019

Baby AF Goes to Europe

After a two year haitus while Mrs. Done by Forty was pregnant and, then, while she was somehow finishing her PhD dissertation and dealing with all the stresses of Baby AF's first year of life, we are finally taking another international trip next month. And this time, Baby AF is along for the ride.

With apologies to our fellow travelers who will have to deal with some crying and constant complaints to crawl/walk down the aisles of the plane, we're sucking it up and making it happen.

With apologies to our fellow travelers who will have to deal with some crying and constant complaints to crawl/walk down the aisles of the plane, we're sucking it up and making it happen.

So I figured I'd dust off one of my favorite posts to write: a summary of the trip we're taking, and how we're trying to keep the costs down using some points.

Monday, August 19, 2019

America's Dumb Approach to Childcare

Mrs. Done by Forty was offered a new position recently, which means in addition to enjoying the ridiculously unfair tax benefits and the joy that comes from being a two income household, we'll also get to experience what it's like to pay for full time childcare for Baby AF.

We got recommendations on childcare from friends and family. We made calls, asked questions, looked up rankings when possible, and visited about six of the facilities we thought might be the best fit. Finally, we settled on a place we really liked, and where a couple of our friends had sent their children. While the hourly costs were higher, they had a pricing system that allowed us to only pay for the hours we needed and wanted: scaling up or down as needed for vacations, or working fewer hours in the office.

So we'd settled on our choice of daycare.

And then I heard an amazing short podcast on the American approach to childcare from the University of Wisconsin Institute for Research on Poverty, and why our system is so flawed. So let's talk about that today: our system of caring for children, and how it might be improved.

Monday, August 12, 2019

Two Years Out: Are We on Track for Financial Independence?

Today's my birthday. I turn thirty nine, one away from the big year where I leave my thirties, turn forty, and run against the number I foolishly set as my goal for reaching financial independence.

Astute readers will note that I'm only one year from turning forty, and wonder why the post says I'm still two years out from the goal.

A while back I decided to give myself a little wiggle room: that if I hit financial independence by the last day I'm still forty years old, I'd call it a success. I used to post net worth updates and budget porn posts, giving readers (and myself) a monthly check in on all the financial details in the Done by Forty household. Somewhere along the line I decided I didn't like doing that, so now you voyeurs just get one chance a year to peek in.

So let's take stock and see where we stand. Are we on track to make the goal in time?

Monday, August 5, 2019

Even Out the Tax Benefits for All Workers Saving for Retirement

We are awash in big news these days. Right after reaching the milestone of paying off our mortgage we found out we maybe, technically might have achieved the goal this blogger set out to accomplish way back in 2012: being financially independent according to the 4% rule.

With all that still fresh in the air, last Friday Mrs. Done by Forty accepted a full time post-doc position to begin when we return from a trip abroad. She'll get to work in her field, and locally, too: two things we never thought would be possible at the same time when she entered the PhD program.

Her new job will bring on some changes, which we're going to tackle in our first ever collaborative post in the coming weeks.

But today I wanted to talk about one big change that's going to occur specific to our financial independence plans: Mrs. Done by Forty will have an employer-sponsored retirement account for the first time in over a decade.

With all that still fresh in the air, last Friday Mrs. Done by Forty accepted a full time post-doc position to begin when we return from a trip abroad. She'll get to work in her field, and locally, too: two things we never thought would be possible at the same time when she entered the PhD program.

Her new job will bring on some changes, which we're going to tackle in our first ever collaborative post in the coming weeks.

But today I wanted to talk about one big change that's going to occur specific to our financial independence plans: Mrs. Done by Forty will have an employer-sponsored retirement account for the first time in over a decade.

Monday, July 29, 2019

The Investor Class & the Working Class

The middle class is one of my favorite things to think and write about. I've tried reframing the classes into quintiles, I've written about the difference between having a middle class income and having middle class wealth; about how your location determines a lot about what kind of income you need to be considered middle class. This blog has posts about how class and inequality are inexorably linked, and how one of the traditional definitions of being middle class (doing better than your parents did) is completely unsustainable.

