Every New Year's Day, Mrs. Done by Forty and I go to an uninspiring chain restaurant and plan out our upcoming year. We bring a little notebook, enjoy some some average-but-carb-heavy meal over bottomless sodas, and talk about everything. The trips we want to take. Babies we might want to make. Do we want more or fewer rental properties? Do we feel the same way about early retirement? What sort of fun stuff should we do if we do retire?

The Olive Garden, which is lovely, had been our usual spot for years. But it only took one meal with that dumb tablet on the table to ruin the place forever. Apparently I'm a luddite, since I don't think punching in my own order into an Amazon Fire is the best way to experience all the flavors of Tuscany.

So this year we went to Mimi's Cafe (the site of our very first date: I was also cheap way back then) to plan out all of 2018...in June of that year. And I'm just now writing about it in July.

Can we blame the baby?

Mimi's, unfortunately, was not as good as we remembered it being back in 2007. But we did get a good plan together. Here are the big takeaways:

The Olive Garden, which is lovely, had been our usual spot for years. But it only took one meal with that dumb tablet on the table to ruin the place forever. Apparently I'm a luddite, since I don't think punching in my own order into an Amazon Fire is the best way to experience all the flavors of Tuscany.

So this year we went to Mimi's Cafe (the site of our very first date: I was also cheap way back then) to plan out all of 2018...in June of that year. And I'm just now writing about it in July.

Can we blame the baby?

Mimi's, unfortunately, was not as good as we remembered it being back in 2007. But we did get a good plan together. Here are the big takeaways:

- Now that we have Baby AF, we want to bump our emergency fund to $15k, up from $10k.

- We want to sell our last remaining rental property. Our plan calls for some money up front, to flip the property: roughly $15k. More on this in a future post.

- We'll split the profits from the sale, and our original down-payment, between a lump sum to make a principle-only payment mortgage ($40k), using the rest to set up a college fund for Baby AF (maybe $20k, depending on what the rental sells for).

- Oh, and we want to pay off the mortgage before declaring ourselves financially independent or pulling the trigger on early retirement.

Shouldn't we avoid opportunity costs, let the mortgage ride, and just invest the funds instead, earning way more than 3.75% on average over 30 years?

And while that was our original plan, the short answer to those questions is that we read Early Retirement Now's series on safe withdrawal rates. It should be required reading for anyone working towards FIRE.

And one of the eye-opening insights from 'Big ERN' is that a mortgage can really derail an early retirement, because it exacerbates Sequence of Return Risk: when you might average quite good returns over a long timeframe, but having losses in the very early years of a retirement dooms the portfolio's chances of success. A mortgage can increase this risk, because it forces early retirees to deal with a large, non-negotiable expense right at the start of their retirement.

Retirees might not want to sell stocks while they're down, but then there's the pesky fact that banks repossess your home if the mortgage isn't paid. The irony is that the mortgage expense goes away years down the line, after the Sequence of Return Risk has gone away, too.

And one of the eye-opening insights from 'Big ERN' is that a mortgage can really derail an early retirement, because it exacerbates Sequence of Return Risk: when you might average quite good returns over a long timeframe, but having losses in the very early years of a retirement dooms the portfolio's chances of success. A mortgage can increase this risk, because it forces early retirees to deal with a large, non-negotiable expense right at the start of their retirement.

Retirees might not want to sell stocks while they're down, but then there's the pesky fact that banks repossess your home if the mortgage isn't paid. The irony is that the mortgage expense goes away years down the line, after the Sequence of Return Risk has gone away, too.

