I tried to find the methodology for this statistic, but H&R Block isn't making it very easy to find on their website or elsewhere on the internet. On the plus side, they do have a lot of interesting statistics about a billion dollars. Did you know that if you stack up a billion dollar bills, the pile is 109,250 meters high? Apparently, this billion comes, at least in part, from the 56 million Americans who will do their taxes on their own this year, and H&R Block estimates 11 million of those could contain errors that left money on the table. (Their site claims that H&R Block professionals found more money for one in five people, with $460 per person, on average.) So the question is: should I try to do my taxes on my own?

I've always done my own taxes, using H&R Block's or TurboTax's software (or, in earlier years, just paper forms). The cost of the software varies, but if I hunt around on Amazon.com or wait for a deal to come through on email, it seems I can get both state and federal for about $25-40. I usually have to get the second or third tier of software, too, as we do rent out a room in our house, and that gets a little more complicated trying to depreciate a portion of our home. But $40 is still much less than $246: which is the average cost for a CPA to file a Schedule A and a state return. So at least on the front end, it seems we're saving about $200.

That said, the amount of money I'd be leaving money on the table is, by definition, an "unknown unknown." If I were aware of the error, I'd correct it. But I'm not (so I can't, and I won't, but...) Using H&R Block's statistics, I have a 20% chance leaving money on the table, and that average error would cost me $460. But the math says I should not pay the extra $206 to hire a professional, for a one-in-five chance of netting $460. (I would need a one in five chance to net over $1,000 for the odds to point to hiring a professional.) This also means that, even though Americans might have left one billion on the the table by not using H&R Block, they'd be paying H&R Block several times more than that had each one of those do-it-yourself tax payers simply paid them $246.

But these are all just gross averages: who knows where my individual situation fits in? And then there's the fact that doing taxes is kind of a chore. I don't hate the process of filing my taxes, but I wouldn't say I particularly enjoy them, either. It's boring, and there are better ways to spend a weekend. Regardless of the money spent, this might be a case for outsourcing.

Do you readers pay a professional to do your taxes? Or are there reasons you prefer to DIY?

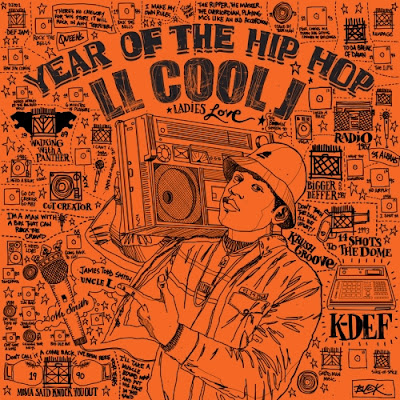

*Photo is from zaneology at Flickr Creative Commons.

My Dad always did my taxes cause they were super easy and he is an accountant. This year I am going to try to do my own and compare to him... If it is the same then I will do my own from here on out :)

ReplyDeleteThat's fantastic to have that expertise in the family! Let us know if there are any differences: I think that'd be a great case study to see how an average DIYer compared to a professional.

DeleteUntil last year we always did our own taxes with Turbo Tax. Because last year was the first in which my wife had any real income and expenses from her business we decided to use a CPA, but I double-checked their work with Turbo Tax anyways (yeah I'm cool like that) and got the exact same result except that Turbo Tax found an extra deduction. I told them and they corrected it, but it didn't inspire much confidence.

ReplyDeleteI'm going to be talking to an accountant soon to make sure I'm not doing anything dumb with my business from a tax standpoint, but my guess is I'll still end up actually doing the taxes myself. Until things really get going there just isn't all that much complication.

That's an incredible result, Matt. I would love to hear their excuse as to why $50 tax software found a deduction they didn't. I'm leaning towards DIY for now as we don't yet have a business, but maybe 2014's tax year will change that.