These days I'm not really sure I love the terminology.

What if we're using some antiquated ideas of lower, middle, and upper classes that don't mean much anymore?

These days I'm not really sure I love the terminology.

What if we're using some antiquated ideas of lower, middle, and upper classes that don't mean much anymore?

Monday, July 15, 2019

Wait, Did Paying Off Our Mortgage Kind of Make Us Financially Independent?

So, we did it. We sold a bunch of stock, pulled together our dividends and ESPP payments from June, scrounged up all the cash we could find, and paid off the mortgage last Friday. Pending some paperwork that has to go from the bank to the county, we are mortgage free and own our home outright.

It's a great feeling, if a little more subdued than we thought it might be. Maybe it's because we'd been mortgage free once before. Or maybe it'll just take some time to sink in.

Maybe we're a bit distracted as Mrs. Done by Forty was offered a job on the same day, and her decisions on that are more pressing than celebrating a milestone.

Maybe we're a bit distracted as Mrs. Done by Forty was offered a job on the same day, and her decisions on that are more pressing than celebrating a milestone.

Monday, July 1, 2019

So We're Going to Pay Off the Mortgage

Talking things over with a few friends last week helped us make a decision: we're going to pay off the mortgage. All at once, by using the remaining cash we have from selling our two rental properties, but mostly by selling investments we have in our taxable accounts.

I already know from our mortgage swoop posts that most people probably won't like this idea. I'll try my best to explain our rationale, which I really do think is sound. But I'm not trying to convince other people that this is what they should do. Instead, I want to explain where we're coming from, our thought process, and just want to be as transparent and honest as I'm comfortable with on the blog.

Monday, June 17, 2019

I'm a Goddamn House Cat

Thanks to some changes at work, I've been slacking on all things internet: writing for this blog, reading and commenting on others', and keeping up with the latest nonsense on Twitter.

We just went through a re-org, the first I've had to go through in seven years at this company. That means I have a new role, a new team, a new boss, and a new and exciting level of work and stress that I need to get acquainted with.

As long time readers of the blog know, I work in procurement and have ever since I was getting my undergrad. I worked in my university's procurement office during the day, negotiating prices and contract language, running RFPs, managing our supply chains and cutting POs, and then went to classes at night to earn my BA and then, later, my teaching credential.

Monday, June 3, 2019

Middle Class? How about Middle Quintile? (2019 update)

It’s been four years since I wrote a post on household income quintiles, in a vain attempt to reframe the way we think about the middle class.

I’ve never liked the way that the term ‘middle class’ was simultaneously poorly

defined and yet somehow still critical to the way we talked about finances, the

economy, and politics.

Nearly

everyone considers themselves middle class. A household earning $30k can define themselves

as middle class, even though a family of three at that income level would

qualify for some federal subsidies, being within 150% of the poverty line. But most

millionaires also consider themselves middle class as well, absurd as that

is.

Either the middle class has a definition that is so broad

that it includes both the wealthy and those skirting the poverty line, or it’s

a term so poorly defined that anyone can claim membership just based on how

they feel.

Tuesday, May 28, 2019

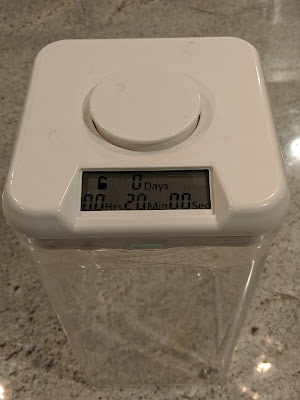

Battling Internet Addiction with a Time Lock Safe

I’ve never thought this blog was meant to help people. For one, I’ve never been

particularly good at helping. I have no insights into helping with someone’s nutrition,

or the kind of exercise that will finally stick, or how you can get to sleep at

a reasonable hour.