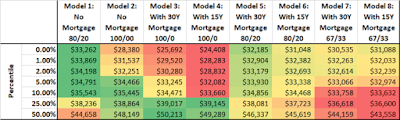

How much impact can a mortgage have on your Safe Withdrawal Rates? Here's an explanatory chart from Big ERN:

|

| Source: EarlyRetirementNow. Sustainable withdrawal amounts when targeting different failure probabilities. Per $1,000,000 initial net worth, conditional on CAPE between 20 and 30. 1871-2015. |

"According to this table, no mortgage and an 80/20 portfolio would have done the best if targeting a failsafe withdrawal amount and all other failure probabilities up to 10%. If you want to maximize the withdrawal amount to target 25% and 50% failure rates (which seems way too risky for my taste), then the 100% equity portfolio with the mortgage become the most attractive. But Models 3 and 4 with the most leverage also have the worst failsafe withdrawal amounts." [Source.]Considering that our asset allocation is closest to the 80/20, that we also don't want to consider plans with failure rates of 25 or 50%, and that CAPE is now north of 30, we think entering retirement sans mortgage is the safe thing to do.

With all that said, here is our latest mortgage pay-down plan:

- Make one big payment to principle of $40k. Why did we choose this amount? It would make all of our future payments at least 50% towards principle, rather than interest. Sure, it's arbitrary, but we like the idea of our payments going mostly to principle. And since the Trump Tax Plan gutted the mortgage interest deduction by doubling the standard deduction, a big benefit of owning our new house and its big honking mortgage went away. Thanks a lot, Donnie.

- Going forward, half of our 'investment money' each year will be split evenly between paying down the mortgage and to funding our financial independence plans. The bottom line is that we'll put a lot less towards investments with this plan.

- However, we'll always be sure to max out any tax advantaged accounts we have. Currently that means a 401k and Employee Stock Purchase Plan for me, IRAs for both of us, and a family HSA. If Mrs. Done by Forty gets a full time job with benefits, we'd max out her 401k as well.

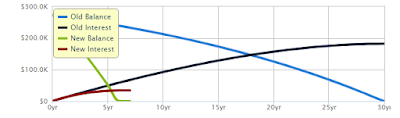

How quickly will this get the mortgage paid off? A whole lot depends on our job situation over the next five years. To be really conservative, let's assume Mrs. Done by Forty doesn't pivot to full time work, but somehow kept working part time as an RA/TA for five more years, really stretching out that PhD plan. (Not going to happen, but stick with me just for the sake of making a pretty chart.) We'd get the mortgage paid off in about five years.

|

| From calculator.net -- click image for bigness. |

The catch is that, even if we throttled down our savings for financial independence to 50% of our current rate, we'd hit FI way before five years from now. (Note: the impending catastrophic market correction was not considered when making that statement.) So, we probably wouldn't actually need all five years to make that plan happen anyway if we hit our FI number somewhere along the way.

But what if we put Baby AF in daycare, Mrs. Done by Forty got a full time job, and now could contribute all her take-home pay (after maxing out her 401k) to the mortgage payoff? Say, adding an additional $2,000 per month on top of the plan outlined above? Here's how that plan would play out, paying off the mortgage in a little over three years:

Of course, projections for these plans are really hard. We don't know when Mrs. Done by Forty will go back to work, but it's probably not any time all that soon. There's still her PhD to finish and we're really digging hanging at home with Baby AF. Let's say that's at least a year off.

And, hey, maybe the bull market will continue to run for a few more years. With some luck, stocks might do the heavy lifting for us, and we could sell some of our financial independence funds to pay off the mortgage in one fell swoop.

But in all likelihood, we really might not be done by forty. While it would be rough to miss the goal, especially so publicly, I think I'd be fine with that.

This isn't a race. We're not competing against anyone else, or the clock, either.

But this is a big, complicated plan with a very long retirement. There might be some real consequences if we get some of the major details wrong.

And there's a little freaking baby in the mix now. Nothing wrong with going a little slower, being a little more conservative, and making sure the plan is water tight for this little guy.

As always, thanks for reading.

*Photo is from Osbornb at Flickr Creative Commons.

I think this is life and there are so many twists and turns. Hell, I'm thinking of getting INTO a mortgage at some point. I think the fire community has some great inspiration out there, but I think too often it can lead to comparison. You are on your own journey! Love the baby pic!

ReplyDeleteI hear that, Tonya. Comparisons (or worse, competitions) seem to spring up just by the nature of how we're open with our financial situations. I think it's in our nature to hold our own processes & outcomes against others'.