DeleteAs a CPA, I sometimes see errors by other firms and I wouldn't be surprised if some others found ones I've made. However, where CPAs can make/save our clients money is by tax planning. For example, do you think tax software packages or bargain preparers will know that in some cases, it is actually better to increase your taxable income to pay more taxes (to take advantage of lower tax rates when you expect higher ones later on for example)? Do they know some legal ways of doing that (moving money from traditional IRA's to Roth IRA's for example)? In some cases, you might still end up with no taxable income and just loss opportunity. What about other retirement planning scenarios? Asset protection concerns? If you have a simple return, you honestly could probably do them yourselves or have an inexperienced preparer do them without any problem. However, sometimes it may worth checking into whether your "simple return", while being error free, is still the best return that could be filed for you.

DeleteWe'll be doing our taxes this year. We've been to H&R Block in the past, but after doing some research I feel confident we can handle it with the help of TurboTax software. Plus, H&R Block charges RIDICULOUS fees if you have 1099 forms.. learned that the hard way in college when I did a bit of freelancing work one summer. They charged me over $150 just because I had to file a 1099 - and I only made about $700 bucks off that contract position! That was in addition to the $100 or so I had to pay to file federal and state. That was when I filed on my own. When my husband and I filed jointly last year, they charged us $250 - so I can just imagine how expensive it'd be this year since my 1099 forms are back!

ReplyDeleteOh, man. $150 just for having a 1099? That's not like some rare way of getting income. I could see that really adding up quickly.

DeleteMy dad is a tax attorney so he has the pleasure of doing my taxes each year free of charge :)

ReplyDeleteThat's a great deal for you! My dad's degree in engineering has yet to pay off for me, but maybe one day I'll have to build a bridge...

DeleteMy dad built me a bug box for my 9th grade science project with his engineering expertise, but I would totally swap that for tax expertise.

DeleteWe pay for a professional and have since we got married because we started out with two rental properties and didn't want to deal with three depreciation schedules.

Our bill has ranged from $450-$700, with the $700 this last year when we had three rentals, two businesses, and multiple sources of W2 and 1099 income. We write off a portion of our house and garage for the businesses as well.

It doesn't seem all that complicated, but I feel like I am paying extra for two things: audit prevention (heard somewhere that they flag self-filers moreso than those who use a CPA) and expert advice on how to reduce our tax burden. The latter has us interviewing several tax professionals this year as our last tax guy did nothing but review the numbers we entered and sign-off, which ISN'T worth what we paid.

Good luck!

That makes sense, Emily. I'd happily pay for some audit protection and for insights into how we can further shield our income from taxation. That, I could easily see being worth $500 if the advice results in a recurring yearly save.

DeleteIn the UK, I undergo self-assessment which is the same as filing taxes for the self employed. So I do my own taxes but if I'm honest, I'm not quite sure of all the elements where I could be saving on tax relief. I don't earn that much so I don't get taxed much generally. If I start earning more, I'll definitely be paying an accountant to sort it out!

ReplyDeleteThat sounds like a good approach, Hayley. As your situation gets more complex, the services of an accountant might be more warranted.

DeleteI've had an accountant do my wife and I's taxes for some time now. In my eyes it's worth paying for. It's like singing. Everyone can do it but some are better than others.

ReplyDeleteThat's a good analogy, Michael. Have you ever compared your results with your accountant's, to see if the added savings overcame the cost?

DeleteWe have had a tax guy do ours ever since we got the duplex. With a rental property and some empty land that we're holding it's just easier to have someone who really knows all the details of how to treat everything. Our guy is absolutely top notch and while we pay more than the average ($500), that's actually way less than he would charge most clients since he took us on as a favor to an incredibly wealthy friend of ours who is also a client of his. He's just that good.

ReplyDeleteHe sounds like a good guy to know, Mrs. Pop. We were thinking that after we acquired a rental property and opened the LLC, that we might just hand it over to a professional to avoid any big mistakes on our part. Right now, we might still qualify as an 'easy' return.