Even the thing you’d probably expect me to have good advice

on, money, is oddly something I’m not all that good at advising on. The tactics

that worked for me may not work for you. We’re outliers in a lot of ways. And just

because we’re be able to work towards an early retirement doesn’t mean I have

some secret on how to do so; some plan that you can follow, too.

(If there is any secret, it’s this: we were able to retire early because we earned about double the median household income for the entire time we were working towards FI, and we did so in fairly low cost Arizona after moving here from ridiculously expensive San Diego. That’s kind of it. We might seem more frugal than people who earn as much as we did; but we’re not far more frugal than the median family…who just happens to be stuck earning the median income, too.)

(If there is any secret, it’s this: we were able to retire early because we earned about double the median household income for the entire time we were working towards FI, and we did so in fairly low cost Arizona after moving here from ridiculously expensive San Diego. That’s kind of it. We might seem more frugal than people who earn as much as we did; but we’re not far more frugal than the median family…who just happens to be stuck earning the median income, too.)

Monday, May 13, 2019

Tariffs are Just Regressive Taxes

Would you rather read a post on tariffs being regressive taxes or, what I assumed would be more popular, our latest life hack that involves a time delay safe?

Apparently a slight majority of you would like me to be an amateur tax policy blogger, so this week I will try to write again about the dumbest part of our revenue system: regressive taxes.

Monday, April 29, 2019

Our Truly Regressive Tax: Social Security

A reader asked me a good question last week, after reading my jumbled rant on systemic problems, and the individual tactics that aren't going to solve them. What, short of running for public office, can we citizens do to encourage systemic solutions?

I have to admit that stumped me a bit. Thinking about changes to the system is nice. Actually coming up with plans to do so is harder.

Executing them? Who even knows how to do that?

So let's give that a try today. Let's talk about the system we use to fund most Americans' retirement: Social Security, one of the few truly regressive taxes out there.

I have to admit that stumped me a bit. Thinking about changes to the system is nice. Actually coming up with plans to do so is harder.

Executing them? Who even knows how to do that?

So let's give that a try today. Let's talk about the system we use to fund most Americans' retirement: Social Security, one of the few truly regressive taxes out there.

Monday, April 22, 2019

Systemic Problems, Individual Solutions

I've always been a bit of an asshole. While I try my best to be nice, to get along, sooner or later people realize that I'm actually kind of mean.

One of the biggest issues I deal with is being fairly intolerant of others' ideas.

Specifically, I'm really bad at accepting when other people have a different solution to a problem than I think is best. Because, you know, I like my idea.

So let's talk about that a bit today. Let's dig into systemic problems, and talk about the jagoffs who think individual tactics are the right approach to solving them.

One of the biggest issues I deal with is being fairly intolerant of others' ideas.

Specifically, I'm really bad at accepting when other people have a different solution to a problem than I think is best. Because, you know, I like my idea.

So let's talk about that a bit today. Let's dig into systemic problems, and talk about the jagoffs who think individual tactics are the right approach to solving them.

Monday, April 15, 2019

Thinking in Bets about FIRE

Annie Duke was always one of my favorite poker players. Like everyone else who watched Rounders in the late nineties, I was immediately hooked on Texas Hold'em and the new ESPN shows devoted to the game.

Unlike many of the personalities being promoted in WSOP tournaments, Duke wasn't brash or petty or argumentative. Her game was calmly, ruthlessly aggressive: no need to ham it up for the cameras. Duke finished in tenth place (out of 512 players) at the 2000 World Series Championship, while nine months pregnant.

In the first year of the World Series of Poker Tournament of Champions, an invitation only event where ten of the world's top players competed for $2M, she faced the best, including her brother, Howard Lederer, and beat them all. Take a look at the final segment of the tournament, where she schools Phil Helmuth heads up. After she beats him, he spends the rest of his time on camera complaining what a long shot she was to even be in the tournament. He can't believe he lost to a woman.