DeleteFor what it's worth, I am one of the few who thinks owning is actually a really good idea in early retirement. Getting rid of nearly all housing expenses is a great way to mitigate sequence of return risks: something the 'always rent' crowd doesn't write about much.

Sounds like an excellent plan to me. I think having a mortgage only really makes sense if you've got enough income coming in the door to cover it on top of your other expenses, because otherwise you're really just robbing Peter to pay Paul, as the saying goes. For me (and granted, my mortgage was miniscule to begin with) it was a question of keeping about $10K in a CD making next to no interest, putting that money into the market and hoping it made enough to offset the cost of the monthly mortgage payments (highly unlikely), or paying off the balance of my mortgage (which was a 6% loan.) Really glad I paid it off. Made the whole early retirement question sooo much easier, because it meant I was able to make my monthly expenses from my passive income sources (web pages) without dipping into my investments.

ReplyDeleteThat's a really sweet set up, ECL. I love the idea of passive income but our attempts at it (via rentals) are anything but passive, to the point that we just want them gone.

DeleteAt least the investment dividends are somewhat regular and passive. Though Big ERN has a great post on how we need to be careful not to just rely on the dividends in down times...

DB40,

ReplyDeleteDo you still have 25% of your networth in bonds/fixed income?

What is your reason to hold a large amount of fixed assets in your portfolio that yields around 2% or so, but have a long-term liability yielding 3.75%? ( I ask myself this question as I also have a mortgage, anytime my level of cash/fixed income increases to say a certain %-age of NW)

One thing most retirement projections miss is that they are very US centric. There have been long periods in developed markets where housing did better than equities. ( like in France for example)

As a retiree your goal is to make sure you do not run out of assets. So while there may be an opportunity cost in missing out on future equity returns that are above 4%/year, you also increase your "staying power" in case equity returns are lower than 4%/year ;-0

Hi there, DGI.

DeleteYep, we still rock the Simpleton's Portfolio, which has 25% of our portfolio in bonds (and really, really safe bonds at that: all short term, which REALLY won't keep up with the mortgage). And yeah, we're 25% international, too (rounding out with 25% S&P 500, and 25% Small Cap US).

"What is your reason to hold a large amount of fixed assets in your portfolio that yields around 2% or so, but have a long-term liability yielding 3.75%? "

That's a fantastic question! I think the reason we have bonds + a mortgage, and this is off the cuff, is that we're not willing to drastically change our asset allocation just in order to pay down debt. That is to say, if I had credit card debt equal to our bond position, I wouldn't necessarily sell all our bonds at once to pay it off because that would put us in 100% stocks overnight, drastically changing our risk profile.

Simply put, we might sell our investments overall to pay down debt...but our AA is our AA. Whatever we did, we'd want to rebalance back into our desired asset allocation.

Great point about opportunity costs just kind of being part of the equation if you're mitigating risk. Like you said, the goal isn't to maximize gains, but to avoid running out of money!

First thing, I noticed you don't keep a lot of cash in your emergency fund.

ReplyDeleteWe're probably very conservative and keep a year worth of expenses.

I like your take on looking at the sequence of return risk. As I'm about to enter a 30 year mortgage, I'm already thinking of how to pay it off.

Hi there, Savvy Financial Latina!

DeleteWe used to keep more cash around (and ironically, we have a lot now because we sold two houses in the past year). But once again, Big ERN has convinced us that keeping a big cash cushion might not be so hot of an idea.

https://earlyretirementnow.com/2017/03/29/the-ultimate-guide-to-safe-withdrawal-rates-part-12-cash-cushion/

In any case, for us, $15k would still be about half a year of true bare bones expenses. If unemployment was the reason we'd be tapping it, then we could stretch it out quite a bit further.

But yes, I can DEFINITELY see the appeal of keeping more cash around. The bucket strategy can work!

Best of luck with the mortgage and the payoff!