DeleteSo many points on this. First, if you're just filing a simple tax return (no kids and you only get W2s aren't a student, etc.) it's really, really simple. There's no way I would pay someone in that situation. The second is that if you have something more complicated, but are willing to put the time into it, it still might be worth doing yourself. It depends on how much you trust your professional. One year part of my family's income came from the military, with residency in a state that returns all taxes of military members. I was getting 1099s that year, so we went into a professional, who wanted to charge $300 to file our return without returning our state taxes, regardless of how many times I informed him of the state's law. All the other numbers he ran were exactly the same as mine. So I filed by myself. The third kind of falls into that: many of these places will give you a quote and run your numbers, so you can figure out if you trust them or if they're going to get you more before you even have to pay. Lastly, if you're really low income, I'd recommend checking out VITA. They file them for you for free. I bet a lot of the money left on the table was by people who are told they don't HAVE to file because their income is so low. Many don't, leaving not only the money their employers predictively took out of their paychecks to the government, but also credits they would have received like the EIC and child tax credit.

ReplyDeleteGreat information there. Femme Frugality. It sounds like you're speaking from some experience -- are you in the tax business?

DeleteI think we'll probably go DIY this year again, but some bloggers I respect seem to hand the services off to a professional. Could be a wise move.

Haha, no. I'm just dorkily into taxes. Also, I hate paying people hundreds to do something I could do myself with a few hours of research. But if it gets too complicated it can be worth it. As long as it's someone you trust it would be worth the peace of mind to be sure you're filing correctly.

DeleteI think we are in the same boat, Femme Frugality: leaning towards DIY until my situation proves to be beyond my capabilities.

DeleteMy wife is a CPA and she says the average person does not need a professional - TurboTax works just fine. Their base fee is $500 for a return, which is fine for a business but tough for the common household to stomach. But when the cost of doing it wrong exceeds the cost of the actual fee, then it's worth it to go.

ReplyDeleteThat's a great endorsement for DIY, Brian. Thank you! I think for now, we fit in the 'average person' bucket...with the possible exception of the fact that we rent out a room. $500 does seem like a cost that'd be easy for a business to absorb, but would be tough for us to swallow in one month.

DeleteI am a former TurboTax employee AND a practicing CPA. Part of what I did is watch people use TurboTax in order to see which screens they understood and which screens they misunderstood or were confused by.

DeleteMy conclusion:

Anyone whose income consists strictly of W-2 income and interest should be able to use TurboTax and get it right. Mortgage interest and real estate taxes are typically ok too. Basically, anything that simply requires a user to enter a number that they already have is ok. But add other types of income/expenses and people start getting it wrong. Rentals? Stock sales? Any kind of depreciable asset? (and you have one if you're renting out a room!) Fuhgeddabout it. And if you're smart/nerdy to begin with, you're probably prone to the Dunning-Kruger effect. And using TurboTax reinforces your perception.

All that said, professionals are far from perfect, especially during busy season. In some ways I trust TurboTax more. To cover all your bases, I'd suggest doing your return using tax software and THEN going to a professional to see if they can do appreciably better. A couple years of that and you should have a good idea of how competent a user of TurboTax you are. [I should add that if you're going to have a pro prepare your return you ought to PAY them for doing so unless they are just completely incompetent (i.e., if they come up with the same result you do, they ought to be paid, and if they come out with a worse result than you do, it's quite possibly your fault for doing it incorrectly - so be sure to have them explain the difference between your result and theirs before you get on your high horse and think your superior results are due to your fantastic ability to purchase software and answer some questions!)]

Oh, and while I'm on my own high horse :) let me just say to be skeptical of any tax advice you read on the internet (including in the comments on this post!) It's the sort of stuff that gets told to one person in one specific situation and gets repeated a couple of times until it's now in a form that is only vaguely recognizable. It may have been true in its original context, but now looks very different. Just as a COMPLETELY random example....a CPA might tell his client that he can deduct the mileage when he comes to the CPAs office to have his return prepared. In the hands of various laymen that morphs pretty quickly into tax-deductible trips across the country/planet in order to see your CPA. Is it completely inaccurate? I'm not going to pronounce on that, but at a minimum I'd call it highly aggressive unless you ONLY made the trip to see your accountant. Here's a link which contains a reasonable summary for the deductibility of business travel. "Business" and "tax prep" travel are not necessarily equivalent, but this is the closest thing I could find in two minutes of Googling to address this particular scenario.

