We spent way above our long term monthly average, most of our spending was completely discretionary, and this month threw off our future financial independence projections pretty significantly.

Here's the breakdown of what we spent last month:

Total September Spend: $5,807

Non-Mortgage Spend: $4,249

Annual Spend YTD: $36,661

Forecast 2017 Spend: $48,881

Yikes. So what the hell happened?

To start, some nesting happened. We bought two sofas for our living room, deciding that we didn't like the old couch that we inherited from a family member years ago. It worked just fine in the old house. It also worked just fine in the new house. Nothing was wrong with it, except that we didn't like the style or color.

But as one sometime does when moving into a new house, we wanted new furniture. We wanted new couches, so we bought them. It's as simple as that.

So when a check from our lender showed up in the mail, for our old escrow account balance, we earmarked those funds for furniture for the living room.

(*Technically, we had already marked this money as "spent" in 2017, since it's coming from our old mortgage payments that were supposed to go to taxes and insurance. There was a temptation to not count this in this month's budget, since the funds were already accounted for in prior months' mortgage payment. But I'd rather double count, and make sure large purchases like this make their way into the history of our spending.)

|

| A rare moment of obedience. |

We were going to buy a print for $100, but asked if she would part with the original. At $500, it's obviously many times more expensive. But we're happier having the original. At least it's already matted and framed.

This is another case of just getting something because we wanted it. And if you can't splurge a bit on a birthday...

Just to pile on, we spent $100 for NFL Sunday Ticket (available as a streaming option, as Mrs. Done by Forty is a student) and even shelled out an additional $50 for the Game Pass, so we can go back and watch whatever games we missed throughout the week. (And by "we", I mean "me". I have to force Mrs. Done by Forty to sit through a Steelers game.)

Rounding out our spendy month, we ran in to some medical costs. Both of us visited the dentist, where I learned I had my first cavity in some time.

More troubling was an injury I developed on our trip to Europe this summer. It seems I have an inguinal hernia. It's not a huge deal. I can still bike and run; I just can't lift weights or anything too heavy.

But it will require surgery. I'm putting it off for now so we can potentially pair it with some other medical costs next year, especially as Mrs. Done by Forty might be coming on to my insurance.

Still, we can count on shelling out about three or four grand, right around where my deductible currently is. Got to love those high deductible health plans.

Looking at all the money we've spent, and are going to spend in the coming months, there's a part of me that wishes we showed our full financial picture. Because despite all the money we parted with, we did still manage to save something in September.

I get defensive when we spend too much. And who knows what too much is.

I'm also pretty insecure about the prospect of spending more than $40,000 a year, since our initial goal set when we started the blog all the way back in 2012 hinges on spending exactly that amount. And the annual figures aren't trending to that amount.

When we decided to purchase our pricey new home, the deal that my wife and I made was that we'd tighten our belts a little bit. We'd commit ourselves again to frugality.

So far, that is not happening.

Is this increased spending in our new place just a temporary setback? Or is something approaching $50,000 annually going to be a truer figure, now that we have a bigger mortgage, and maybe someday, a bigger family, too.

If so, we'll need a bigger nest egg. Meaning maybe we won't be done by forty.

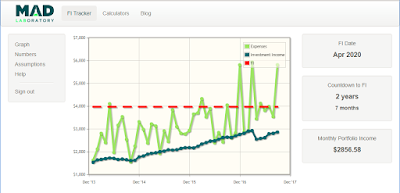

Here's how this month's spending impacted our forecast to reach financial independence, from the Mad Fientist.

April 2020 is the new target, a full three months later than the target date from August's annual check in.

This is surprising, since even with the spiky green line showing an ever-increasing spending trend, it seems that we might actually reach financial independence just before my 40th birthday.

I have conflicted feelings about this. I'm happy that it seems we're still on track to reach our goal, somehow.

And, when looked at one at a time, I feel fine about all of these purchases. I like having new furniture to sit on, football streamed into our television on Sundays, and art to hang on our wall that makes my wife smile when she looks at it.

But the main reason I brought back these budget porn posts was to provide more motivation: to be more frugal. While I'm fine spending money in the abstract, or on a single purchase, we're not saying "no" to a lot of potential purchases these days. We're not delaying spending all that often. And it's at the point where it's impacting our larger financial goals.

So, as I always do, I turn to you fine readers when I get in a jam. If you can, please leave a comment below that gives us some advice, some motivation, or a tip that nudges us back to being a bit more frugal.

Thanks for reading, friends.

*Photo is from Joelk75 at Flickr Creative Commons.

Thank you for your honesty though! I think when I have "bad" months, I tend not to post how much I spent on my blog. lol! Man words of wisdom? I'm not sure I have any really. I feel like I'm right there with you though! Glad you were still able to save some!

ReplyDeleteThanks, Tonya! We're striving for honesty and, hopefully, accountability with this series. That's the main reason we included the couches even though we might have counted those funds as 'found money'.

DeleteI know it's a lot to ask others how to make yourself more frugal. But I'm an extrovert -- the encouragement and advice of others usually delivers results.

