It doesn't feel like I have so little time, to be honest. I don't feel forty one. And I don't feel old. I feel like I did all through my twenties and thirties: I just feel good, and I feel like the same guy. Yes, I have kids now and, sure, my body isn't as taut. But I'm me.

So I feel young, even as I get old. I'm okay with the trade off. Though I wonder if I stopped counting all these years, maybe I'd feel even better.

Back when I was thirty two, I started writing with the goal of reaching financial independence, and retiring early, on the last day I was still forty. I stopped working back in February, so I guess I can check off the early retirement part.

Did we actually reach financial independence?

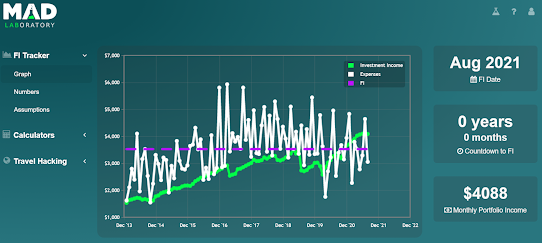

Let's let the numbers do the talking, and start with the easiest scenario. Did we hit financial independence with the metric that I used back in 2012: the 4% Rule? Here's what the Mad Fientist's laboratory calculated:

|

| FI Progress at 4% SWR. Click for bigness. |

A couple caveats for these charts:

- Our spending for the past 12 months was $42,324. But that number is weird for a couple reasons.

- One, we paid off the mortgage a couple years ago. Our spending would be in the neighborhood of $57,000 if we kept it around.

- We also purchased two used cars in 2020 for a total of $20k or so (a post to come on those purchases), and gave our old Matrix to our niece for her first car. I didn't know how to include this "one time" (okay, two time) spending in the calculations while still having the spending & FI calculations make some sort of sense. So I omitted these "one offs" but still include the cost of registration, insurance, etc.

|

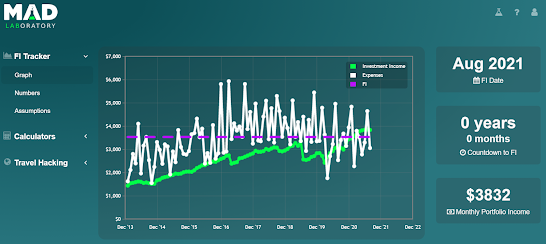

| FI Progress at 3.75% SWR. Click for bigness. |

|

| FI Progress at 3.5% SWR. Click for bigness. |

Change cookie settings on Safari

Change cookie settings on Chrome

Change cookie settings on Internet Explorer

Congrats! Your midwestern roots are showing with your slice of humble pie (better to be lucky than good). I'm sure there was plenty of hard work to get you where your are today!

ReplyDeleteHi there, BLL. It's true! I recoiled when I wrote something positive about my accomplishment and felt I had to qualify it in some way, if only so I could show my face when I went back home.

DeleteYes, there probably was some hard work in there, too. :)

Happy to read. Lots of thinking going on here on safety margins. A few years to go, let's see when we make the leap.

ReplyDeleteThat sounds like a good idea, lucilius. I wish we'd had more margin for safety when I left work, but it was kind of a gotta-leave-now situation. Still, if you can plan it out and have some wiggle room, that is surely a better way to go. Thanks for reading.

DeleteCongrats! You made it!

ReplyDeleteIgnore the retirement police; they are bored and need to be assholes to stay functioning otherwise they explode. ��

Aw, thanks again, friend! I really appreciate that.

DeleteI think I'll have to write a guide for the IRP. Maybe a FAQ? How many acronyms can I fit in one post?

Happy belated birthday! I turned 41 a few months ago. I turned 40 during the pandemic and said that pandemic birthdays don't count so I'm still 39! My boys tell me I have some white hairs and that means I'm old =P

ReplyDeletePlans never work out how we originally thought but that's okay. You're doing great and have plenty of options. You guys will figure it out.

Very insightful, I must say! btw finding a skilled Diesel pick up truck mechanic in Texas is essential for keeping your truck running smoothly.

ReplyDelete