I do our taxes every year. I have been using TaxAct ever since the IRS recommended them as one of the "Free" tax software vendors. I had been using TurboTax prior to that. They are both pretty much the same. We always itemize, and I made sure to squeeze every last dollar out of our taxes. I don't like paying taxes, but I know we must, and I appreciate many of the government programs that they pay for.

ReplyDeleteI was thinking of trying TaxAct this year, Bryce, and if you recommend it I'll have to consider it more closely.

DeleteI agree that the programs are generally a very good use of our dollars, even if I think we pay too much in federal tax for them. It's weird, but I feel like I get so much more 'bang for my buck' with local and state taxes (maybe as I pay less, compared to federal)?

I am going to try TaxAct this year too. I hope it goes well.

DeleteLet us know, Lee! I'm also considering using that software instead of TurboTax.

DeleteI was working on taxes for our rental income this afternoon as well as my blog income and I was about to slam my head on my desk...not only are taxes boring, but the more complicated your taxes become (like having random income sources on top of your full-time job), the more you realize rich people have a huge advantage. The tax code is so complicated and there are so many loopholes it's ridiculous! But anyway, I was wondering that myself - how did they quantify $1Billion? I'll do my taxes myself this year with TurboTax.

ReplyDeleteHa! Maybe that's an argument for me not to monetize the blog or make additional side income: less likely to slam my head on my desk. :)

DeleteGood to hear another person is DIYing though. That seems to be the trend.

DBF.

ReplyDeleteHere's another "investment" idea for you, get an accountant in an area you always visit or want to go to annually. Mine is in SF, the IRS allows you to take an annual trip to get your taxes prepared. I can go to SF with my wife annually and write the whole trip off, we were going to go there anyway so let the government rebate you.

Notice why rich people have accountants in various desirable areas as that is a tax write off. You can have an accountant in Hawaii so your annual trip is a write off.

Your beer tab is now up to 4.

Charles, you are my go-to guy for tips that might save me money. We've actually never itemized and now, with no mortgage, we are even less likely too. But maybe in a year or three, we'll have a stable of rental properties and can really take advantage of those sort of itemized deductions.

DeleteMaybe I can pay you back one of those beers in February?

That is genius advice, Charles! I am totally looking into getting a tax person in the Keys now.

DeleteThat's good to know Charles. Our accountant is in California, I have been with him for 13 years after making a costly mistake on my own trying to save a buck. Even after moving to Texas, l fedexed all my stuff. Now that we are in Europe, l am still going to send him my stuff. He is great and l pay so little in taxes, l can't even bring myself to say it loudly. All legitimate deductions too. Things l would never know if l did it myself. I do wonder if l go to L.A, if l would be able to deduct it on my taxes like Charles says??

ReplyDeleteIf you're still paying US Federal taxes, I think that might be the case (though that's, ironically, probably a question for your tax guy in CA). I sure hope you can do so -- that'd be another great reason to move overseas.

DeleteWe used Turbo Tax the first year we were married. The second year, we used a local tax guy who has a long history with Rick's family. Even though circumstances were largely the same, we got WAY more back with our tax guy, so we've been using him since, and he charges just a bit over $100. Just a small family operation, so no big name/big expenses. Well worth it for us. :-)

ReplyDeleteThat is a killer deal, Laurie. Does he want another client? :) Only half kidding, seriously.

DeleteGreg does our taxes, mainly because they're so complex that it would cost a fortune to pay someone to do them. I doubt that Americans leave 1Billion on the table! I don't even understand how they can arrive at an estimate like that.

ReplyDeleteYeah, that number does sound specious. By my math and using their statistics, it seems they are estimating that something like $5B was left on the table...hard to really know if they don't 'show their math'.