Sounds good to me. I'm guessing the fact that you are considering this though is that your rental isn't pumping out a lot of extra cash flow?

ReplyDeleteOn a totally unrelated note, I thought your dining choice introduction quite funny. That being said, I found myself thinking, "No, don't eat/drink that!" (e.g., bottomless soda). I finally put myself on the health (diet/exercise) path I should have started years ago, and now my brain is already hard-wired onto this new path, like I'm a different person (I have always had sort of a super-power ability to be able to re-wire my brain very quickly, if I'm motivated enough. It's a trait I found very useful in my dating years when I had to rewire to quickly move on from girl friends ;-).

Anyway, FWIW the current state of dumb politics has made me so angry that I was getting unhealthy/stressed. I decided to redirect that wasted energy into something I can actually control. My motivating health vision statement is: "This guy is stressing me out and making me die early. I'm going to eat much better and get really fit, because I don't want to die before that joker does."

Bringing it back to you, with kids this becomes even more important. Ever read the book "How Not To Die"? I think you would like it as the tone quite frankly is DBFish (but medically related).

Hi Tin!

DeleteYeah, the rentals have barely been making a profit. Or I should say, they make profit for a while, but then we get a bad renter, or a major repair, and nearly all the prior year's profits are wiped out.

In the end, the thing that made us pull the trigger was the stress. I get upset when someone purposely trashes the property, because I have so many emotions tied up in the place. It's our house, so I unreasonably expect people to treat it a certain way...

What's your health/diet plan look like? I could use some help in that area!

Will check out that book, too. It's on the list!

A hybrid of popular things.

DeleteEssentially: Intermittent Fasting combined with Keto and then mandatory daily exercise. As I'm finishing up that book, I'm also converting myself to a much larger percentage of plants vs. animals in my diet (so start with keto, but transition even away from animal fats as much as you can).

My sister is a big Keto fan, but that is not something I think we'll be doing.

DeleteBut more plants is do-able!

Did something also happen with the other rental or you didn't see the point in just keeping one? I've heard the Indy market is pretty hot so hopefully the flip will be successful. My wife and I should do those yearly meetings as well.

ReplyDeleteAs for the mortgage, I'm probably on a different boat. Well being that I think we'll outgrow our current place, there's no real point in paying off the mortgage. And if we stay in NYC, paying off a mortgage seems unlikely. For better or worse, I'm taking the opposite approach and taking on my debt and buying more rentals. To be honest, the cash flow from my first rental wasn't great either but it did have some decent appreciation. I bought another property which I'm renting short term. Hopefully that goes well.

Hey there, Andrew!

DeleteYeah, we had bad experiences with both rentals, alternating between good renters and very bad ones. More to come in a future post.

But I think the thing that tipped the scales for us was the opportunity to make some money when selling. We bought the first rental at $80k and sold at $126k a few years later (though we did put a good chunk to flip it a bit). Once we saw we could get out and make a profit, we decided to do the same here. (Bought around $90k, will list at $140k, putting $14k or so into the flip.) Here's to hoping.

And yeah, if you know you're moving I totally agree: no reason to pay it off. We feel like this is going to be our forever home. It was flipped and totally done when we bought it, big lot to expand on if we really want it, and it has a pool which we didn't think we'd want but now can't imagine living without during the summers in AZ.

But if we were going to move, we'd certainly follow your plan and hold off on any prepayments.

I honestly think rentals are a GREAT investment for the right person who has better luck than we did. I certainly see a lot of FIRE folks using it as the foundation for their plans, and doing so successfully.

But it ain't for us!

Maybe after my experience...maybe it ain't for me either! LOL Nah, it's alright, I'm still pretty gung ho about real estate. Good luck with the flip!

DeleteMore food for thought! I viscerally prefer the idea of paying down the mortgage before retirement but we have a really big number right now and I don't think we can swing it in the next 7-10 years. So either I change our retirement aims or I change our plans for retirement. But I should not be (though sometimes I am!) in a rush to make it all happen right this second, I want to be sure we do the right thing for our brood over the long term.