You'd have to watch live, but Sling TV could potentially cut your NFL budget at least in half. Here's a full review from a friend:

ReplyDeletehttp://johnjanedoe.com/sling-tv-review/

How far back would pushing your yearly spend to $50,000 put you? I don't know the timeline, but may be better to account for inflation/children.

Hey Femme Frugality!

DeleteWe did try Sling once for The Walking Dead. It was BAD: like, skipping throughout an episode, have-to-turn-this-off, bad. But maybe things have improved?

We could just go down to $100/year if I only watched live. Honestly, that's what I do for the Steeler games anyway. The extra $50 to look back is what I do during the offseason, mostly. I do like dialing up old games from 2010 and reliving the games.

As for the $50k budget, the figures above are trending toward a $49k budget and that seems to push us out 3 months, to about April 2020. It's not really that bad of a consequence. I suppose I'm most worried about the future costs of children/healthcare: we'd have to get more frugal to account for those extra costs.

Shoot that stinks. I haven't tried it myself as I'm living in county, but good to know. I've also had a harder time convincing myself the NFL is worth giving my viewership to, lately, which has me really conflicted to say the least as a Pittsburgher, but that's another story for another day.

DeleteAhhhh I see. Three months isn't bad! And yes, those are very big things to worry about. While you don't have to spend as much money as "they" say you will on kids, but it's definitely an added cost, and the healthcare is definitely something to be worried about. Especially when things are so uncertain right now in that realm.

Yeah, kids+healthcare are the big variable in our future plans. We'll have to stay flexible.

DeleteAs for the NFL, I try to support it now more than ever. I still love the game, love the fact that players are exercising their rights, etc. But I'm someone who will be a lifer: it would take a whole, whole lot for me not to watch the Steelers. They're my team.

"I get defensive when we spend too much." Man, I know how that is. If it makes you feel better, rent alone costs us over $30k per year. So, imagine how it feels when you see other people living large on $24k all inclusive. I'm not complaining, but comparatively, our spending feels 'overindulgent,' even though that depends on where you live.

ReplyDeleteSounds like the house stuff is one-time deal. I ran into the same problem when I moved in with my husband. We didn't budget for one-time furniture costs so it really messed up our monthly 'house supplies' budget. Sometimes it is what it is.

Also, fall football is a sticky point in our house. I want to cut cable, but my husband seems to think we won't end up saving much by getting the NFL Sunday Ticket.

For what it's worth, we love the streaming version of NFL Sunday Ticket (i.e. - we don't have to pay for DirecTV, since it comes through the internet). You can get it if you're a student or, ahem, if you know of a student who doesn't like football who'd be willing to help you out by signing up for you...

DeleteI also think it's available to people living in big cities (NYC) who don't have a clear view of the skyline or can't put a dish on their building (or, ahem, who say they can't).

Thanks for letting us know we're not alone on the new house stuff! We're feeling a little guilt but really do want to put some nice stuff in our nice new house. Hence appliances, furniture...but I think we're at the end of the list by now.

And yes, $30k/year on rent does put things in perspective. When we were in San Diego, rent was the only thing we didn't like...

He wants the out of market games. Honestly, I've read maybe 10 articles about how to watch football without cable, and I'm still lost! You'd think a personal finance blogger would be able to figure it out. The satellite thing on our building might not be something the landlord likes, but maybe I can convince my husband to do the streaming option.

DeleteForgot to say earlier, one thing that helped the new furniture purchase was selling old stuff on Craigslist. That way we could offset the costs of the new stuff. I'm a stickler about buying used things on Craigslist now so you can basically recoup most of your money by selling them BACK onto CL.

So the streaming NFL Sunday Ticket shows all the out of market games (i.e. - everything NOT being shown over the air in your city). So here in AZ, I can stream the Steelers, Seahawks, whoever...just not the Cardinals (but can get that game with our antenna).

DeleteMaybe I should write a post on this? Anyway, here's the link:

https://nflst.directv.com/student

We did end up selling our old couch on craigslist...but only got $40. :/

See, I guess we're looking at it a little differently - the time to splurge a little bit is while you are working. If we had said "not yet" to the kitchen renovation or to Mr PoP's dream car, pending complete financial independence - I'm not sure we would have ever actually pulled the trigger on them (it's hard to be splurgy when $$ isn't coming in on a regular basis and collectively those cost us about 9 months of savings!).

ReplyDeleteSo I say enjoy the painting! And the couches! As for the sports on tv... meh! not my thing. If that's all worth a month of working to you, then make the most of it and don't guilt yourself over it. But keep the time/money tradeoff in mind for future fancy purchases as well - since months can add up to years if we're not careful.

Hey, Mrs. PoP.

DeleteYou're totally right that the time to splurge, if you're going to do it, is while you've got W2 income coming in. Way easier to pivot while we've got checks coming in on the regular.

Your kitchen model, and car, are envious splurges, too. Very nicely done on both.

