We are entering the home stretch of baby mania, 2018, dear readers. I owe you an apology for missing last week's post but we were hosting friends and family for a baby shower. I underestimated how little time we'd have to ourselves that weekend, as well as the stress level involved.

Am I the only one who finds it crazy stressful to have guests in town? I love people, and as an extrovert I even feel like I'm happiest when I'm around a lot of people. But when those people are staying in my home, something changes. It's no longer fun: everything's a chore. Literally, as I work through our chore list, cleaning our house far beyond what is normal for us.

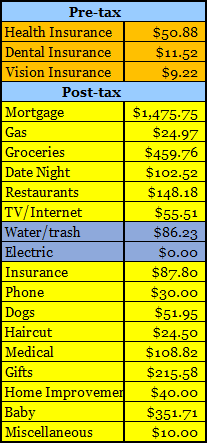

But that's all in the rear view mirror now, and I've carved out some time to write my favorite post. Who's ready to take a gander and our monthly budget?

March Total Spend: $3,345

Non-Mortgage Spend: $1,869.15

2018 YTD Spend: $11,686

Projected 2018 Spend: $46,744

While our overall spend was right where we want it to be, we somehow found a way to blow our budget on all things food last month. We treated all the nice people who helped with Mrs. Done by Forty's shower to a dinner: nothing fancy, but with ten people the bill's bound to get a little pricey no matter where you go.

We were on track to stay within our $400 goal for groceries, but I managed to blow our grocery budget when I got a $10 coupon from Bevmo if we spent $50 on booze. You can guess what happened next.

The baby continues to rack up expenses from within the womb. This little fucker is turning out to be pricey, as apparently his room (yes, he gets his own room) would be better off with this mural in it. Bare paint is fine for mom and dad, but Little Lord Fauntleroy must gaze upon art. So fancy.

Throw in some gifts for a wedding, paying back a favor to a neighbor, and medical bills that keep trickling in from that surgery, and I'm pleasantly surprised that we managed to come in right where we'd need to be for an average month, if we're going to hit that $40k annual spend. (Although I suspect we're going to miss it by a lot when 2018 is all said and done.)

Here's how were tracking towards financial independence, per the Mad Fientist's Laboratory.

The Mad Fientist's lab is a lot more optimistic than I am with that projection. But I think I know what might be happening. One, the red dotted financial independence line is based on the last twelve months of spending, and that means one of the high points from March 2017 just fell out of the average and was replaced with a below-average figure for March 2018.

The other reason I think we're further than one year and eleven months from financial independence comes from Big ERN over at Early Retirement Now. I'm reading through his excellent, but absurdly long, twenty-three part series on safe withdrawal rates.

I'll write a separate post on this, but my main takeaway is that the 4% Rule is too aggressive for early retirees. Short answer? Mrs. Done by Forty and I think 3.5% may be a better target. And that half a percent makes quite a difference.

The rub is that our figures on the Mad Fientist's charts, using data we've entered going back to 2012, are based on an assumption of a 4% withdrawal rate. When does the Laboratory think we'll hit financial independence if we require a 3.5% withdrawal rate?

We have even more wrinkles to add to our FI plan, but I'll save all that noise for August, when I write our annual 'are we on track' post. For now, I'll just assume we're still two-or-three years out.

Which isn't too bad! As we get closer to the goal, I am finding work to be a lot more enjoyable and, oddly, fulfilling. I recall the Mad Fientist mentioning something similar on his podcast: as money becomes less and less the reason you go in to the office every day, that it can become more satisfying and, ironically, less something you feel the need to escape from.

As always, thanks for reading, friends. I hope you have a great week ahead.

3.5% is a good target. It gives us some padding just in case.

ReplyDeleteYeah, baby is expensive. I wouldn't buy much more stuff. I found that we didn't really need all the stuff that people said we needed. We didn't even get a diaper changing table. Just change diaper on the carpet. It's only a couple of years. Enjoy your sleep while you can. ;)

Hey Joe!

DeleteWe're starting to come around to the opinion that 4% is (as the Trinity Study noted) really geared for a 30 year retirement. A 50 or 60 year retirement really might destroy a 4% plan.

The tip for not buying too much is a good one but, sadly, I just pulled the trigger on like $1300 worth of baby stuff that didn't get purchased on the registry.

It's our first kid and, man, I just do not have enough guts to try to go without. :)

"This little fucker is turning out to be pricey" Lol! Thank you for your honesty! I thought my cat was bad! :) Maybe that's why you need so much alcohol? :) Is the 40k annual spend with mortgage or without? Too lazy to do the math.