DeleteMy husband is a retired IRS agent so he does our taxes using his brain and TurboTax. This year even he is struggling with some rather extensive real estate transactions we had, so I can understand that many people do miss out on a lot of deductions if they are not sophisticated tax preparers. I think, however, that many people go to a professional so they can electronically file and get that refund quicker. Personally, since I can't fathom paying someone money for me to get my own money back, we subscribe to the no refund theory and try to arrange withholding and estimated tax payments so that we will not receive a refund. As long as we avoid underpayment penalties, I'd much rather have to pay in April rather than get a refund the government has held all year.

ReplyDeleteI'm with you, Kathy. As long as we owe under $1k, I am happy. But our income has been changing yearly (at least it's in the right direction) so we find it hard to really get super accurate with our witholding numbers.

DeleteIf you really just break that down by the number of actual taxpayers, that means they are leaving just $5 on the table! So little that it doesn't make a big difference. The commercial does its job though.

ReplyDeleteGrayson, I wish I were smart enough to do that math. Great insight and a fantastic point. $5 per person is ridiculously small, and is indicative that most people aren't making huge errors in the government's favor. (It's probably the opposite, if I can be a little cynical.)

DeleteThose commercials have been popping up on my Hulu stream left and right! I was incredibly curious where the number comes from as well, so thanks for breaking this down. I agree that paying a professional, at least for me, doesn't make much sense right now. I did start freelancing, in addition to my full-time job, this year, so I'm worried I'll want to pull my hair out when filing my taxes which makes the idea of just handing over the paper work to someone else really tempting.

ReplyDeleteP.S. When I was in college in 2008 and 2009 I filed taxes on paper before switching to TurboTax in 2010. I actually preferred doing it on paper which makes me sound like such a hermit. I also dated a the son of an accountant so I could get my tax forms checked for free! Ah the good ol days.

Thanks, Erin, and so glad you stopped by the blog. A lot of heavy hitters in personal finance commented recently, and that makes me smile.

DeleteI think that's one of the downside of hustling for extra income: your tax situation gets a lot more complicated than just plugging in a W-2, especially if you've set up an LLC or other business entity.

And I miss paper, too. Simpler days.

Wow, that's a big overpayment amount. I can see how many people purposely want to get a refund. It is better to get than a bill at tax time. I usually stay pretty even and don't get a refund.

ReplyDeleteAnd I have been doing my own taxes, but now as my investment and business income becomes a bigger part of my world, I may have to seek professional help. We'll see though. I usually use TurboTax and can make it happen on my own.

Kraig! Long time, no chat. I prefer owing just a little, too, though Jason Hull had an interesting article about how, from a behavioral psychology standpoint, it's better to get a big refund. Go figure.

DeleteYou seem like a DIYer in just about everything you can, so I see why you'd apply that to taxes, too. Best of luck in the new year with freelancing!

I'm curious at how they arrived at the $1B claim, as well. Maybe you can try out a 'real person' for a year or two, and if there's a big difference in returns then that's awesome, but if not, at least lesson learned?

ReplyDeleteThat's a sound plan, Anna, but my frugal nature can't stand the idea of paying a service provider and then also paying for software to DIY. I know it's probably the smart thing to do, but, man, the procurement professional in me would have a hard time pulling the trigger.

DeleteLike with Turbo Tax on their website, once you plug in the numbers it shows you on the sidebar what your returns would be? You don't have to pay until you're ready to submit/e-file (I just did it during my lunch break and saw what my tentative return is, but won't submit (and pay) until I get some other forms).

DeleteSmart! I like that approach. If we end up hiring a professional, I am going to steal your technique. Thanks, Anna!

DeleteDB40, Love Momma Said Knock you Out, got that one in my iTunes. Not a huge rap fan by LL Cool Jay is a Cool as they come, may tune into the Grammy's just to see if he belts it out! Not surprised about the $ billion over-payments, wonder where that money goes?

ReplyDeleteJim! I'm so glad someone commented on LL Cool J. "Momma Said Knock You Out" is one of those videos from my youth that was, in a deep way, incomprehensibly cool. For a half-Filipino kid from the suburbs, early nineties rap was an insight into another world: a world where cool people did awesome things while rapping into a ring mike in an oversized hoodie.

