But motivation is a rare thing, and I should at least try to capture it the one time a year it predictably shows its head like Punxsutawney Phil.

My goal is to bring our annual spending back to $40,000 again. That translates to a very attractive looking $3,333 a month. We used to come in under that figure, no problem... back after we'd paid off our mortgage. So, yeah, apples and elephants now that we have a big honking mortgage again, I know.

Still, when I look at a single month, it sure does seem possible. Plus, I have a secret weapon, as shown in the picture.

No, not the adorable, obedient puppy who gets an appropriate amount of love and attention, and definitely is not spoiled. I mean the high tech system of pizza sauce jars with cash money inside.

Yes, we are getting back to basics in the Done by Forty household, and using a cash system. At least for a month. (Or at least that's what Mrs. Done by Forty has agreed to. Little does she know that I plan to institute a cash year in 2018, and this first month is just the tip of the iceberg. But seeing how she is this blog's editor, she is probably becoming aware of my ruse right... now.)

The Plan:

- Each of us will keep $100 in our wallets, as that's almost always enough to cover any single purchase.

- We'll keep receipts for whatever we buy, and then "true up" when we get back home or whenever we think about it (i.e. - I buy $47 dollars worth of groceries from the money in my wallet, I put the receipt in the grocery jar, and pull money/make change from the grocery jar to get my wallet back to $100.)

- We'll still pay for a lot of things electronically: if it's necessary (e.g. - Amazon or other online shopping/utility bill pay), or just convenient (gas for the car), or if we just don't have enough cash on hand. The system's meant to help us, not be a pain in the ass.

- Rather than using our credit card statements to track individual purchases, we will just tally up the receipts in the jar at the end of the month or, in the event that we don't think it makes sense to track every purchase, just see how much cash is in each jar at the end of the month and do a little subtraction. This could actually reduce the amount of effort we put into budgeting.

- We can pull cash from jars if we run out (e.g. - we can yank $50 from date night if the grocery jar is low, or vice versa).

- No tracking coins: everything gets rounded to a dollar. Change from purchases goes into the console of the car, or a pocket in the backpack when biking, and will be used for future purchases when we think of it. But life's too short to count change.

Who's Winning the Rewards Game?

So why are we reverting to a cash system in 2018, the year in which we can pay not only with plastic, but with our phones and with our faces?

For one, I've been beating the drum for a long time that the people who are good with finances, who pay their bills on time and go after credit card rewards, are exactly the sort of people who are likely to spend more when using a credit card. I suspect that the impact of the credit card might well exceed the 2% cash back we're currently getting. So even though there's a $500 opportunity cost with the cash-only plan (what we would earn at 2% cash back on the $25k in spend we typically put on a card each year) there's a good chance we're still coming out way behind with plastic.

Even beyond our 'everyday' spending, our purchasing behavior might be particularly skewed when we're trying to churn a new credit card for a sign up bonus. Trying to get a big bonus turns our frugality on its head: instead of being frugal and questioning purchases, we end up looking for ways to hit a spending target so we can get a mess of miles.

Some in the personal finance community don't like hearing this sort of stuff, because it's awesome to get rewards and fly for free and, ahem, earn side income from people signing up from credit cards on our blogs. People who might get in to some serious credit card debt in the process, for all we know.

And sure, I like to think that I'm just spending money "that I would have spent anyway" when using a credit card. And my behavior might not be influenced in any way by the specter of getting 50,000 airline miles if I spend three thousand bucks in the next three months, right?

But the entire field of behavioral economics is founded on the idea that we humans are not particularly rational actors when it comes to money. We might not be in a position to objectively evaluate our purchases, and whether rewards are enticing us to spend more. We should consider the possibility that the rewards game is gaming us. Anyway, give this post a look if you weren't reading the blog back in 2013.

Regardless, after traveling internationally every six months for the past four years or so, we're taking a break in 2018. I figure this is a great time to see if we might spend less using a cash system. If it doesn't work, we can always switch back to plastic and start earning miles again.

And I should note that this is nowhere near a perfect experiment. Each year is unique and has a ton of variables that we cannot control for. Even if we do end up spending a lot less in 2018, I'm in no position to say it's because we used cash.

Still, if we end up cutting our spending by $10k or more, while we're in a bigger new house with a much bigger mortgage, I won't really care why it happened. I'll care that it happened.