ReplyDeleteHa! Yes, the correlation between baby and alcohol is real!

DeleteThat $40k goal is including the mortgage. It's going to be really tough! But hope springs eternal. At least until the fall when we pass right by $40k. :)

That made me chuckle as well as the little lord fauntleroy line :)

Delete23 part series on the swr?! Erm.. fancy summing it up in a few sentences for me as definitely don't have time to read that (you will find this out in ~2 months)

Really interesting to compare as usual. We blew our grocery budget as well this month and that's even with me sneakily taking our bulk buy of booze out and recategorizing (is that even a word?!) it. But we have a freezer jam packed with food so hopefully it will balance out in April.

Cheers!

Hey FIREstarter,

DeleteMy short review of ERN's is that the 4% rule is not appropriate for people who are seeking 50 or 60 year retirements, and that most of the off the cuff accommodations people suggest ("I'll just spend the dividends" or "I'll stop adjusting for inflation for a few years" or "I'll get part time work for a few years") are based on intuition, not data, and do not seem to be sufficient.

Very short answer: aim for 3.25% or 3.5%.

I'm hoping for a better food month in April, too! Let's do it!

Thanks for that, even though it is a bit of a dagger through my general plans for our version of FIRE as we are getting no where near the 4% rule any time soon and I'm pretty certain I'll quit the day job way before we do. I think a paid of mortgage and then enough to cover half the rest of our spending would be more than enough to see us through, but that is obviously because we would be happy to continue working part time in some sense.

DeleteI don't really get how that wouldn't work?

Your example below:

"go work a little, maybe $1000 a month, for just a few years"

If two adults did that and they were only spending around $2000/month anyway then it wouldn't matter how bad the downturn was because they would be drawing hardly anything from the actual pot?

Is the conclusion that earning $1000/month part time is hard to do if you've been out of the work force too long? Because I find that very hard to believe :)

Just to clarify, I realise you can't (or may not) be able to do part time work when you're 80 odd. But we are talking about early FIRE types only here so I find it very hard to believe industrious folk like us won't still be earning even in "retirement". Obviously also comes down to each individuals definition of ER, FI and plans for those definitions as well.

DeleteAnyway, to underline my outlook it's very much in the optimists camp a la MMM.

Cheers

Optimism is great! But so is a data driven approach. Here's the post from ERN specifically on the "go work for $1000 a month":

Deletehttps://earlyretirementnow.com/2018/02/07/the-ultimate-guide-to-safe-withdrawal-rates-part-23-flexibility/

Obviously two different people working two, $1000 jobs is different. But the point here is that the intuition (I'll work for $1000 a month and be fine) is way, way different than the reality for someone trying this in a bad retirement year (he might have to work for 3 decades before getting back to the full amount he started with).

People have taken the "Shockingly Simple Math of Early Retirement" from MMM as gospel. They really should not because it's based on the Trinity Study, which assumes a 30 year retirement.

That's very, very different than a 60 year retirement. The 4% Rule was NOT crafted for that group.

Anyway, I think reading ERN's series is absolutely mandatory if you're working towards FIRE. A lot of FIRE enthusiasts are great at saving, great at investing, but aren't reading enough about the "safe" part of the safe withdrawal rate.

And to reply to your second post, yeah, I agree that if you plan to simply work and earn enough from that income to cover all your expenses, then you're by definition good to go indefinitely...so long as you keep working.

DeleteThat last part is the rub.

The real question is what happens if you decide ten years into the plan that you don't want to keep working part time. How does your portfolio look? Is it in shape to carry you through the rest of your life? And at what safe withdrawal rate?

These are the things that require more planning. Not to beat a dead horse but...shoot for 3.5% or 3.25%.

Hi DbF,

DeleteIt's clear we're kind of representing different points I think so it's not really worth going back and forth all that much further, so I'll put up some bullet points to keep things more concise :)

1. I agree the 4% rule is not very safe for early retirees if you think you will never earn another penny after you FIRE from your main job.

