Astute readers will note that I'm only one year from turning forty, and wonder why the post says I'm still two years out from the goal.

A while back I decided to give myself a little wiggle room: that if I hit financial independence by the last day I'm still forty years old, I'd call it a success. I used to post net worth updates and budget porn posts, giving readers (and myself) a monthly check in on all the financial details in the Done by Forty household. Somewhere along the line I decided I didn't like doing that, so now you voyeurs just get one chance a year to peek in.

Recently paying off our mortgage has changed our annual spending quite a lot, even as it took a big chunk out of our nest egg. Our annual spending should go down, from $49,000 over the past twelve months ($53,000 if we use the 2018 calendar year) to something like $33,600, once we're no longer paying principal and interest, and just have property taxes, insurance, and maintenance to cover.

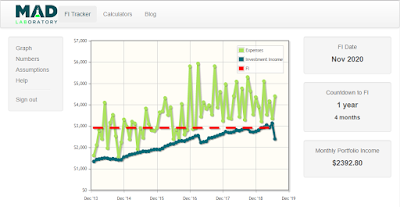

Assuming a 4% rule SWR and that super skinny $33,600 budget, we are technically financially independent already, according to the Mad Fientist's laboratory.

|

| Click for bigness. |

So we have that going for us, which is nice.

But we're going for a slightly increased $35,000 annual budget with no mortgage, and want to use a 3.5% SWR thanks to Big ERN's harrowing series on safe withdrawal rates. Under those assumptions, here's how far we are from financial independence:

One year and four months. We're on track to hit our true goal with some time to spare.

There are some upcoming changes that will impact our finances, and probably change our financial independence plans, too.

First, Mrs. Done by Forty has accepted a position and will be working full time. It's pretty rad. She's getting to work in her field on a pretty cool project, and locally, too. We're kind of over the moon that the stars lined up for that to happen for her.

Thanks to the fairly ridiculous benefits that she gets with this new position, she will be able to max out not one, but two different retirement accounts, completely shielding $38,000 from income taxes each year.

It's a post-doc position, and who knows what she or I will feel about working full time, after a couple more years. But in the interim, with this extra, tax-free income, that should probably have some impact on how quickly we reach financial independence, right?

Unfortunately the Mad Fientist's Laboratory doesn't have a feature that lets you forecast with future savings, or future investment balances. Trying to account for this ends up being a big pain in the ass, but I tried anyway.

(In order to get a forecast, I entered future months' hypothetical savings and spending figures once Mrs. Done by Forty's income kicks in, starting in November: using our past year's savings numbers and adjusting to account for the fact that we no longer have a mortgage, and then assuming our spending will be at $35k. That covered the savings rate and expenses, but what about our investment balances?

In order to be consistent with the prior graphs, I stuck with the existing 7.1% growth rate assumption: that is, having the prior month's investment figure grow by 0.59% in a month, and then added in the amount saved that month. After that, I checked to see which month we'd hit financial independence under those assumptions.

And after I got to December 2019...the Mad Fientist's laboratory wouldn't let me enter in spending and expenses for future months anymore. There was no option to enter in expenses for 2020: presumably because what kind of dork would try to enter in expenses for the future.

In any case, here's what the projection shows with just a couple months of Mrs. Done by Forty's income hitting the books in November and December:

There are a couple more big things we could consider in these projections. First, there is the fairly expensive daycare we'll be putting Baby AF into, and whether we should incorporate that into our monthly spending figures or not. On one hand, it's spending so why not include it? On the other, our plan (subject to change) is to take him out of daycare if both of us are retired. Should we run our calculations off of a five figure expense that's not going to be here in a couple years? And now that Mrs. Done by Forty is working, we might want a second vehicle. That probably changes these FI dates a bit, too, but we have to work with the information we have.

Somewhat surprisingly, the graph shows pretty much the same date as our projections did prior to adding in Mrs. Done by Forty's income: one month earlier, October 2020. A couple things may be at play here.

One, this reflects only two months of Mrs. Done by Forty's income, so of course that will only have minimal impact. It shortened the projection by a month after only two months of her full time income. That's a pretty damn good result.

On the other hand, we're very late in our financial independence journey. With only a year and four months to go, there's only so much any of our actions can shorten that 16 month runway. How much quicker can we reach financial independence? Maybe four or six months earlier? For better or worse, maybe most of the impact is going to come from our investment portfolio, rather than our incomes and contributions.