Recurring Expenses

In addition to trying for a cash year, we want to reevaluate all our recurring expenses because those are the things that have long term impacts. A big one is our insurance. We'll be contacting some local insurance agents to compete our home, auto, scooter & other policies, just to make sure we're still price competitive. And I'll be calling in to our internet service provider to negotiate our rates.

(If you're not already negotiating some of your regular bills, please do give it a shot. This is some of the easiest money you can make on a fifteen minute call, and the reduction you negotiate recurs every month going forward.)

A Little Budget Porn

Draw the shades and make sure you've got the house to yourself, you pervs. Here's the final clip of budget porn for 2017.

Total December Spend: $3,242

Non-Mortgage Spend: $3,242

2017 Annual Spend: $48,379

Non-Mortgage Spend: $3,242

2017 Annual Spend: $48,379

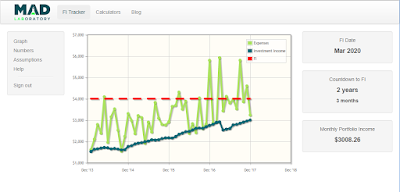

And here is how we're trending towards financial independence, courtesy of the Mad Fientist's laboratory:

We ended up refinancing our new mortgage to a better rate (about half a percent lower to 3.75%, with the new company bringing $2k in credits to close). We did have to pay about $800 in title fees but we'll break even in less than a year, so it seemed like a decent move. And we skipped December's mortgage payment in the process: a hollow victory as our final payment is now a month later, too. But we'll take it.

The outlier expenses this month were Christmas gifts and charitable donations, as I'm sure they were for a lot of us. If you're still looking for a worthy cause to donate to before the new standard deduction makes itemizing charitable donations near impossible for many middle class households, we have a good one to recommend.

We'll have a longer post breaking down the total spend in 2017, but cracking $48,000 is a new record for us, and a dubious one at that. But even with 2018 having one particular new, daunting-yet-exciting opportunity to spend more money, I'm strangely optimistic that we can pull our spending back down towards $40,000, and more in line with our original plan to be 'done by forty'.

Hope abounds this time of year, and that is a good thing. I wish that you, my kind readers, have all the support, motivation, and luck in making next year your best one yet.

But tonight, enjoy the last bits of 2017 with some adult beverages, hug your loved ones, light some firecrackers, and please be safe out there.

As always, thanks for reading.

Good luck with going all-cash next year! Typically I am horrible with cash whereas I’m much more tightfisted with credit card swipes and have never been able to figure out why but I’d be interested to know if that’s changed at all over the years.

ReplyDeleteI should show how I avoid unnecessary spending when we churn credit cards for bonuses - I map out all chargeable large expenses that I can put on a churn card well ahead of actually applying, then time my applications according to when those predictable bills are expected. February is a big charging month for us.

Happy New Year!

I like that system of pre-planning churn purchases prior to making them, Revanche. That sounds like a great way to mitigate any effect. Would love to hear your thoughts on the study cited in my 2013, post, too.

DeleteI quickly skimmed it and I wonder if there is some correlation between the responsible CC users and knowing they have more leeway to spend in general and their spending. For me, form of payment doesn't figure into the question of whether I will spend or not because I trained in the hard knocks school. I grab our credit card balance weekly and put it into our bills tracking so that I always know if we're over or under the average monthly spending and so it's easier for me to track with CCs than with cash. If presented with options like the $8 GC for using a credit card, I'm still going to pick what I buy with a CC carefully to maximize my returns and minimize how much I spend. In other words, no matter the incentive, the profit HAS to work out or no dice.

DeleteI do think you're right in that the responsible CC users likely feel they can spend more because they have more leeway.

DeleteStill, I think the effect the study showed was that those responsible users spent more WHEN they were given a reward, compared to those who were not. In other words, responsible or not, the rewards got them to spend more on average.

Now, there are surely people for whom there is very little or no change in their purchasing behavior. But as a group...

I think you're hitting on the key takeaway with credit card rewards: if the sign up bonus is big enough (e.g. - roundtrip flight to Asia) then we might come out ahead anyway. But the reward has to be big for us to be sure.

I'm with you on the minimum spend, Revanche. I know every penny I'm going to spend before I even apply. And during that three-four month period, I don't spend a penny more than what's in my spreadsheet.

DeleteI'm not particularly fond of using cash--it burns a hole in my pocket faster. For me, though, after that initial signup period is over, I think I might spend a little bit extra because I still get hella good rewards. Not a lot extra--I'm still plotting everything out. But I may justify more than I would if I were using my bank account.