DeleteSo, this post made me listen to "Momma Said Knock You Out" on youtube. Gonna add it to my running playlist, 'cause all those drums make this mild-mannered accountant feel sorta bad*ss.

DeleteHell yeah you're badass. Like LL Says...

DeleteDon't call it a comeback --

Christy's been here for years.

Rocking her peers, and putting suckas in fear.

DBF -- so awesome on too many levels to mention!

DeleteI am a CPA and I also use TurboTax to do my own taxes. I was just in a room with four CPAs and 3/4 use Turbo Tax. It all depends on how difficult your tax situation is. Mine is simple.

ReplyDeleteKeep in mind that many firms are staffed by newbie CPAs who are cranking out returns like crazy. There is a possibility that they will miss something and I sort of subscribe to the mentality that nobody will care about your money as much as you do.

One of the most common tax software packages used by firms is LaCerte, which was developed by H&R Block and is -- I'm convinced -- just a souped up version of Turbo Tax.

If you have complicated situations or just don't have the time, by all means hire a professional. But keep in mind that with most returns 95% of the work is just getting organized and pulling all of your paperwork together, so I don't think there's a big time savings in having someone else do mine.

Ha! I love that 3/4ths of those CPAs just use TurboTax. That's rad.

DeleteGreat point about the heavy lifting being done up front. It seems like if you've done that, maybe it's not worth outsourcing the final steps.

As a former Intuit employee...here's the [tax nerd] scoop: Lacerte was acquired back in 1998 by Intuit, so they are owned by the same company. But they are VERY different under the hood, so I'd hesitate to call it a "souped up version of TurboTax" to a tax pro, though it's an analogy that works for the layman.

DeleteBut if you want to talk about a souped-up version of TurboTax, it DOES exist. It's called ProSeries, and it really IS TurboTax, just with a different interface that makes it more friendly for the tax professional. Admittedly, it's got a few added bells and whistles, but all the calculations are the same for ProSeries and TurboTax. Really - when they compile the code, the calculations for TT and ProSeries are pulled from the same spot. And yes, I've worked on both.

http://www.irs.gov/uac/Newsroom/IRS-Has-$917-Million-for-People-Who-Have-Not-Filed-a-2009-Income-Tax-Return

ReplyDeleteProbably based on something like this. The IRS puts out these news releases to try to get people to file their taxes. Many of them will in fact not receive that money, but owe additional cash.

Great find, Tim! I wish I'd found that prior to writing the post. I think your explanation makes a lot of sense, too. In trying to get their own money back, a lot of people who might not have filed, are getting in line and filing.

DeleteThanks to everyone for their awesome comments here. I am normally a DIYer. Even with odd education grants/fellowships, tuition, retirement contributions, and a full time salary involved, I've been able to manage it, and feel good about my return. However, this year, I bought a house, and I've been making more contributions to different retirement accounts. I have been debating paying someone this year, just because I'm so unfamiliar with all of the real estate stuff. The posts here are definitely advocating to DIY, but I don't know if I'm confident enough in my own skills to make sure I file it all properly, and get the right deductions. Will the software really know best? Thanks in advance for any help! Cheers.

ReplyDeleteYou should not be afraid to hire a professional if you're encountering changes. I was advocating DIY above, but my taxes are very straight-forward. I'm a CPA, but I don't spend my day doing taxes so I would be loathe to to my own if I had a year where I had bought/sold lots of investments or real estate, or if I were starting a business. When your life is in transition like that it's very smart to hire a professional. In the end, it's not just about saving a few bucks, it's also about staying out of hot water with the IRS and being able to sleep at night. I know lots of CPAs who also don't do their own taxes because it's not their area of expertise or they're so busy that they want it to be someone else's problem. It's okay to ask for help.

DeleteMSquared: my guess is that you'll still be taking the standard deduction, as your home was such a bargain that you won't be paying much interest. Other forms of income may complicate things but my guess is that you may be able to DIY, if you feel up to it.