ReplyDeleteI go back and forth on whether continuing down the path of rentals is for us. We have a stable tenant who takes good care of the property now, and the place has appreciated, but I also had a crap property manager that I'm still cleaning up after and that's costing us a bundle this year. I want to set a clear point at which it's not worth hanging on to before we lose a ton, much like setting an exit plan for a business.

That's a good point about the differences in having a very big mortgage in HCOL areas, Revanche. I think the main takeaway from Big ERN's post is that sequence of return risk is greatest at the early end of an early retirement, so you just want to minimize expenses on that front end (say, the 10 years or so).

DeleteMaybe recasting the mortgage right before early retirement is a middle ground?

And I like the idea of an exit plan! That's never a bad idea.

I hope I don't sound like I'm against rentals altogether. I actually think getting some income in early retirement is a fantastic hedge. These rentals just aren't for us, unfortunately.

Thanks for sharing Big Ern's fancy analysis on the wisdom of mortgage pay-down. We're in the middle of slaying ours. No big fancy analysis, just trying to carve out as much cash flow as possible before checking out of cube land. I figure even at 3%, mortgage pay off is like a hedge in your portfolio.

DeleteOlive Garden? Dude...

Hey, we are not fancy folks here at the Done by Forty household. I'm not ashamed to admit I really love the salad and breadsticks.

DeleteBut maybe you culinary elites can show me what real food tastes like up in MN. :)

DbF: I'm totally in agreement about reducing costs before starting retirement - that's why I'd really like to do it even if it's not possible to hold everything else steady over the next ten years so I can make it happen. If possible, maybe it will be something along the lines of a couple of big payments to principal in the next couple of years so I can get the most impact out of them, plus a recast. I've already done two and we haven't had the mortgage two years yet :D

DeleteYou and I are going to have to chat sometime about recasting. I kind of love that idea.

DeleteI suspect that simply going full bore at the mortgage as we plan to do might not be the most effective plan, even if it is the simplest.

Any time! It's pretty awesome. Just cost me a bit of time and the payment to principal to free up hundreds in monthly cash flow.

DeleteYou pivot sounds good. Paying down the mortgage is a good thing. We're planning to consolidate our properties too. Once we're down to one property, we'll figure out what to do with the mortgage. I wouldn't worry about the timeline either. Just go at your own speed. You still have quite a few years left. Keep at it!

ReplyDeleteHey I think we have the same interest rate on the mortgage! 5 years goes by really quickly, especially with a baby. 3 years even quicker. You would want to slow some of these years down because babies grow up in a blink so I think your plan is a good thing!

ReplyDeleteMr. PoP just FIRE'd and we're going through a very similar thought process with our mortgage-we could sell a piece of land, pay off the remaining 68k and put the rest back into the market. Every night Mr. PoP closes his eyes, grit my teeth and repeats the mantra, "I'm not a market timer, I'm not a market timer, I'm not a market timer."

ReplyDeleteTruly not bringing in politics here. That said, my assessment of the new tax plan is there will be a consequence (intended / not intended, not sure) of many people to pay down their mortgages because mortgage rates will no longer be tax discounted for me (and for many people, not all). For the first time in 15+ years I will be taking the standard deduction so mortgage interest doesn't help my taxes burden. So I will in fairly short order plan to pay it off entirely, for the combination of guaranteed return and piece of mind. I have to think I am not in the minority, it's going to be enough people to see the stats overall in a few years IMO. In reality I don't think you can go wrong reducing your yearly expenses by the amount of the mortgage, it's certainly a safe move as we should all tend to make once you have a nest egg worthy of protecting.

ReplyDeleteAlright apparently it's bed time for me since I just read "that dumb tablet on the table" as "that dumb toilet on the table" and was very confused and also disgusted, and I would totally not go to an Olive Garden again if they had toilets on their tables!

ReplyDelete(I hate those dumb tablets too btw, I know it's for convenience but maybe sometimes less convenient things are better?!)

Ha! I think the toilets would be worse...but only by a bit. ;)

Delete