2. I also think that is very, very unlikely for most people retiring in their early 40's, whatever the market does (Look at Mr 1500 for an example who aimed for just over 1million according to the 4% rule, and is already over 2 million Net worth)

3. Had a quick spin through ERN's article, and yes very interesting it is. But the arguments put forward seem to be self defeating if the answer is to get down to 3.5% or 3.25%. He says running a side hustle (or working part time or whatever) would be a bad thing for say 20 years but I think most people would actually enjoy that. Especially if it's in an area they could choose because when they FIRE there is probably no real pressure to get something straight away unless you FIRE the day before a 20% market drop, which would be very bad luck let's face it! Anyway, so he's against doing that, and also against going back to work in his second main point, because that work was not actually needed in that case (great use of hindsight there to prove your point?) but for some reason he is OK with working more years BEFORE you FIRE to get your portfolio up to a 3.5% or 3.25% SWR limit. I find this rather contradictory to say the least and seeing as most people chasing FIRE tend to not actually like their jobs all that much, otherwise why would they be drawn to it in the first place, I would suggest that actually most people are better of "FIRE'ing" before they get anywhere near the 4% rule, and then try to find a job or self-employment that they DO actually like. And I think that is exactly what MMM is saying as well, from what I've read and interpreted.

If you just hate all kinds of work and just want to do you're own thing and specifically never want to earn money ever again, then yea... definitely be careful about the 4% rule.

Mmmm sorry that wasn't very concise at all was it? :)

Cheers for the healthy debate and making me think to at least clarify my stance on it all anyway... great stuff as always :)

Hey FIREStarter,

DeleteWell, I have to disagree again: as I said in this very post, I find that as I approach FI, I am enjoying work more and more. I no longer view it as something to escape from. The RE in FIRE isn't the driving force, for me.

I'll just make one last point:

The debate seems to hinge on a misunderstanding or disagreement of what the "FI" part of FIRE stands for. Financial independence is, in my opinion, a pretty clear cut term: meaning your investments cover your expenses for the rest of your life.

If people want to transition to other full or part time work that they like, indefinitely, before they reach FI, I think that is AWESOME.

But we should be clear to readers that this is not "financial independence". It is "transitioning to part time work for the forseeable future, but I will NEED that income because my investments cannot cover my expenses for 60 years." It's probably best described as a career change to something they like. Which, again, is AWESOME. But it in no way requires you to get to FI, or even near to FI, to achieve. It's just changing careers: go for it!

And that distinction between those terms matters, in my opinion, for people who are reading these blogs and, for all we know, making big career decisions based on that. If you want to change your work, go for it: I'd argue you shouldn't necessarily wait to hit the 4% rule to do so. And if you want to shoot for financial independence, great. They're just two separate things.

And yes, cheers on the healthy debate. Always good to get differing opinions to refine our views, and question them, too.

"Financial independence is, in my opinion, a pretty clear cut term: meaning your investments cover your expenses for the rest of your life."

DeleteYea I guess we just fundamentally disagree on what that term means. You are treating the same as what the good ole IRP would say about Retirement in my opinion.

FI is just a vague term that just means you've saved up enough cash to go and do what you pretty much want to with your life. Or a better way to think of it might be there are many shades of grey of FI rather than black and white. The more you save the more Independent you become from your job and so on.

This may sound stupid to many people but in my defence of my "definition" let's look at the flip side of the more strict definition:

"your investments cover your expenses for the rest of your life."

You will never, and let's make this absolutely clear... NEVER know this in advance so how will you know when to quit exactly? 4% withdrawal isn't safe so make it 3%, no hell let's work another 5 years and make it 2%.

But then what is the point of that because the world economy could come crashing down due to I dunno, say climate change or something like that and your investments are now worth a quarter of what they were.... and yep you are back to work anyway.

Obviously I'm being slightly facetious with that example but I think it illustrates the point that the rigid definition of FIRE doesn't make much sense (to me at least) and (I think) that it is probably not actually helping people out all that much, especially with all of the scaremongering with posts like the one you linked to. I think all this is doing is making people work jobs they may dislike for too many years (I realise you like your job so it doesn't apply to you and so shooting for 3% makes perfect sense in your case).

I'm not advocating people don't think about their futures and just quit their jobs on a whim cos some bloke on the internet said it was OK, just that things like 4% or any% "rule" are just a guide and people should and can adjust that to whatever they like either up or down accordingly, and not have to live in fear just cos another bloke on the internet said so :)

Honestly... sorry if that sounded like a rant, hope it didn't come across that way... haha. I promise I won't make another post after this one so if you want the last word on it go for it... it is your blog after all :)

Cheers again!

First, please don't bow out unless you really just want to. I keep a comments section open because I want to discuss stuff with my readers: there's no shot clock on this shit.

Delete"FI is just a vague term that just means you've saved up enough cash to go and do what you pretty much want to with your life."

Yeah, I have to disagree with that. It's a term with a widely accepted, clear definition. For example:

https://www.reddit.com/r/financialindependence/wiki/faq

Our debate is tripping up on the difference between LIKING your job and NEEDING your job. Those are two very different things.