DeleteBut like Christy notes, sometimes just hiring a professional may be worth it from a risk mitigation standpoint. And sleeping at night is a good thing.

I have an accountant because I'm self-employed at the PREPARATION alone for the stuff to give to my accountant literally takes all my weekend time up in Feb and I want to tear my hair out at the end. So it's WELL worth the money! :)

ReplyDeleteIf I were self employed, I'd probably go the same route. That sounds like a hellish amount of prep, Tonya -- best of luck this February!

DeleteH&R is a waste. Do you want to pay someone to enter your info into a turbo tax alternative software?

ReplyDeleteWell, I doubt I'd actually go to H&R Block for services. The question was really more around whether it's worth it to hire any professional to do your income taxes.

DeleteH&R Block training consists of 75 hours of study. I've not taken it myself, but hear it's pretty good. That said, do you want your taxes prepared by the kid who took the course because he was tired of bagging groceries? And if you pick the older, experienced-looking preparer in the store, you might be getting the retiree who sold used cars for a living and wanted to pick up a little extra cash so took the course.

DeleteI'm in the tax prep industry and have met dozens of H&R Block preparers over the years. They vary wildly in quality, so if anyone were to go there, please at least ask how many tax seasons they have been through (most preparers only work during the tax season, so to ask about "years" worked isn't the best terminology).

I wondered about that commercial myself. Well, they have to scare people into hiring help, right?

ReplyDeleteGreat point, Karen, and one I wish I'd included in the article. Loss aversion is a powerful motivator.

DeleteWow! That's an interesting statistic - They should totally say where they got it from!

ReplyDeleteHey, Cat! Thanks for commenting. I took Tara's advice below and tweeted to H&R Block...maybe someone will get back to us on the source of that stat.

DeleteBefore I got married, my income was below the NY State threshold that I could qualify for free online tax prep for both Federal and NY State tax returns. Now that I'm married, and since we got married last year, we're going to use a tax prep service. We had a lot of financial paperwork last year (husband was on unemployment and did some MISC paid work), I did some freelance transcription work plus worked one week at my old job so I have two W2s, etc so I just want to use the service.

ReplyDeletePerhaps you should try tweeting H&R Block to see if they answer how they got the stat!

I took your advice, Tara, and tweeted out to H&R Block. I'm hoping we get a response!

DeleteI take our taxes to a local place that charges us about $150. Our situation is complicated because hubby and I both work more than one job, and his especially because the location varies (so then you have multiple states involved) and sometimes overseas work. It's worth it to me to just pay someone and get it over with. :)

ReplyDeleteAnd if any of your blog readers are military, they might be able to get their taxes done for free.

Thanks, Amanda! That link could help some military families.

DeleteAnd I hear you on the multiple state thing. I had to do that one year and it was not fun. I can only imagine what it's like for multiple countries.

I wondered about their math ever since I heard those commercials... thanks for the post! We get ours done by a professional just for the peace of mind that it gives us... It usually costs us around $130, and we are confident that over the years, he has more than paid for himself.

ReplyDeleteThat seems pretty reasonable, Jon. At that cost, you're almost just buying your time back, while also getting the advantages of a professional.

DeleteHonestly the commercial is just an attempt to gain your business from fear of error. More and more people file on their own than ever before and that means a loss of money to a business like H&R Block. Just like how movie rental stores are losing business to red box, turbo tax and programs alike are cutting out the middle man

ReplyDeleteSome others have brought up that point, and it's one I wish I stumbled upon when writing the piece, Ryan. It makes sense: marketing strikes again.

DeleteI outsource (and H&R Block is here in Australia too). I no longer outsource to H&R as I thought they were a little too standard for me, but then the accountant I used this year could NOT have been more hands off, so I'm in search of another accountant, now that I have an investment property which I rent out. Weirdly, I also think 'oh an accountant will reduce the likelihood of errors/inspections by the tax authorities', alas H&R puts it back on me... true, but it's not about me lying or not, but them knowing things I don't know about tax law!