Monday, March 25, 2019

The New and Improved Bond Mortgage Swoop

Last week, we dreamed up the idea of our mortgage swoop, where we'd pay off our mortgage all at once as soon as our financial independence fund got to $1M plus our mortgage balance. The feedback from readers was a little...mixed. With few in outright support of the swoop, I think the general consensus was that even if the plan isn't optimal by the numbers, it is at least simple, straightforward, and good in the sense that being without a mortgage in early retirement can be a pretty good thing on its own.

Then I tweeted out to Big ERN as well as Joe & OG from Stacking Benjamins, just to get the take from some people who know more about analyzing financial options than I do. Instead of just giving his opinion on the swoop, Big ERN threw out an entirely different idea, too.

Then I tweeted out to Big ERN as well as Joe & OG from Stacking Benjamins, just to get the take from some people who know more about analyzing financial options than I do. Instead of just giving his opinion on the swoop, Big ERN threw out an entirely different idea, too.

Monday, March 18, 2019

Our Mortgage Swoop

Ever since we purchased our first home, Mrs. Done by Forty and I have had no idea what to do with our mortgage. When we first got in to personal finance we were against debt of any sort, so we threw every dime we could at our first mortgage, paying it off in just over three years.

Seeing how we did this from 2010-2013, this plan had opportunity costs that are so large that it hurts my heart to even think about it. Still, it felt good at the time.

After paying off the house and enjoying debt-free bliss for a year, we up and bought a couple adorable rental properties, complete with tiny mortgages.

After a while, we realized that opportunity costs are just as real as any other cost. So we took out another mortgage on our primary residence in 2016, just three years after paying it off. I always wished I'd called in to Dave Ramsey's show to tell him that.

Now, nine years after buying our first home, both of the rentals and our first primary residence are long gone, as are our dreams of lording over a real estate empire. It turns out we hate being landlords.

Do we hate mortgages, too? Let's find out, because we're about to pivot on our mortgage once again.

Seeing how we did this from 2010-2013, this plan had opportunity costs that are so large that it hurts my heart to even think about it. Still, it felt good at the time.

After paying off the house and enjoying debt-free bliss for a year, we up and bought a couple adorable rental properties, complete with tiny mortgages.

After a while, we realized that opportunity costs are just as real as any other cost. So we took out another mortgage on our primary residence in 2016, just three years after paying it off. I always wished I'd called in to Dave Ramsey's show to tell him that.

Now, nine years after buying our first home, both of the rentals and our first primary residence are long gone, as are our dreams of lording over a real estate empire. It turns out we hate being landlords.

Do we hate mortgages, too? Let's find out, because we're about to pivot on our mortgage once again.

Monday, March 11, 2019

Who Wants a Fight With No Referee?

Since we need to have a fresh injustice each day, the Trump administration is rolling back protections on the payday loan industry, because of course they are.

I don't know why I am still and continually surprised by this administration, but I am.

Why wouldn't they take a look at a situation that has the low-earning, underbanked on one side, and a well-financed predatory lending industry on the other and decide, "You know what? I think we need to take the kid gloves off these lenders. Let's see what the unfettered free market does when they don't have to consider whether borrowers can actually repay loans at 400% interest. The financial crisis was ages ago, anyway."

The good people at MSNBC have a video that explains the situation in an excellent segment titled "Money, Power, Politics".

For a deeper dive, check out this NYT piece that outlines how the one federal agency tasked with protecting consumers has instead put the interests of payday lenders first.

I don't know why I am still and continually surprised by this administration, but I am.

Why wouldn't they take a look at a situation that has the low-earning, underbanked on one side, and a well-financed predatory lending industry on the other and decide, "You know what? I think we need to take the kid gloves off these lenders. Let's see what the unfettered free market does when they don't have to consider whether borrowers can actually repay loans at 400% interest. The financial crisis was ages ago, anyway."

The good people at MSNBC have a video that explains the situation in an excellent segment titled "Money, Power, Politics".