But we'll take your advice on considering the time cost of future big purchases, of which we have several: my surgery (needed), painting the car (wanted, especially if we're going to keep this thing for another 10 years), and maybe a third scooter???

Just kidding.

I so appreciate the budget porn posts. They keep me motivated - and putting it all out there certainly does act as accountability.

ReplyDeleteDeductibles happen.

I was on track to be debt free again post-divorce, but nearly hitting my (also high) medical deductible 2 years in a row plus two rounds of auto deductible this year has frustrated that goal.

In a moment of frustration at my YE financial projection for 2017, I realized that had those events not occurred, I would have paid off more than $10K in debt. Can't do anything about spilt milk, but no need to panic at one-time expenses, just need to avoid crazy drivers better and maintain the tight belt. It's the creeping standard/cost of living that deserves scrutiny.

Thanks for the kind words, Emily! I was hoping others would get something good out of our budget posts.

DeleteIt sucks when medical costs can derail our financial goals. But I suppose a better way of looking at it is that we're just putting our money towards a top priority: if we're not healthy, hardly anything else matters.

And I agree that the creeping standard of living is the thing to worry about. We're taking our eye off the prize quite a lot lately, with the new house in particular.

I'm hoping for a revitalization.

I find your spending so restrained... I know that doesn't help, but our own spending is a lot more than yours, so I'm way impressed and think you're doing great. And while the sofas were a splurge, they were a planned splurge, right? With earmarked money? I got nothing on your football spend... feels like a big waste o'money to me. :) Totally joking. I've been reading Dr. Ben-Shahar's book Happier, about being a rat racer (present detriment/future pleasure) versus happiness, balancing present pleasure/future pleasure. I think your September spending could be categorized as the latter, so that's a good thing. :)

ReplyDeleteRestrained spending. I like the sound of that, Laurie, as I am a total control freak and like to restrain everything that I can. :)

DeleteYour comment is a good reminder that things are relative. And getting perspectives from others is half the reason we posted these things so openly in the first place.

And on weeks that the Steelers lose, I definitely feel like it's wasted money (and time, too). But when they win, there's very little quite as sweet. Celebrating the Steelers' last Super Bowl win with Mrs. Done by Forty (girlfriend Done by Forty back then) was one of the happiest moments of my life, and, somehow, a clue that she might be the one for me.

If she could see me at my worst, screaming at the television when they lost the lead, and jumping around like a small child when they miraculously came back, then she must be someone pretty special.

I'll have to check out that book: I'm a big fan of positive psychology.

Love seeing the pics of the dogs. :-) Sorry about the hernia - my brother had one - not fun. I know you can commit to a "frugaler" fourth quarter, my friend. :-)

ReplyDeleteThanks, Laurie. And it definitely is the 4th quarter. Time to finish. :)

DeleteHello! Well, from the picture the house looks beautiful. It's easier to splurge when you have W-2 income.

ReplyDeleteWe're having a similar dilemma in terms of trying to inflate our lifestyle but wanting a bit nicer things. Like a nicer house. We are, also, trying to keep our annual spend to $40,000.

Thanks for the kind words about our home! We like it. :)

DeleteYeah, there is something nice about that $40k figure, and the round nest egg figure that gets us there, too. It's a common number for us in the PF world to shoot for, I've noticed.

That said, if a little divergence happens one way or another, it's not all that big of a deal. Round numbers are arbitrary.

If it makes you feel any better, our spending this month (not including the mortgage) was $5,800. It also had to do with home improvement, and we've also seen an uptick in our spending. At the end of the day though, like you, I try to remember how blessed we are, and that we can live the good life and still be DBF. I don't think we'll ever be real "spenders", and come anywhere near living check-to-check. I shudder at the thought. We've got most savings on auto-pilot, and the rest is gravy. Keep kickin' ass, friend.

ReplyDeleteYeah, some perspective is always welcome. I doubt we'll ever be folks going check to check -- the closest we'll come is probably in FI, ironically.

DeleteAnd some spending around the house isn't so bad, so long as it's one time stuff to make the property nicer, as you are doing.

Don't beat yourself up! It is just furniture and it's not like you went out and spend a fortune on it. Price seems reasonable. While working towards your FI, you also need to enjoy the present, so good for you for getting those tickets. It is all about balance.

ReplyDeleteTrue, it's not like the furniture was even that expensive.

DeleteIt's in my nature to beat myself up: being critical of myself (or, rather, having a fear of failure) is the thing that both nudges me to try harder, and also causes me to overreact when things do go as they planned.

As you noted, it's a better approach to have some balance though.

I think you're saved by the solid market returns of these last couple of years. They counteract the larger spending that you've done, but I wouldn't count on them to last.

ReplyDeleteTrue, you never know when this bull's going to run out of steam.

DeleteWe've managed to save well over 50% of our income throughout all the spendiness, so that certainly helps.

To be honest, I hope you're right. I want the market rally to end, and soon, so we can put our dollars to work more efficiently. Constantly buying at the top is kind of a drag.