But I figure this is the reality at this point in our financial independence journey. The tradeoff is that our portfolio is doing most of the work, so we don't need to rely as much on our contributions as we did when we first heard about this stuff back in 2012.

Put another way, the things we choose to do with our hours from nine to five, the work we choose to take on, becomes more and more detached from the paycheck it comes with. Mrs. Done by Forty will talk more about this in her future post, but the reality is that she's the first one of us taking on employment from a perspective of financial independence: of choosing to work because she would rather spend her time doing the work than not, and not because she needs the money.

Absent an extra month or three shaved off our already-close financial independence date, we don't really need the money.

I'm excited to see what that's like for her, and for us. I'm excited to learn from her, as she approaches work in this new way.

For me, I still am caught up in the same view of work I've always had. I like my job some days and it's hard some days. It provides the right amount of challenges and I get satisfaction from knowing that I have the skills to do the work and that I'm good at my job; but make no mistake: I am here for the paycheck.

In some ways, the more interesting part about this final push to financial independence is figuring out whether I have enough time to prepare for what comes next. Will writing on this blog prove to be the right kind of fulfilling work, or should I plan to pursue something else, like trying to intern at a local paper or public radio station? Will I like being a stay at home dad with Baby AF and baby-to-be-named-later? (MC Baby is the frontrunner.) Would I be happy with side projects, like creating a podcast?

I suppose I should be worrying about the money itself. Whether we saved enough or if our asset allocation is too risky for where we are in the process.

But I'm more concerned with the other stuff: the good stuff. The way I want to spend time with my friends and my family, and myself. This big wide life I still have ahead of me: one that I can't really plan all that well, no matter how much I noodle over it. I'll just have to figure some of it out as I go, I think, and that's probably true for a lot of us. We can't know what we're going to think about something until we try it, until we do it.

I've got a year or two until we get there, and I can't wait.

*Photo is from bubili at Flickr Creative Commons.

**Having trouble leaving comments? Blogger's comments require cookies from third parties, which your browser may block (especially if you use Safari). You can change your settings here:

*Photo is from bubili at Flickr Creative Commons.

**Having trouble leaving comments? Blogger's comments require cookies from third parties, which your browser may block (especially if you use Safari). You can change your settings here:

- Change cookie settings on Safari

- Change cookie settings on Chrome

- Change cookie settings on Internet Explorer

Love hearing your thought process on all of this. Looks like you will rebuild that nest egg quickly! I am curious about the fact that while living off of around 35k (or less) a year seems doable now, will that still be doable in 10 years? Wouldn't inflation make your cost of living go up by a 2-3% each year? Also, I'm curious where you got the 7.1% return assumption from.

ReplyDeleteHi there!

DeleteSo to answer your question, our safe withdrawal rate does account for inflation: in that our spending will continue to increase every year. The idea is that our investments should continue to grow, and provide enough cushion to also increase enough to account for those larger withdrawals as we go.

Check out Big ERN's posts on safe withdrawal rates to see ranges of, historically, how much you could take out each year (inflation adjusted) while still covering a long retirement.

https://earlyretirementnow.com/2016/12/07/the-ultimate-guide-to-safe-withdrawal-rates-part-1-intro/

As for the 7.1% rate, that's the default in Mad Fientist's laboratory. I kept it in this post simply to be consistent with past charts & posts, but I happen to think it's optimistic going forward. Either way, we'll not actually leave work until our basic parameters are met (having enough assets to cover a 3.5% withdrawal rate at our proposed budget).

Generally SWR is built to increase by 3-4% to compensate for inflation each year. All good FIRE calculators are built to compensate for that.

ReplyDeleteYep -- luckily Big ERN's series has done a lot of the heavy lifting for us to help figure out what SWRs would survive the high inflation periods of the past, so that gives us some solace.

DeleteGood luck on the final push!

ReplyDeleteTough question about childcare. Will you or your wife really quit working once you're FI? If so, then you probably don't need to include the childcare cost.

When I quit working, we saved on childcare for just a little over a year. We sent him to preschool when he was 3. It was cheaper than childcare, but it was still an expense.

Thanks, Joe!

DeletePreschool may indeed be something we need to figure in, at least for a few years. And honestly that may be a good thing to just assume on a go-forward basis, just to give us some wiggle room for future kid activities like sports or hobbies.