Right now I'm sitting in a little bit of (zero percent interest) debt which I blame on health insurance premiums and copays. It's a true argument when I look at the numbers, but I could have cut back more last year and gone into an ultra frugality frenzy. Instead I was just in a mild frugality frenzy. If I had been pulling that money from my bank account directly, I may have felt a bit more pain and gotten my stuff together slightly better. Not sure how much of a difference it would have made, but every little bit helps.

Man, you're making me examine myself haha.

I hope I wasn't being a jerk about the credit rewards-increasing-spending stuff. I personally find the study compelling, but within any data set there will be outliers who buck the trend. And certainly with a good system, any effect can be mitigated or perhaps eliminated entirely if it even exists.

DeleteBut with a large enough reward, it might all be a moot point. Who cares if we spend 15% more if we get rewards that far exceed that? That was certainly our viewpoint when we were churning our way to travel on 5 continents.

But we're shifting our approach now that we likely aren't traveling much and kind of have some points left over anyway (about 200k American Airline miles) that we don't really know what to do with. At the moment, I'd like to see if we end up spending less.

Not a jerk at all! Introspection is a good thing. And true at 15%, but I haven't signed up fora card in a while so mine are sitting at 2%. Definitely worth thinking about before I pull out the card next time.

DeleteWe're at 2% and have been for a while, which kind of prompted me to look back at that study. When I saw the increase of 15% among certain users, that nudged us to try out cash.

DeleteWe'll see if it correlates with lower spending though.

Do update how that goes. I have tried and failed at all-cash. All plastic works fine for me. I have certain times of the year when I know the expenses go up - like paying for summer camps. I get new cards only at that time. That keeps it easy to manage, and causes no extra spending.

ReplyDeleteHi BusyMom! We'll be providing monthly budget updates as we go, and I'm interested to see how we do.

DeleteAnd like Revanche's system, I can see how predictable, anticipated increased charges combined with new cards can really mitigate any credit card reward effect. If you get a chance to read my old post, let me know what you think!

I don’t carry cash because when I do I spend it at the vending machine and whatever on campus bake sale is going on in the commons. It’s bad for my health!

ReplyDeleteThat's a sneaky downside to carrying cash, Nicoleandmaggie.

DeleteCash used to feel like it was burning a hole in my pocket.

I'm actually going to Vegas this week for a bachelor party, and I'm particularly worried that cash might find its way out of my pocket and onto the felt...

Yea I'm more likely to spend cash when I have it although have not tried the all cash diet, so maybe my viewpoint will be totally different if I knew that was the only way to spend. I have a feeling it wouldn't be though!

DeleteDefinitely a hole burning in pocket kind of guy when it comes to cash. If I don't have it in there I just don't think about buying things on a day to day basis.

Cheers and good luck with the experiment! :)

(Oh and sorry to see the Steelers result the other night! Booo :( )

I'm a solid debit card user. The only time I try the cc thing is if I KNOW I'm going to be making a big purchase, i.e., my new mac that I'm buying as soon as the card arrives. Otherwise I'm with you. I think it's always good to evaluate, and reevaluate your spending habits. Good luck my friend!

ReplyDeleteHey Tonya.

DeleteYeah, with something distinct, like a macbook, I'm not sure how the credit card would increase spending. Maybe a few more add ons or upgrades?

And you nailed it: we're trying to shake things up and re-evaluate whether what we're doing is really optimal for us. $48k or higher annually really changes our FI plans, so it's worth an experiment.

Cool post. I've thought about doing a cash-only diet with the husband as an experiment. Maybe we'll follow along with you! Or I'll make my husband do it and write a post about it.

ReplyDeleteI'm def one of those CC users you mention. I've always used credit cards so I don't have anything else to compare it to. I did notice my spending increased as my income increased--lifestyle inflation, anyone? Anyway, I have no doubts that I spend more because of CCs, due to convenience. However, I'm not sure that I spend more because I'm chasing rewards. I usually line up the signups when I have big spending coming up--like paying for our wedding, etc. Not a big churner or anything. But I buy most everything from the Internet (clothes, toiletries, etc.) because it's faster for me--can't buy that stuff without a credit card. Although I guess I could use a debit card.

Anyway, the more I think about it, the most this all-cash diet is appealing to me!

For what it's worth, we have noticed that we are NOT especially frugal when we're churning. In fact, we start worrying about whether we won't hit the limit sometimes, so we actually are looking for things to buy.