ReplyDeleteWithout an accountant, I might never have learnt I could claim proportions of flights, and food, for a conference work paid for. Bonus if you ask me - as the flight were Australia to France!

I think I'll steer clear of H&R Block based of your comments, and those of some others. I have a feeling 2014, with a business in the plans as well as a rental property, might be the first tax year in which we choose to hire a CPA.

DeleteGreat find on those deductions, too! An international flight with a reduced cost? Yes, please!

I use tax software since I think my taxes are relatively simple. I don't think an accountant will add much value and will be much more expensive. If I had business income or other complicated matters, then I'd seek out an accountant. But I might switch back to doing it by myself once I figure out what he/she did.

ReplyDeletePretty savvy approach there, Andrew. I suppose once you see what the accountant is doing for a couple years, you could DIY, presuming your situation doesn't change.

DeleteI mostly do my own taxes with TurboTax. Two years ago, when we sold some investment property, I paid a CPA for assistance with just that part, and he got me about $6000 more in my return and I paid him $3500. When Dad and I first got married, we had two incomes, two states (me in both, him in one), and I sent it to an accountant to do for us. I still had to fill out all of the information (just like turbotax), and it still took me just as long. They charged us $800, and I found several mistakes in their paperwork, *and* we got a nice "you made a mistake" letter from the IRS asking for more money. I'm never using an accountant again except for advice!

ReplyDeleteThose are big figures, but if your CPA found you $6k I can see splitting it with him being a true, win-win.

DeleteYou're the first one to suggest paying for tax advice only, and I can really see the value in that. The best part of working with an expert is the expert advice, not the expert inputting of numbers.

I am seeing these commercials more and more, and I'm sure they don't plan on stopping until tax season is over. Last year, I went to a professional to do my taxes - paid $50 total and I barely had to do any thinking ;)

ReplyDeleteWhoa! That is an awesome price, Lisa. That's basically the cost of the software for DIY, and it sounds like they're a full service operation too, as you had to do so little. I may hit you up for your professional's info.

Delete$1 billion doesnt seem too outrageous and those H&R block numbers do not make sense.

ReplyDeleteEven if only the 11 million people doing it themselves that have errors account for the entier $1billion? Thats only $90 per person. They will be spending far more money than that for having H&R do their taxes.

I echo many of the comments in this post. Tax software is the way to go.

I have used H&R block and Turbotax and by far I prefer Turbotax.

I use the $100ish version as I have rental property and some oddball investments. The ability to import previous years' returns and automate the electronic desposit and submission is well worth the money.

One reason I would tell people to consider doing your own taxes... knowledge and learning more about finance. Yes its dull and boring and I hate tax time as much as anyone but its a chance to learn another aspect of personal finance.

Oops I re-read their numbers. 11 million people have a 20% chance of having an error. Ok the $460 number makes more sense. Sorry about that.

DeleteYeah, the numbers do seem to work out, roughly, from their estimates. But as you noted, if everyone went to H&R Block, it'd be a losing proposition for the group.

DeleteMy husband does the taxes himself without any software. I don't know how he does it, but he is dedicated to it. For a few years he did our 4 kids' taxes too when they had college jobs/internships in other states and at home.

DeleteBy the way, I read that the best way to avoid getting your information stolen is to file your tax returns as early as you can. Scammers send in forms in your name using info they've been able to scrounge about you. They can't do that if your return has already been filed.

Thanks for the tip! I was planning on waiting until the end of February, but maybe I'll get going on my taxes when we get home from vacation. Cheers!

DeleteDBF,

ReplyDeleteTax Act is the cheapest and very reputable. Same package including State, rentals, investments, everything for $17.99. I think the commercials are fear mongering. Taxpayers underpay WAY more than overpay, as a whole. Known as the tax gap. Something like 300+ billion these days.

-RBD

Thanks for the tip, RBD. We're on the fence about that software but you're the second or third person to give an endorsement. At that price, I think it's worth a try.

DeleteThis comment has been removed by a blog administrator.

ReplyDelete