For a deeper dive, check out this NYT piece that outlines how the one federal agency tasked with protecting consumers has instead put the interests of payday lenders first.

Monday, February 25, 2019

Hitting a Moving Target

It is weird to think that this blog is over six years old now. Back when I was starting out in 2012, I was only 32, had only recently started getting interested in financial independence and early retirement, and with the fervor of the newly converted, thought I should be able to knock out that goal in eight years.

Mrs. Done by Forty and I were newly married and still didn't know whether we wanted kids in the near future, or at all. We were living in our first house, a true fixer that was originally a two bedroom, one bath with odd additions for the third bedroom and second bath. We were renting out a room to help pay the tiny, $104,000 mortgage. Looking back at our old budgets, we were frugal. Our annual spending barely tipped over $30k, after we had the mortgage paid off.

I figured retiring by forty would be pretty achievable.

But a lot's changed over the past six years.

Tuesday, February 12, 2019

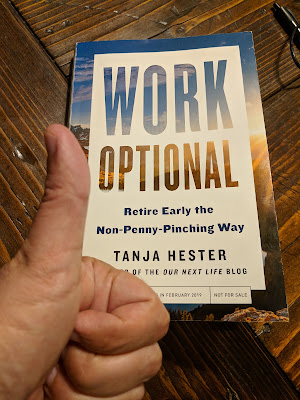

Work Optional: Rebranding FIRE

Inspiring, thoughtful, and detailed to the point of wondering if a book can be too well researched, Tanja Hester's Work Optional examines financial independence and early retirement with a scope that sets the book apart. This easy read can surely introduce "FIRE" to a newcomer, while forcing long-time enthusiasts to question how well they've really thought their early retirement plans through.

Engaging and thought-provoking throughout (no small feat considering most people will get up and walk out of a room to avoid a discussion about money), Work Optional deserves a spot beside A Simple Path to Wealth: the two books you should share with a friend or coworker asking what this whole financial independence thing is about.

Hester manages to balance the small-but-necessary details (for example, have you, thirty-something early retirement enthusiast, budgeted for the fact that Medicare will only cover 60% of your medical expenses thirty years from now?) with the motivating, why-are-we-doing-this big picture items. (What kind of life do you want to live? What does your ideal day actually look like?)

Engaging and thought-provoking throughout (no small feat considering most people will get up and walk out of a room to avoid a discussion about money), Work Optional deserves a spot beside A Simple Path to Wealth: the two books you should share with a friend or coworker asking what this whole financial independence thing is about.

Hester manages to balance the small-but-necessary details (for example, have you, thirty-something early retirement enthusiast, budgeted for the fact that Medicare will only cover 60% of your medical expenses thirty years from now?) with the motivating, why-are-we-doing-this big picture items. (What kind of life do you want to live? What does your ideal day actually look like?)

Monday, February 4, 2019

The Wage Gap, & Sharing Salary with Women

|

| Source |

"I know. But I'm new."

Without me realizing it, as a 21 year old employee who knew nothing about anything, Ang was mentoring me, as well as advocating for me to be reclassified. I was technically doing the work of a buyer, while being paid as an administrative assistant.

If she was right, I'd be reclassified into a new role with a higher salary. But submitting formally for a reclassification was tricky: we had to involve the union, human resources, my own boss. And it might not work, which could be a career limiting move. Would my boss view it as a slap in the face?

Monday, January 14, 2019

College Plan? Undeclared.

Two days after Christmas, we closed on the sale of our second, and final, rental property. We got a full price offer, too. (Minus having to give the buyers a $2k credit towards closing).

It is hard to describe how good this feels.

It is hard to describe how good this feels.

Though I was a bit nervous right up until the day the check cleared. A previous buyer on this property backed out at the last second, even after we agreed to fix the major items in his inspection list. So I wasn't going to declare we were officially-and-forever out of the rental business until the papers were signed.

Subscribe to:

Posts (Atom)