DeleteNow, perhaps the miles are worth so much that it's still a good tradeoff. But at least in our case, it's folly that we're just spending "what we would have anyway".

If you do any cash experiment, let me know. Maybe you'd be down to join in a future PF chat to discuss card vs. credit?

Best of luck! This past year was really the first year we tracked our spending. We spent $40K. If we had stuck to our food and shopping budget, we would have spent $6K less. Next year we will have a bigger mortgage, so will definitely need to stick to our budget. It's like squeezing into skinny jeans. In this case, the $40K annual budget skinny jeans. I really hope you can do the $40K budget. :) You can do it!

ReplyDeleteI love that idea, Savvy Financial Latina: because my jeans are all somehow skinny jeans these days.

DeleteTime to break out the pliers, lay flat on the bed, and exhale hard...

My wife and I were just talking about how we should go more to cash. I love the idea of travel hacking, but I think you are right, at least for me, we might actually spend more by credit cards just for convenience sake. I am still trying to develop the system of how we pull this off going to more cash (I like your jars idea). Good luck on reducing your spending. I wish I could say ours is at 48k, but with student loans, mortgage, and the like that is about 36k right there. Someday it will be gone....let's hope so.

ReplyDeleteHey Jason! Good to see you, friend.

DeleteWe will keep giving updates on our monthly budget porn posts, so I think we'll see pretty quickly whether this is resulting in a lower monthly spend...even if we can't confirm it's really because of the cash, or some other factor like a renewed sense of frugality.

So the Nov '17 budget lists Medical but Dec '17 says Medical/Maternity! I know you've mentioned plans to have mini-db40's...

ReplyDeleteYou may just be on to something there...

DeleteCongrats!! =)

DeleteGood luck with going all cash. I definitely see that I sometimes increase spending when I'm aiming for a credit card bonus, but I usually time it with a big expense (insurance pymt or something) to avoid having to "buy" stuff to hit that requirement. I remember your post about unknowingly spending more when you use credit, but it's hard to say how true it is for me. Pretty much the only thing I buy is gas for my car and food/household supplies, and stuff on amazon (which I can do with cash). I also hate getting change!!

Yeah, got my first handful of change today (89 cents) and I was like, hmmm.

DeleteI think the hard part with this issue is that it's nearly impossible to really know what impact any particular method has on our spending. Cash is inconvenient, and many people think that they spend more with cash. But are they really? Or are they noticing it more because research indicates it's more painful to let go of cash than handing over a card?

All this goes to say that I, as an individual, am not necessarily in a great position to isolate the impact (positive or negative) that a payment method has on the way I negotiate, choose different items, choose to go without, etc.

I, personally, lean towards the research's conclusions but there's a real possibility that we'll come out behind using cash. Which would suck!

All the change can just go into piggy banks for mini-db40s. How cool would that be for a "college fund" to be started!

DeleteThat's a neat idea. Change goes to the kiddos...

Deleteyou'll have to let us know how the cash thing goes and see if it really does make you spend less!

ReplyDeleteThanks, Joe! I'm not sure I'll have any definitive conclusions other than what our new 2018 spending correlates with. We've got a lot of unique items coming up in 2018, too, so it's hard to really isolate the impact.

DeleteNow THAT is an interesting concept - are we the gamers being gamed by the credit card companies? You might be on to something. I for one use those damn things to try to offset my real estate expenses. Feels like a go a little overboard with what I purchase, since after all, I got the nice little bonus! Sigh... Good luck with your cash centric 2018 - I'll be interested to see how it goes!

ReplyDeleteThanks, Cubert! And sorry for the long delay in responding. Work has gotten CRAZY.

DeleteI certainly get spendy when I'm trying to net a big mile bonus...but I could be the odd one in that respect. It's hard to really say since we're always a sample size of one.

Interesting thoughts on credit cards - especially since I almost exclusively pay electronically for purchases. It is so much more real handing over hard cold cash though - here in Oz a 65 litre tank of fuel can sometimes approach $100 and while I twinge with pain a little when I pay by AMEX, it would be nothing like handing over a couple of pineapples. I get a free flight each year with that card but lately I've been wondering if its worth it.

ReplyDeleteYes! The pain of handing over cash is well documented and, likely, is one of the driving factors for why a rewards credit card user spends more.

DeleteRewards feel good. It's a less painful transaction than handing over cash, for which there is no reward other than some annoying change.