I agree with Joe. Baby/toddler care is expensive, but you may decide to send your kid(s) to a private school or preschool at the very least. Plus depending on your vision for raising your kids, you may want to spend some money on things like music lessons or tutors. I think it's rare that a parent with financial means will opt not to offer financial support for the child to pursue his/her interests. Of course you don't have to spend the money, but it's good to build it into the budget just in case.

DeleteGood call, Hannah. While daycare is perhaps more monthly than we'd need for kid activities/preschool ($1,100 a month for one baby, not even full time) we should probably budget for some expenses regardless.

DeleteHappy Birthday! You're definitely on track and I really appreciate the detail you put into your analysis. Like you, Big ERN influenced my thinking on SWR a lot.

ReplyDeleteI'm probably 3 years out from being able to quit, and may work as long as 5 more but I've already started thinking about what I would do for the fulfilling work piece. Great to see someone else calling that out as an even greater concern than the money!

Congrats on being just three years out! We're right in the same ballpark. I do think we may decide to work longer just to be safe (how cliche is the 'one more year'?).

DeleteBut yeah, the fulfilling work part is far more important than the money, to be honest. It's easy to go back and find some sort of work for money...but finding something really fulfilling is the tricky bit.

Happy birthday! I'm glad to know you <3

ReplyDeleteI hope that Mrs DbF loves her new job but it's cool that she won't have to work if she is over it in a few years.

It's quite odd to me that the financial calculators don't stretch into the future. Aren't we here to calculate ten years into the future??

Thanks for the well wishes, friend!

DeleteAnd yeah, it's like a ridiculous privilege that Mrs. Done by Forty (and I) can make work optional (nod to Tanja). But it's a privilege that we're going to lean in to.

I should say that the Mad Fientist calculator allows us to look in to the future for some things (future spending, future rates of return) but not for the specific thing I'm looking for (e.g. - my income and savings will go up starting in month X, and my expenses will be lower thanks to no mortgage). I'm probably nerding out a bit too much for the tool. ;)

NEVER such a thing as nerding out too much!

DeleteAin't that the truth. (*Sets up another online board game to play with his nerd friends.)

DeleteSo many mazels, Mr. DBF! Can't wait to hear the stories of the good times!

ReplyDeletePlease tell me you won't stop blogging here once you've hit your goal!

Hey buddy. I plan to write here for sure. It's like my baby t this point: I want to see what it's like when it grows up. :)

DeleteHappy happy birthday, friend! You are exactly three decades older than my pup ;)

ReplyDeleteAnd I’m so excited for Mrs. DB40- working because I want to not because I have to is my ultimate goal.

Thanks, Angela! It's nice to know I have a birthday connection to your pup.

DeleteI'm pretty pumped for Mrs. Done by Forty, too. I think I may be able to learn a lot from her take on work these next couple years.

I've not worked since February 2019, and have been living off savings. I do intend to work again (soon) but I have appreciated this 6-7 months of trial retirement. I don't dislike the time - but I've certainly been bored. I don't have a child, so there's not that option (many of my friends are on maternity leave, and I know if I had a baby, it would be a different story). Initially, I spent time getting my home sorted, having recently moved back in. I have read a lot of books. I am up to date much more regularly on my blogs and podcasts. I still work out every morning - sometimes more it to lunchtime or evening to sleep in. I have baby sat. But I'll circle back to: I have been bored.

ReplyDeleteWhat it has meant is I'm going into a new career/job - out from 10 years of engineering and into the funeral industry. Because the endless money - there's no real point. My mortgage payoff is within reach. I've travelled to 52 countries, and I love travel, but it's not something I'd do for more than 6-8 weeks in an year (and not all at once). I wish you luck and commence endless lists now, of what you'll do once 'free' from work.

Hi Sarah! Good to hear from you.

DeleteA trial retirement sounds pretty rad. You get to see how you'd like a longer retirement, and just as importantly, the things you don't like about it. I can definitely see boredom being a big part of it. My initial thought is that MC Baby may stave off boredom for a while but who knows: the future is never exactly what we think it'll be.

The funeral industry sounds really interesting. Would love to hear more about how you picked that as a new career.

We feel the same about travel. We were traveling for 5-6 weeks a year and found that to be enough for us. We'll try some slow travel in the summers but with the kids in school I don't think we'll ever really be true nomads, not that I think we'd like it anyway.

And yes, time to make some lists of things to do!

Congrats on being on track! Regarding the need to model different income streams in your retirement calculator, you may want to look at the calculator on Financial Mentor -- it has a lot of flexibility for people who have real estate, consulting or other income streams. Regarding children, even if you have a stay at home parent, you still need to budget for childcare -- every parent needs a break. We're empty-nesters now and one of the best investments we made as parents was on couple-only trips and date nights. You can't assume you'll always have at least one parent watching the kids -- you need that couple time!

ReplyDeleteThat's a good call out, Caroline! We should definitely budget in some money for daycare, even if it's just at a minimum some date nights out with a babysitter. Like you said, we need some adult time.

DeleteAnd who knows, we may like having daycare anyway. Though, whew, with two kids its going to be really expensive. An extra $12k a year, just for one baby, requires an extra $342k under the 3.5% rule, just to cover that expense!

Woot, fellow Leo!

ReplyDeleteGlad you're on track and tell Mrs. DBF congrats for me inre: her new job. It's great that she now has the option of taking the work she wants rather than having to take whatever position she can find. And it's great that she got a job locally, since I know that was a worry.

I say for now assume daycare costs in there. Worst case scenario, you end up not needing it and -- oh no! -- you have more money than you bargained for. The horror.

Hi there Abby!

DeleteThe rub with assuming daycare on an ongoing basis is that we'd need like $342k additional in our nest egg just to cover those $12k in annual costs. Much more to cover two kids. So, yeah, that would definitely change our FI date...like a ton.

But if that's really important to us then maybe that's something to consider. Right now, I think I'd rather be a stay at home parent than work full time at my current job...but maybe there's some third option to consider.

Thanks for the well wishes and I'll definitely pass them along! Looking forward to our next board game night.

Happy Birthday, Brother DBF! (Little Brother, that is...)

ReplyDeleteDone by Forty One -- That has a nice little ring to it. Worth considering a branding change, perhaps?? Either way, you are far ahead of most people in your journey - awesome work!

PS - You might have to increase the font size on your posts. My eyes are getting too old for your tiny a$$ letters... :-)

Oh, man, is the font too small? I'll see what I can to do change it. (Though I just read in David & Goliath by Gladwell that making things harder to read apparently forces the reader to pay more attention...so maybe it's a good thing that readers are straining their eyes?)

DeleteI'm going to fight the urge to be actually done by 41 but I can definitely see some scenarios where that's the case. (Hey Pres, maybe quit with these trade wars: they're messing up my portfolio, guy.)

Happy Birthday!! I turn 40 next April...man time flies! I definitely think preparing for what comes next is very important. I wouldn't just be DONE because you reach an arbitrary number. Would it be possible to try out those projects on the side before you leave? I haven't really even thought about what would be next because I don't think I'm that close. I'd just be happy with more flexibility like working from home/flex time/part time, etc. But my employer is ridiculously rigid and backwards. I asked to change my schedule coming in half hour early and leaving a half hour early and they rejected that!

ReplyDeleteAndrew! Good to hear from you friend. I love the similarities in our journeys: all the best people were born in 1980, weren't they?

DeleteI definitely WANT to try some of these projects prior to stopping work but time is proving to be scarce with the baby, work, social obligations, writing for the blog, reading others' blogs, etc. Some of that is me making excuses, probably: there's always some downtime I can find. But some of it is just the reality of 24 hours in a day.

Still, maybe I could try just one.

Sorry to hear your employer is rigid like that. If it helps at all, I work from home full time and I still want to retire early: at least in my case it wasn't enough for me to keep wanting to come back.

Happy birthday! And congratulations on being to the point where you can think about the various ways you want to spend your first retirement.

ReplyDeleteThanks so much, Daizy! Good to hear from you.

DeleteOh how cool, we share the same birthday month and year! I'm older though, by a couple of decades. It's interesting to read other peoples' tales of their journey to FI. I hit FIRE a couple years ago then foolishly accepted a 'temporary' position back at my former employer to help them out. That 4 or 6 month commitment has turned into one with no end date in sight. But, I have a LOT of flexibility to choose my hours per week and my schedule, and it's all work from home, so it's not all bad. And I can walk away whenever I wish.

ReplyDeleteThat's great that you have that kind of flexibility in FIRE and congratulations on hitting that achievement!

DeleteI, too, work from home and it's such a nice perk that, on the good days, I wonder if I should just stick around and keep on collecting the paychecks while working from my dining room table. I guess we'll see how things turn out once we're there!