A financially independent person does not need his job. He can love it, and keep on, or hate it, and leave any time he wants. But he doesn't NEED the income from the job: he already has a means of covering his expenses. He has enough saved to cover his expenses for the rest of his life. Thus, the job, or ANY job, is completely optional. That's the key.

If I still need to find additional income from some sort of work to fund my life, I may be happy in my job and life, I may be kicking ass in all the ways that matter...but I am not financially independent. And that is FINE.

Now, to your point about what safe withdrawal rate is actually safe: how much is "enough"? That is surely up for some debate. That said, it's not as though it can be anything we like, either. Just because something has a degree of uncertainty, doesn't mean we can't arrive at some range of assumptions that are generally agreed upon.

I really, really hope you read that series by ERN. It's a data driven approach that is specific to long retirements for early retirees.

If you end up reading some of his series, please come back and let me know what you think.

Just wanted to say one final thank you for the healthy debate and that really I'm bowing out as I think we've said what we both wanted to say enough times now so there isn't much left to say, so no worries on that account :)

DeleteMaybe I will give the series a read to get a bigger picture of where that one article fits in.

Cheers again and have a great weekend.

You too, friend!

DeleteI have a bad habit of 'not letting go of the bone' once I've latched on, but I appreciate that your cooler head prevailed!

Cheers and thanks for having a good debate with me.

LO FUcking L! "Little Lord Fauntleroy"??? Serious?? My mom called me that growing up when I thought I needed the royal treatment (big birthday cake, party, toys galore, etc.) still chuckling.

ReplyDeleteI can totally relate to your stress with guests factor. I love having people over, and then I sweat it getting the food and drinks in order, and seem to spend more time in the kitchen than actually socializing. Main thing I'm learning is to leave those damned dishes sit there until ppl leave. Keep the wine a flowin'!

You know where I first heard that title? Tim Roth in Four Rooms -- that dude just cracked me up and it stuck with me.

Deletehttps://www.youtube.com/watch?v=oWlS4lZ5TTY

And yes, keeping the alcohol flowing is the key but, damnit, these women up and had a dry baby shower. How is that even possible?

Juggling friends/family with baby preparations is tough alright. My brother is about to have his first next month and he and his wife have been so flat out that they booked a week away in Tasmania! Sounds like they're loving it though. It might blow your monthly budget but Aus would welcome you guys anytime!

ReplyDelete3.5% drawdown could be a wise decision. There was some discussion about 4% and longer retirements on a blog (can't recall where!) and basically it's far more likely to work out if you go back to work at some point, even if its just a day or two a week or reduce expenses.

Wealth from Thirty: if you haven't taken a gander at ERN's series on safe withdrawal rates, it's like the very best FIRE thing I've ever read. He tackles the "go work a little, maybe $1000 a month, for just a few years" plan (spoiler: that plan doesn't really work in bad downturns).

DeleteA trip sounds amazing! Australia is the very last continent we have on our list to visit (not counting Antarctica). Maybe that's the first trip the little guy will go on! We're probably holding off until 2019, but we're already considering locations.

"I'm actually making up excuses to keep these lovely people out of our home after the baby arrives."

ReplyDeleteI banned all visitors in the first month except for handpicked loved ones I trusted to come help. Even still some visitors after that were annoying as hell because they were a ton of unnecessary work. Some of them I wish we could ban for three months but I can't. :(

LOL $1300??? DbF! You don't need that much stuff! I promise! If I may make a recommendation - keep your receipts, and don't open everything up. Just organize them so you can get to them in your sleep haze if you need them but keep the packaging nice enough that you can return if you don't need it after all.

We got SO MUCH stuff free that we might have bought and even still did not use most of it. Our kid could ninja out of any and all swaddles so that was four swaddles we didn't ever use. I still don't even know what several of those things were that were passed down - was that an Abominable Snowman suit? We'll never know.

How do you know $1,300 is too much without knowing, at all, what we purchased?

DeleteI'm going to be a little defensive when people have strong, mocking opinions on my purchases without any information or context.

Very glad you got lots of free stuff and, surely, spent less than I did. Good on you. But different strokes, friend.

I was teasing you :)

DeleteSure.

DeleteTwo thoughts!

ReplyDelete1) If you're gonna blow the budget, I love it that you did it with beer! And Pizza Port! We were at one in San Diego and it was pretty great.

2) "This little fucker is turning out to be pricey" Don't hold back! Let me know how you really feel! :)

This comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis blog is so nice to me. I will keep on coming here again and again. Visit my link as well.. PODROCHI - Онлайн порно смотреть бесплатно

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDelete